Will history repeat itself, or will we see a new normal post the COVID-19 crisis? Unpacking previous events, TFG heard from FCI’s Secretary General Peter Mulroy, comparing how the factoring and receivables industry has fared during previous crises and what we can learn moving forwards.

Considering the times, it’s only appropriate to share some views regarding the impact the COVID-19 crisis is having on our members globally and provide some insight into the future. We have all heard many different views about its potential impact, so I don’t necessarily want to take a guess on what will come, but instead look back in time as a means to determine what tomorrow will bring. History does have a way of repeating itself and if it is any indication, factoring should see a significant rebound in 2021 and the years that will follow. One just has to look at the past as an indication of the future.

The Great Depression 1929-1939

The Great Depression was a worldwide economic event which began on “Black Thursday,” October 24, 1929 when stock prices fell 22% within four days. Factoring at the time was predominantly practiced in the US. A notable and interesting story is that of my previous employer, SunTrust Bank, which established its factoring business in 1939 at the tail end of the great depression. This was a time when we saw the first major rise in new forms of secured lending including factoring, as it became clear that receivables were appreciably better collateral than mortgages due to its short term and “self-liquidating” nature.

At SunTrust, the bank management saw the great depression as an opportunity to “finance small businesses through the collateralization of their accounts receivables”.

At SunTrust, the bank management saw the great depression as an opportunity to “finance small businesses through the collateralization of their accounts receivables”. Others also led the charge. James Talcott, one of the largest players at the time (later to be acquired by CIT) expanded rapidly in the 1930s. Juin inst a few months after the notorious stock market crash of 1929, CIT invested and built its first factoring operation. Consumer spending rose dramatically and CIT prospered due to its secured finance business in factoring, consumer appliance, furniture, and automobile financing.

This period also marked a time of consolidation of the early factoring industry in the US, who were forced to diversify their clientele, expanding beyond their traditional base in textiles, apparel and woolens. Around 1930, CIT expanded its receivables financing by buying five well-known factoring companies in the space of four years, including Morton H Meinhard & Company and William Iselin & Co, two well-known brands at the time. By the start of the war, new factored markets included chemicals, cosmetics, electronics, furniture, glassware, home furnishing, and many more. During this period, factoring volume boomed (certainly supported by the economy during the war years). Between 1935 and 1948, the US factoring industry grew by an unprecedented 13% CAGR, a four-fold increase during this 13 year period.

The Great Depression had gutted the nation in the 1930s and its effect cast a long shadow that can still be seen today. One economist, Miguel Faria-e-Castro of the Federal Reserve Bank of St. Louis recently raised eyebrows when he estimated that the unemployment rate could increase up to 30% by the end of the second quarter 2020 in the US, far exceeding the record held during the peak period of 25% in 1933. Europe has fared much better with an expected increase of 9% this month. At the time of this article, the official unemployment rate in the US stood at nearly 15%.

The Great Recession 2008-2009

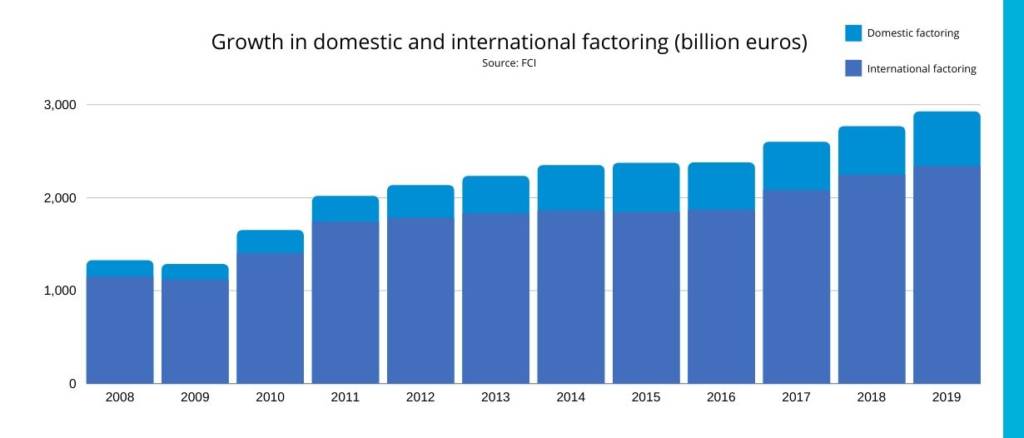

Now, let’s look at the great recession and its impact on the global economy between 2008-2019.

Not since the great depression had the financial community witnessed a period of time quite like it. First Bear Stearns collapsed in March 2008 and was ultimately rescued by the US Government. They received an emergency bail-out from the Federal Reserve and was then taken over by JP Morgan Chase. Lehman Brothers filed for bankruptcy protection in September 2008, which within six months led to a domino effect, adversely impacting such giants as Merrill Lynch, AIG, CIT, Freddie Mac, Fannie Mae, RBS, Fortis and others, all coming perilously close to following Lehman’s demise, most rescued through large bail outs by their respective governments.

Risk increased dramatically and global trade was severely affected. SMEs were particularly hard hit as banks pulled back funding. Large bank-led SCF programs concentrated in Spain and the US began to witness numerous reductions or complete program shut downs, impacting the continuous liquidity needs for SMEs. Unemployment peaked during this period in the US to 10.0%. This was much lower than during the great depression and the current COVID-19 inspired recession. The factoring industry only declined modestly in 2009 by -3%, generating EUR 1.3 Trillion in volume that year. However, a decade later, this figure would rise to nearly EUR 3.0 Trillion, a more than two-fold increase, growing by a staggering 9% CAGR, similar to the surge experienced after the great depression.

The extreme global economic and political volatility since the Great Recession in 2009 has given rise in nationalism and protectionism. Trade wars that have since arisen, which has contributed to a slow-down in global trade. Despite all of this, factoring has remained resilient during this period. Throughout the past ten years, and especially during and after the financial crisis, the factoring community took up the slack left behind as banks pulled out of financing arrangements. In fact, the receivables finance industry played an important role in the continued health and eventual growth in global trade, particularly by continuing to finance SMEs during this challenging period.

COVID-19 Recession 2020 – ?

There are the stark differences today as compared to the other two crises. This crash has been driven by the mandatory cessation of business due to the shutdown in most countries, and has not yet been driven by a collapse in the financial sector. Unlike the great depression, banks in the US had either been shut down or placed on “bank holiday” by closing the banks for a three-day cooling off period. The most memorable line from the President Roosevelt’s speech was directed during the banking crisis, “The only thing we have to fear is fear itself.”

The only thing we have to fear is fear itself.

President Roosevelt

In the last crisis, governments around the world who for years boasted about the self-evident benefits of limited regulation had to sink trillions of dollars to prevent the global banking system from collapse. However, this crisis is different as governments are more prepared, due to the increase in capital stemming from the requirements of Basel II-III, including the numerous stress tests that both US and European banks had undertaken, leading to a system that so far has been able to weather the storm. Also, governments this time have injected trillions of dollars into the system in the form of economic stimulus via direct payments to consumers, low interest loans to SMEs, targeted bail out funds to economically hard hit industries such as travel, leisure, hospitality, etc… In the US alone, the government has directly or indirectly pumped in over $9 Trillion into the economy over the past two months, a historical record accounting for nearly half of annual US GDP. This all bodes well for a potential recovery in 2021.

There will certainly be winners and losers coming out of this dark period. Sadly SMEs and consumers will be the most impacted by this crisis. Retailers who have already undergone great strain from the evolution to e-commerce are already feeling the pain. Some have begun to file for bankruptcy protection, including such brand names in the US like JC Penneys, Pier 1 Imports, J Crew, Hertz, and Neiman Marcus. Over a third of those large restaurant and retail chains are under “watch” by the rating agencies as likely candidates for bankruptcy. The “mall” culture around the world is in for a big shock, stemming from this crisis. If there were any doubts about their eventual demise, the impact of the pandemic will likely dispel them.

This disruption will have a significant impact on the industry. However, the need for liquidity and risk mitigation will be greater in the coming months than at any time before. And this gets back to why the factoring and receivables finance industry matters now more than ever. I had estimated last year that the combined open account trade volumes financed by such means like traditional factoring, reverse factoring, asset based lending and other forms of receivables finance accounts for well over US$5 Trillion globally, representing approximately 6% of global GDP. A significant portion of this figure is targeted to SMEs, the engine of economic growth and employment around the world. And as history has shown us repeatedly, we can count on a surge of growth in receivables finance, as indicated in the past two major economic calamities over the past century. But for those who do invest must do so carefully, ensuring they implement strong operational controls, proper underwriting procedures, increased awareness of potential fraud (always an enhanced risk in times such as these) and heightened analysis of dilution risk in these sensitive times. As such, even though volumes will be challenged due to the recession, the demand for secured finance in the form of factoring will only increase. If these past two economic events are any indication, I estimate that the industry could excel this decade, potentially achieving US$10 Trillion in volume globally by 2030, increasing by a 7% CAGR.

I estimate that the industry could excel this decade, potentially achieving US$10 Trillion in volume globally by 2030, increasing by a 7% CAGR.

Peter Mulroy

As we have seen, this recession has unique characteristics that can take a page from almost every economic calamity mentioned above.

From it, we can make some predictions for the future:

1. Commercial bank lending tightened

Expect commercial banks to become much more conservative, pulling lines especially on SMEs. This will create a significant uptick in new business opportunities for the industry, which we are already beginning to hear from our members.

2. Less abundant liquidity which affects non banks and commercial factors

Liquidity will be not as abundant as before. Non-Bank Financial Institutions (NBFIs) and Commercial Factors will feel the pinch most, with reduced liquidity to support SMEs. And corporates will want to diversify their funding sources to ensure stability.

3. Collections will slow and portfolios will age

Collections will continue to slow and ageing portfolios will increase due to delinquency, breaching eligibility ratios and covenants with funders which will lead to the cancelation of committed lines. We have already seen by FCI members a 160% increase in past due invoices assigned via edifactoring as of 30th April 2020 compared to 31st December 2019.

4. Term extensions to rise

Term extensions will rise, demanded by debtors around the world. One of our larger members report that they are seeing over 30% of their outstanding portfolio of receivables extended for a period of up to 90 days, others seeing extensions as far out as 180 days.

5. Credit insurance lines reduced or cancelled

Credit insured lines will be affected, impacting customer/debtor credit availability, both underwritten in-house or by the credit insurance community. We hear this already from a number of members that lines are being cancelled or reduced.

6. Dilution to increase

Expect to see dilution to increase, as supply chains become disrupted due to increased geo political uncertainty. Just this year, FCI has witnessed amongst its members a 40% increase in dilution as reported in edifactoring as of 30th April 2020 compared to 31st December 2019.

7. Business volumes will dry up

Business volumes will be severely impacted, especially in the 2Q2020. Volume will dry up, as new invoices contract in part due to the declining economy, in part due to plummeting commodity prices. However, we expect that inflation is inevitable, which will have a positive affect on volumes in the coming year. However, we can certainly predict a significant drop in global volumes in 2020, more than the 3% drop experienced in 2009.

8. Businesses to borrow less

Businesses are borrowing less due to increased efficiency and inventory management, and the ability to borrow cheaper from banks. However, with the crisis, we anticipate an increase in the percentage of advances to factoring accounts, even though we expect volume to decline.

9. Fintechs go out of business

What is interesting is the rise of fintechs and their success that they have experienced over these past years. However, I predict that you will see numerous fintechs go out of business, stemming from losses, frauds and an increased challenge to raise capital.

10. SCF / Reverse programmes might be frozen or eliminated

SCF/Reverse Factoring users will feel the pinch. Most SCF/Reverse programs are uncommitted and will most likely be frozen or eliminated in their entirety, in particular impacting programs from non-investment grade companies BB+ or lower. We are already seeing this in the auto sector around the world, a repeat of the great recession, resulting in long term memories of corporates to ensure their liquidity sources are diversified.

The Future of Factoring

Factoring will be in high demand during and after this crisis, as banks pull out of credit facilities, especially SMEs and companies looking for new alternative sources of working capital financing. With the significant increased volatile environment, companies will look to mitigate the risk of their receivables.

However, receivables as an asset class will be tested like never before. Nonetheless their secured nature and the controls that factoring affords will make them more attractive. And for those using history as a milestone, we certainly have the wind in our sails. As the Oracle of Omaha recently quipped, “don’t bet against” factoring as it will continue to surprise and support companies around the world, especially SMEs!

Now launched! Summer Edition 2020

Trade Finance Global’s latest edition of Trade Finance Talks is now out!

This summer 2020 edition, entitled ‘Coronavirus & The Fourth Industrial Revolution’, is available for free online, covering the latest in trade, export credit insurance, receivables and supply chain, with special features on fintech and digitisation.