Despite concerns over public sector corruption and debt sustainability, Ghana’s economy is set to grow at a sustained record pace in 2019, opening up fresh opportunities on the back of the government’s industrialisation agenda. TFG spoke to Robert Besseling, partner at Exx Africa, about Ghana’s industrialisation agenda and opportunities for 2019.

Ghana: Industrialisation agenda creates fresh investment opportunities

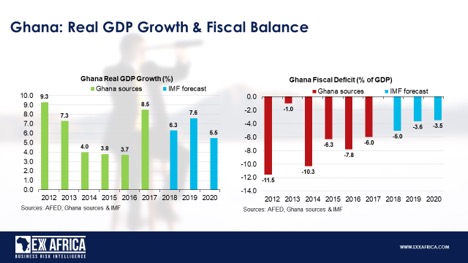

According to the latest Budget, Ghana forecasts GDP growth of 7.6 percent in 2019, including the important oil sector. Non-oil growth is expected to grow at 6.2 percent next year. These forecasts would make Ghana one of the fastest growing economies in Africa, let alone globally. The forecasts are not unrealistic, but do require some consideration.

Finance Minister Ken Ofori-Atta is seeking to replace Ghana’s dwindling foreign aid receipts, as the country consolidates its status as lower-middle income economy. Total donor support is expected to drop from 2 per cent of GDP to 0.5 per cent in the next two years. This is also partially due to the expected completion of the International Monetary Fund (IMF) USD 900 million credit programme in April 2019.

Ofori-Atta’s strategy to replace these sources of financing is focussed on two main aspects: improving revenue collection and raising new debt. With the termination of the IMF programme, Ghana will be able to access debt markets more freely to fill this void. The government’s ambition is to establish the country as an industrial hub for West Africa, based on oil production and refining, agro-processing, manufacturing, and marine services. In this briefing we assess the opportunity inherent in this macroeconomic strategy, as well as the likely challenges ahead.

Corruption weakens revenue collection

According to the latest Budget, Ghana aims to narrow its budget deficit to 4.2 percent of gross domestic product in 2019. Principal to this objective is the improvement of revenue collection. The Ghana Revenue Authority (GRA) expects to collect USD 8 billion this year, although this remains under its annual collection target. Nevertheless, the GRA has made significant improvements in tax collection over the past two years.

At the ports of Takoradi and Tema, import and export businesses have been moved online, thereby reducing the scope for corruption. The GRA has also enforced excise stamp duties by cracking down on large-scale defaulters such as luxury hotels and restaurants. Additionally, the GRA is planning measures to boost collection of VAT by monitoring income and expenditure using mobile phone technology.

Moreover, extractive industries have faced greater scrutiny over mounting concerns of mining revenues being moved offshore. The regime governing repatriation of foreign exchange through the Bank of Ghana is likely to be amended, while extracted mineral quantities will face more stringent inspection. Tax exemptions for oil and mining companies have long been a political stumbling block. From next year, these will increasingly be accounted for as state-owned equity in oil firms.

Despite the new measures, Ghana’s public service remains prone to corruption and embezzlement. The New Patriotic Party (NPP) government is facing mounting allegations of misprizing contracts, cronyism, and fraud, in an apparent continuation of the previous National Democratic Congress (NDC) government’s practices. According to some sources, Ghana’s government is losing some USD 2.8 billion per year in revenues due to overpriced contracts and commercial criminality.

Debt sustainability remains a key concern

Following the completion of the IMF programme in April 2019, the government is widely expected to tap into debt markets to finance its budget deficit and fund expansive spending programmes to boost liquidity in the banking sector and SME sector. Revenues from Eurobond issuance over the past two years have mostly funded existing debt servicing obligations. The NPP government has increased the national debt by almost USD 10 billion since taking office. Much of this has been spent on bailouts of Ghanaian-owned banks since mid-2017.

As such, there remain alarming warnings over debt sustainability. Ratings agency Moody’s has warned that Ghana remains at high risk of debt distress despite official projections that the country’s debt-to-GDP ratio will fall from 69.2 per cent in December 2017 to 54 per cent by the end of this year. However, such projections are skewed due to the rebasing of Ghana’s economy and do not reflect an actual decrease in the debt burden.

However, rather than issuing further Eurobonds, the government is moving towards short-duration securities. This is mostly due to falling appetite for African debt from western investors, but bodes well for the outlook of Ghana’s foreign denominated public debt burden. The government is also seeking Chinese soft loans towards infrastructure and health, which are proving highly successful in boosting government spending in these sectors.

A major challenge for Ghana remains its high level of indebtedness. With the debt ratio at around 70% of GDP, the government’s prudence with debt management remains key to the country’s economic prospects. The energy sector, in particular, is heavily burdened by debt, yet long-term energy sustainability is needed to meet growing demand and to facilitate economic growth.

In 2019, Ghana’s central bank will seek to protect the local currency against possible global pressures on emerging economies, including global trade pressures, steady rise in global inflation, further hike in US interest rates and a strong US dollar. The local currency depreciated 7.8 percent since January, above the bank’s end-year projection of less than 5 percent while public debt rose to USD 35.8 billion or 57.2 percent of gross domestic product at the end of September from USD 31.6 billion or 54.3 percent.

Insight

Despite obstacles in the form of public sector corruption and high indebtedness, Ghana’s economy is set to experience a more sustainable economic growth spurt in 2019. The objective is seeking economic diversification through broad-based industrialisation, specifically agro-processing and light manufacturing. The government says 79 industrial projects out of its pledged 216 new industrial projects will be at some stage of completion by the end of 2018. There is a strong focus on the poorer northern regions in the completion stages.

Larger industrial projects are also underway. The newly formed Ghana Integrated Bauxite and Aluminium Development Corporation will process the raw material into alumina for export. The oil economy also remains on track for further expansion in 2019. However, erratic power supply remains a key concern for the industrialisation agenda. A dispute over pricing of gas through the West African Gas Pipeline led to a wave of power cuts in November.

Meanwhile, the government will seek fresh investment and loans for high-profile capital expenditure projects, including a new regasification terminal in Tema and the construction of 4,000 kilometres of new railway lines at a projected cost of USD21 billion. Minister of Finance Ofori-Atta is also seeking broad banking sector reforms. New capital requirements are likely to trigger a fresh wave of consolidation, just as several new entrants join Ghana’s banking sector.

The absence of key electoral cycles for at least another two years also suggests that fiscal imprudence is unlikely during this period. That said, failure to narrow the deficit and public wage bill discipline, in addition to possible debt accumulation by an expansion-oriented Ghana, could stoke investor anxiety.

Download Report Here