Yerevan, the capital of Armenia, is home to one of the world’s oldest known wineries, the Areni-1 cave, which dates back over 6,000 years.

The discovery of this ancient winery reveals the depth of Armenia’s historical engagement in trade and commerce.

The early Armenians were skilled in the art of winemaking, using large clay pots called karases to ferment and store wine.

This practice required robust trade networks to distribute their products.

One notable Armenian wine, the Areni Noir, traces its origins to these ancient practices.

The grape varietals used in these wines, such as Areni and Voskehat, are indigenous to Armenia and offer unique flavour profiles distinct from European wines.

These ancient trade routes facilitated the exchange of goods, services, and early forms of credit, much like modern factoring and supply chain finance, which enable businesses to manage cash flow and mitigate risks today.

This historical context set a fitting stage for the European Bank for Reconstruction and Development’s (EBRD) Trade Facilitation Programme (TFP) conference, where industry leaders gathered to discuss the evolution of factoring and supply chain finance in emerging markets.

Moderated by Irina Tyan, Principal Banker, TFP, EBRD, the panel featured:

- Anzhela Barseghyan, Director of Trade Finance and Correspondent Relationship Department at Armswissbank, Armenia;

- Çağatay Baydar, Chairman of FCI;

- Kamola Burikhodjaeva, Executive Director at JP Morgan Chase Bank, USA;

- Tamara Khizanishvili, Director of Trade Finance and Factoring Department at TBC Bank, Georgia.

Growth and trends in factoring

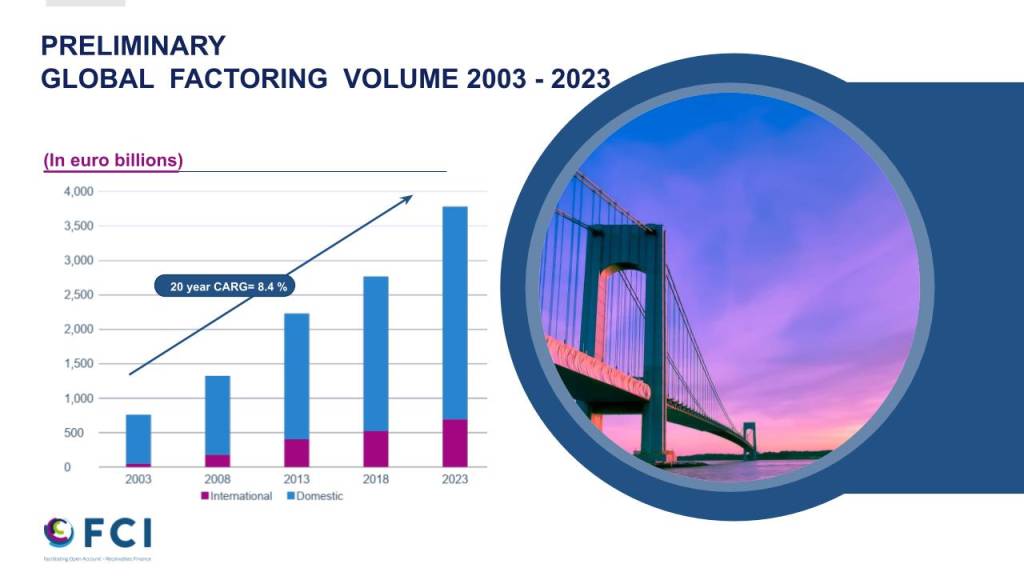

Çağatay Baydar highlighted steady growth in the factoring industry over the past two decades.

“The factoring industry has experienced an average annual growth rate of 8% over the last 20 years,” he said.

In 2023, the industry saw a 3.3% increase despite a slowdown compared to 2022’s post-pandemic surge.

Source: FCI, Preliminary global factoring volume, 2003 – 2023, published 22 April 2024

“Europe remains the largest factoring market, with significant growth in Africa and steady performance in the Asia-Pacific region,” Baydar said.

Baydar emphasised the potential for further development in EBRD regions, particularly in Eastern Europe and Central Asia.

“Countries like Poland, Estonia, and Lithuania are leading in market penetration, but there is still considerable room for growth in emerging markets such as Armenia and Georgia,” he said.

He emphasised the role of FCI in supporting these markets through educational programs and collaboration with local banks.

Source: FCI, Preliminary Global factoring statistics and market share by region, 2003 – 2023, published 22 April 2024

Tyan said, “EBRD’s regions are increasing focus on developing factoring and receivables financing. The Trade Facilitation Programme, together with the EBRD’s SME Finance and Development team and Legal Transition team of the Office of the General Counsel, work unitedly towards assisting the authorities, its partner banks and SMEs, to create a conducive environment to develop and promote factoring and receivable finance. We look forward to work closely in advancing receivables financing in EBRD’s regions, to bridge the gap in access to finance for SMEs and create inclusive economies.”

Factoring in Armenia and Georgia

Anzhela Barseghyan discussed the Armenian factoring market, which has been developing since 2007.

“Currently, only four or five banks out of 17 in Armenia offer factoring services,” she said.

Despite the absence of specific factoring legislation, the market operates under a section of the civil code.

Barseghyan highlighted recent legislative changes that have improved the business environment, such as new payment terms for supermarket chains and enhanced procurement processes.

She said, “These changes could boost reverse factoring, though awareness and competition from short-term loans remain significant challenges.”

Tamara Khizanishvili from TBC Bank provided insights into Georgia’s factoring market, which was introduced in 2007 but still needs development.

“TBC Bank holds a 74% market share, with most transactions now conducted digitally,” she said.

The introduction of a new factoring law, expected to be enacted in 2025, aims to address issues such as double financing and introduce a register for all financed invoices.

“This law will also open the market to new private factoring companies, increasing competition and transaction volumes,” Khizanishvili said.

Challenges and the way forward

The panellists discussed various challenges facing the factoring and supply chain finance sectors.

Barseghyan pointed to potential clients’ low level of awareness and competition from short-term loans offered without collateral.

Khizanishvili highlighted the importance of digitalisation, stating, “99% of our factoring transactions are now digital, which is crucial for efficiency and scalability.”

The discussion also emphasised the role of partnerships and innovation in driving growth.

Baydar highlighted FCI’s efforts to support market development through education and collaboration with local banks.

Barseghyan discussed the potential for reverse factoring to improve working capital for supermarket chains and other large buyers.

Khizanishvili emphasised the importance of a robust digital platform for managing factoring transactions efficiently.

Digitalisation, legislative changes, and strategic partnerships are vital to enhancing financial inclusion and supporting economic growth in emerging markets.