Millennials in the US struggle to buy their first house due to high housing prices. The Global Financial Crisis, politicians and competition in the job market could each impact housing prices.

Most expensive cities in the world

According to Bloomberg (2018), the top 10 most expensive cities to live in are, from highest to lowest, Singapore, Paris, Zurich, Hong Kong, Oslo, Geneva, Seoul, Copenhagen, Tel Aviv and Sydney. In fact, Singapore has been the world’s most expensive city in the Worldwide Cost of Living report for the fifth straight year.

Although the US is not on the list of the most expensive cities, four out of the ten most expensive houses in the world are located in the US (Time.com, 2018).

Will millennials have to suffer to buy a house?

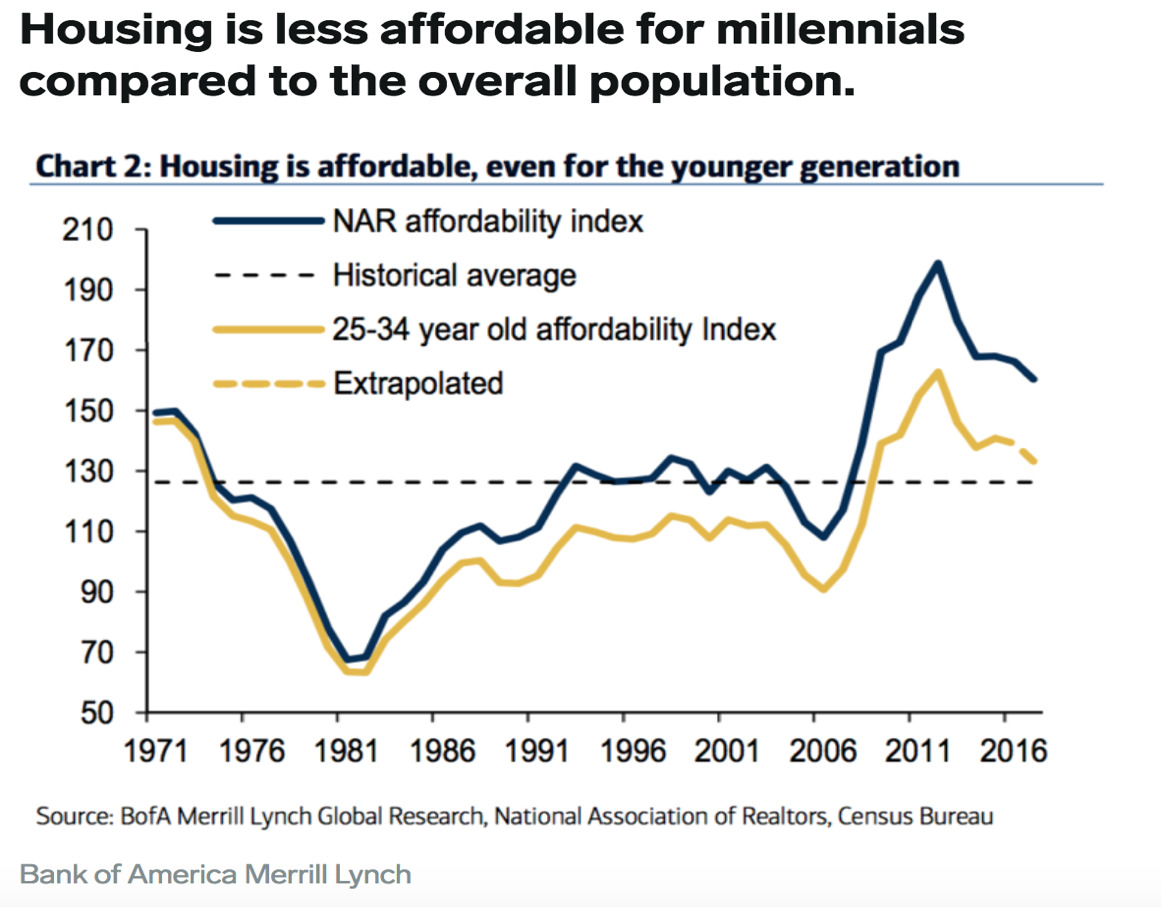

Millennial (also known as Generation Y) home ownership is at a minimum in the US (see the chart below)

Housing is less affordable for millennials compared to the overall population,(Oyedele, 2017)

Apartmentlist statistics show that 80 percent of millennials would like to buy a house and only 55 percent can actually afford one (Woo and Salviati, 2017). The population has risen dramatically since the 1950s, banks are ramping up money printing, and competition in the job market is high. Consequently, young people struggle to find a high-salary job and often can’t afford to buy their first home.

The average price of a new home in the US is $300,200 (Zillow, 2017). Millennials cannot afford to buy such a high price unless their family and friends support them financially.

What factors affect housing prices?

Housing prices go through appreciation and depreciation over time, but the long-term average rates indicate that prices generally appreciate, hence there is frequently no loss in housing investment. Housing prices, like other goods or services, are driven by the law of supply and demand. As the population increases and many transactions are easily completed, the demand for houses rises, which reduces the housing supply, as it takes a long time to build a house.

Top End(HomeFlow, n.d.)

There are several reasons for the change in housing prices:

- General economic activity which depends on disposable incomes

- The number of the population willing to get access into the housing market

- Low, affordable mortgage interest rates causing more people to access the market

- Easy access to loan/credit market which attracts more buyers

- Financial illiteracy of buyers and high risk-taking by mortgage borrowers

- A short-term relationship between broker and borrower, under which the borrower is encouraged to take high risks through CFD trading

Can economic factors lead to a bubble burst and an economic crisis?

House Bubble(Mozo, 2016)

Over-inflated bubble bursts can cause massive destruction in the financial world. A good example of a bubble burst would be the Global Financial Crisis 2007-2009, which was mainly caused by backed mortgages. There are several reasons which may lead to a bubble burst.

- An increase in mortgage/loan interest rate that puts the borrower in default, as they no longer can afford the house.

- A slow general economy movement may reduce the disposable income, causing an increase in unemployment and reduce housing demand.

- These reasons in turn can lead to increases in housing supply and less affordable borrowing.

What does the research say?

Research conducted by De Montfort University proved the following hypothesis: “The US economy affects the movement of the number of new houses sold” (Mazhitova, 2018). Real data was based on the US housing market section of the Economic Report of the President between the years of 2013-2016.

Financial Crisis (SteamitImages, 2016)

The dependent factor is the number of houses sold in the US, and independent factors are the following:

- The US seasonally adjusted civilian unemployment rate (%)

- The US seasonally adjusted M2 money supply (US$ billions)(%)

- New home mortgage yield (%)

- Prime Rate charged by banks (%)

- Real GDP, US$ billions

The thorough analysis proved that a change in any of the factors listed above will cause a change in housing supply and demand.

What is the future of housing prices?

US President Trump, with his spontaneous laws and actions, taught Americans to expect the unexpected. Mr Trump has recently signed an agreement to reduce mortgage interest and property tax. This will save money for homeowners, depending on how they would like to spend their savings. The experts believe that in the coming years house prices will increase (Collins, 2018).

Falling off Downward Market (AskTheMoneyCoach, 2016)

According to the Pew Research Centre (2018), more than one-in-three American workers are millennials, making them the largest working generation in the US. Consequently, any change in the general economy or politics will have a direct effect on housing prices in the US. Trading Economics (2018) shows statistics of the current and past economy that most affect housing prices in the US.

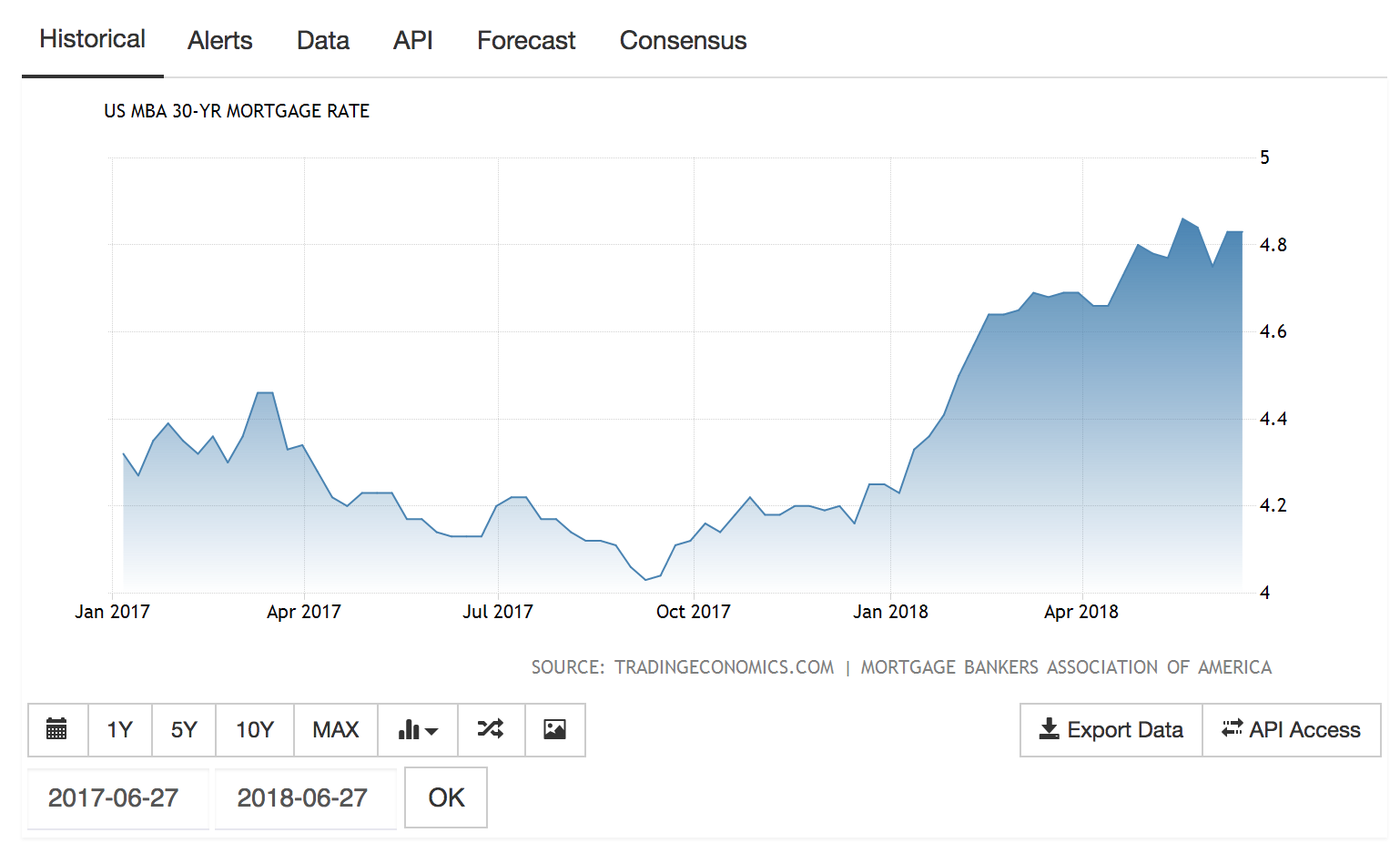

Mortgage rates have been rising and are expected to be around 4% (Sharf, 2018). High-interest rates usually reduce housing demand.

The money supply has been rising constantly and is expected to rise in the future. This will lead to an increase in consumer expenditure and trigger activity in the US economy, hence the likelihood that household demand and purchases will increase.

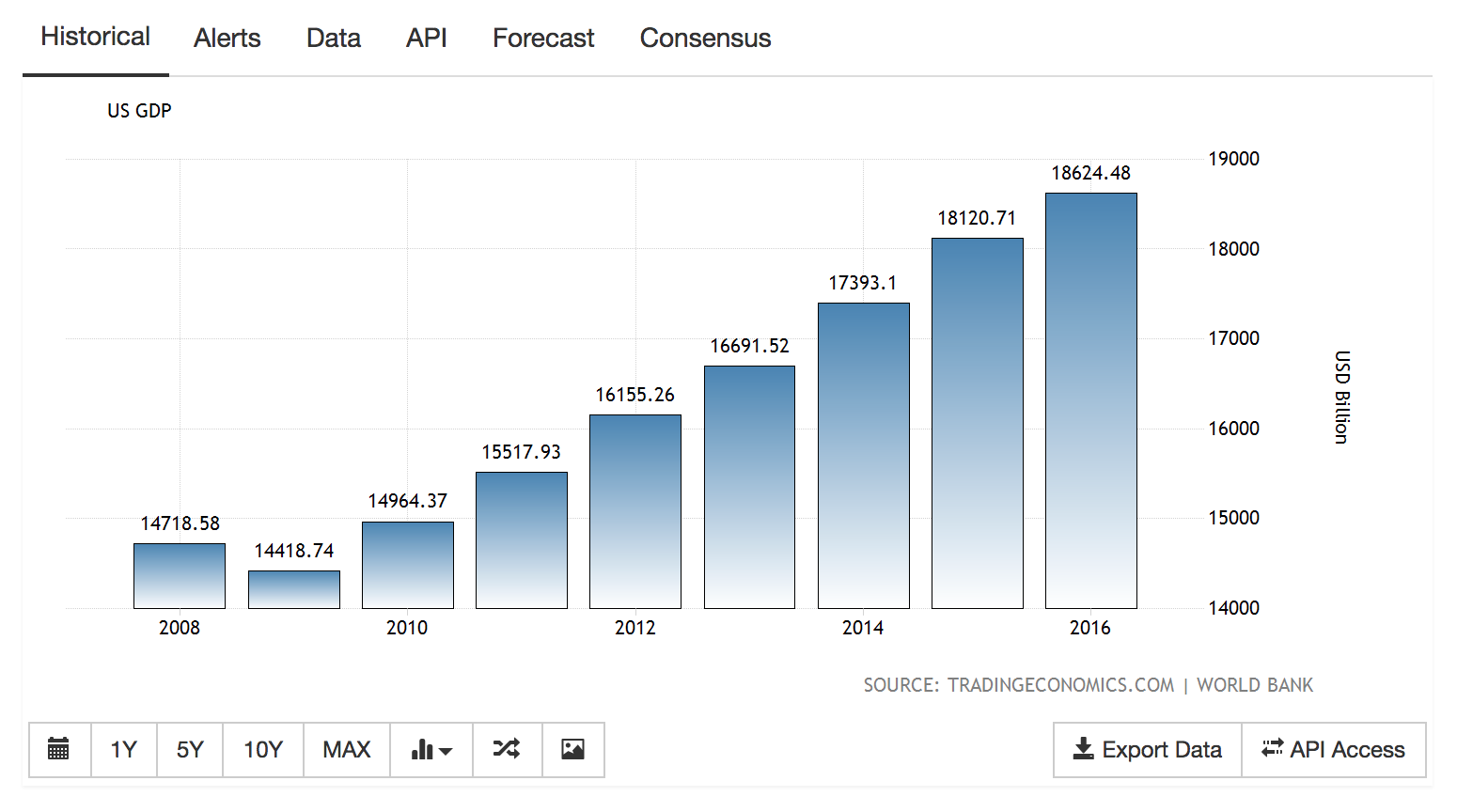

The GDP of the US has been rising for the last 10 years, with the exception of 2009 – the time of Global Financial Crisis. As GDP increases, the market becomes active, hence the demand for housing would also increase.

US GDP

(Trading Economy, 2018)

The US unemployment rate lowered from 4.3 to 3.8 percent in less than a year’s time. It is expected that the unemployment rate will reduce unless there an unexpected event occurs. This would increase disposable income and encourage people to buy a house.

US Unemployment Rate (Trading Economy, 2018)

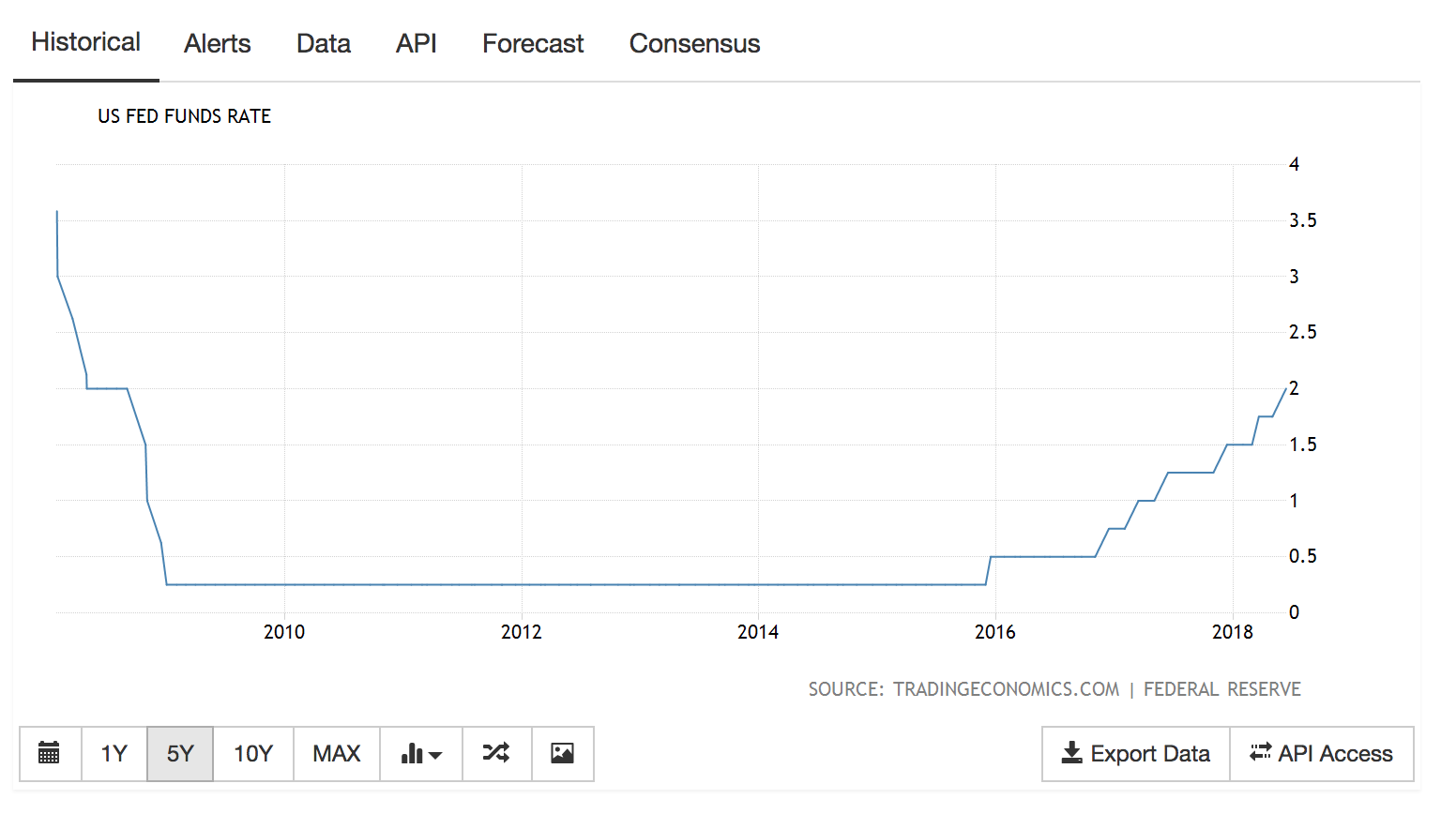

The base rate in the US was around 4% 10 years ago, followed a rapid fall during the Global Financial Crisis, after which it remained unchanged for seven years. The prime rate picked up in 2016 and currently is at 2%. The prime rate is expected to rise further, hence general interest rates in mortgages and savings should also increase. This will increase housing demand and purchases, and housing prices should rise in turn.

US Fed Funds Rate(Trading Economy, 2018)

Considering all of the above, it is clear that any change in the general economy will lead to a change in the labour market, where the majority (35%) are millennials. In the current market, millennials struggle to buy their first home due to the expensive cost of living and house price.

Rent vs Buy(Zillowstatic, 2016)

In conclusion, although US cities are not on the list of the most expensive cities in the world, housing prices remain high. The majority of millennials who would otherwise be buying their first homes struggle to purchase them due to high prices.

The future financial forecasts cannot be certain; however, it is assumed that generally, housing prices will continue to grow, making it harder for millennials to buy a house.

Author Name: Yulduz Mazhitova