Estimated reading time: 6 minutes

Letter of Credit Explained

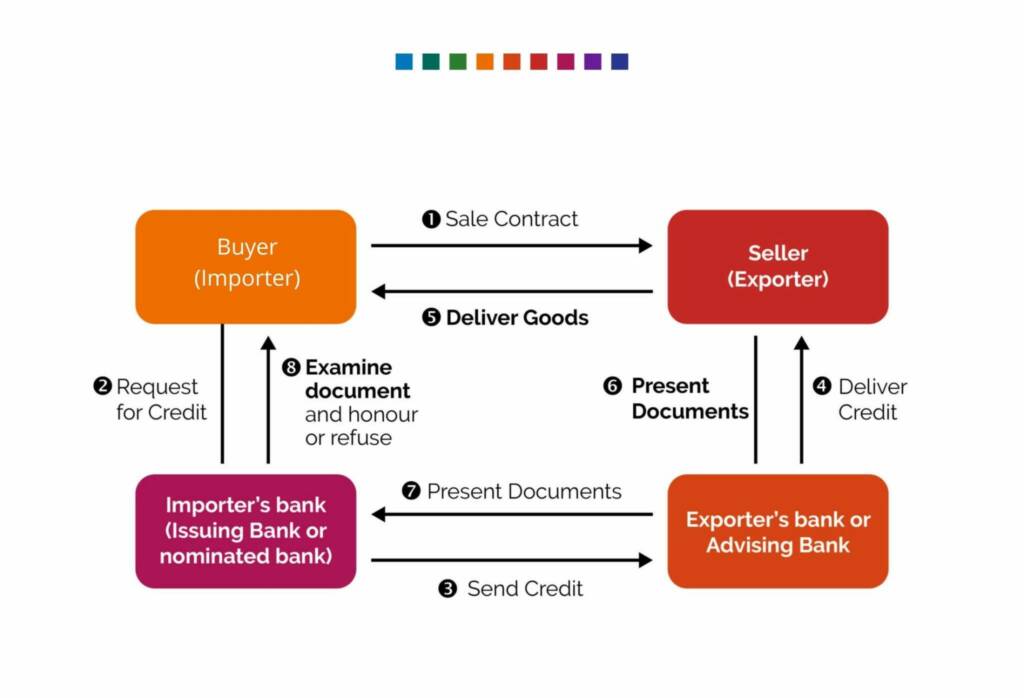

A letter of credit is a document issued by a bank, which guarantees that one party’s payment to another will be received on time and for the indicated amount.

If the payer does not honour the full or partial payment of the amount indicated, the bank is still required to honour it.

Given the payment risk involved and the service rendered, banks charge a fee to the payer to issue a letter of credit.

The fee is typically a percentage of the amount covered by the letter of credit.

History of Letters of Credit

Letters of credit emerged in Europe in the 1800s, and grew slowly to serve international trade, which had flourished since the 1700s.

However, in their early days the functionality of letters of credit was limited, due to the non-uniformity of national laws.

Letters of credit needed standardised international rules and procedures to become fully functional, and this did not happen until 1933, when the International Chamber of Commerce (ICC) developed its first Uniform Customs and Practice for Documentary Credits (UCP), which offered a framework for banks to use letters of credit for transactions worldwide.

UCP is a collection of written agreement rules that ensure uniformity, international understanding, and a standard interpretation and application of documentary credit.

Advancements of Letters of Credit

Letters of credit soon became the go-to instrument in international trade, because they solved the problem of trust between global traders, time zones, distances, and non-uniformity of laws and regulations across jurisdictions.

During the late 19th century and up until the early 20th century, circular letters of credit that allowed withdrawal of money from various banks around the world were the name of the game among global travellers.

Letters of credit played the role that travellers’ checks and credit cards played subsequently, and that e-wallets play today.

Since the first version of the UCP – known as ‘UCP 82’ – was printed in 1933, it has been revised in 1951, 1962, 1974, 1983, and 1993. The latest version is called ‘UCP 600’, and it was amended in 2007.

The objective of these revisions is to provide a clearer common language, and to adapt to changes in different industries, in order to unify the interpretation and the application of documentary credits.

Is it time for a big change?

Nevertheless, the dizzying pace of change in financial instruments driven by digital technology begs the question: have the six UCP revisions – the last of which was in 2007 – kept the letter of credit relevant and useful?

Or is the letter of credit’s position as the go-to instrument for trade finance at risk of being disrupted?

Trade is an increasingly important component of all nations’ GDPs due to globalisation and digitisation.

Trade finance is the arterial network that nourishes this trade. In 2019, the total value of global trade finance was put at $63.5 billion, and by 2026 it is estimated to reach $79.4 billion, with a compound annual growth rate (CAGR) of 3.2% from 2021 to 2026.

Banks have traditionally served the trade finance sector well by providing participants with a range of solutions, including bridging the trust deficit, providing risk mitigation, funding working capital gaps, and executing the settlement of transactions, all through using letters of credit.

Nonetheless, the paper-intense, high operating costs, and slow transaction delivery time that characterise letters of credit are crying out for change.

On the one hand, letters of credit are not easy to understand, and they are made up of stacks of paper, processes, and jargon.

This is possibly one of the reasons they have not seen much innovation.

They are effective tools for the experienced professionals who use them, but there are fewer document experts to support them.

On the other hand, the disruptions in finance that have taken place so far show a clear customer preference for zero-paper processes, low costs, and real-time delivery.

These trends suggest that tomorrow’s products will be digital, and will enable real-time multilateral collaboration, data and document feed, and cloud storage from all parties associated with the trade.

If you are closely monitoring the fintech space, you will have noticed that the fintech wave has gradually enveloped large swathes of the industry, one segment at a time.

It started with the low hanging fruits of P2P payments, beginning with PayPal going to Venmo and Zelle.

Then it reached the B2C segment and created decacorns such as Square, Adyen, and Stripe.

Recently, the mega rounds of funding have been channeled to platforms solving pain points in procurement, accounts payable, account receivables, working capital, trade finance, and other supply chain finance matters.

Digital Dataflow: One obvious pain point in trade finance is the sheer volume of paper-based documents on which the information flow is based.

Companies and banks involved in the supply chain are seeking to streamline the existing processes for less time, less effort, and lower costs.

This will also lead to higher transparency for all parties involved, reduced risk, and optimised allocation of working capital.

Security: Automated processes in trade finance will enable layers of fraud protection through multiple information tracks and systems that intersect and provide checkpoints in every stage of the transaction.

Significance

To ensure that the letter of credit continues to meet international trade players’ expectations, streamlining and digitising processes across the transaction initiation, and providing evidence of supplier performance and settlement stages in real-time and across parties will be crucial.

The letter of credit possesses the unique feature of combining security and risk mitigation.

If it is enhanced by the cost-efficiency and speed of open banking, and the traceability and immutability of distributed ledger technology (DLT), it will bring trade finance up to speed and will solve its current pain points.

But the fusion of an old and established international financial instrument such as the letter of credit with frontier-thinking technologies will first require a change of mindset.

It will also require that a global network of banks, corporates, and sources of digital documents agree to uniform international regulation and legal enforceability, before any widespread global adoption can take place.