Estimated reading time: 3 minutes

- Small and medium-sized enterprises (SMEs) in Vietnam are severely underfunded.

- When seeking trade finance in particular, SMEs face adversely high rejection rates.

- Large banks must shoulder some responsibility for ensuring the integration of Vietnamese SMEs.

Vietnam has established itself as a major trade player in Southeast Asia. In 2022, the country’s trade-to-GDP ratio reached an impressive 185%, according to the World Bank collection of development indicators, showcasing its active role in global commerce. However, according to a report by the International Finance Corporation (IFC) and the World Trade Organisation (WTO) about trade finance in the Mekong Region, banks in Vietnam support only 21% of the country’s total merchandise trade of $731 billion. This disparity is particularly significant for SMEs, for whom high costs and stringent requirements make it difficult for them to access trade finance and supply chain finance (SCF).

Challenges faced by Vietnamese SMEs

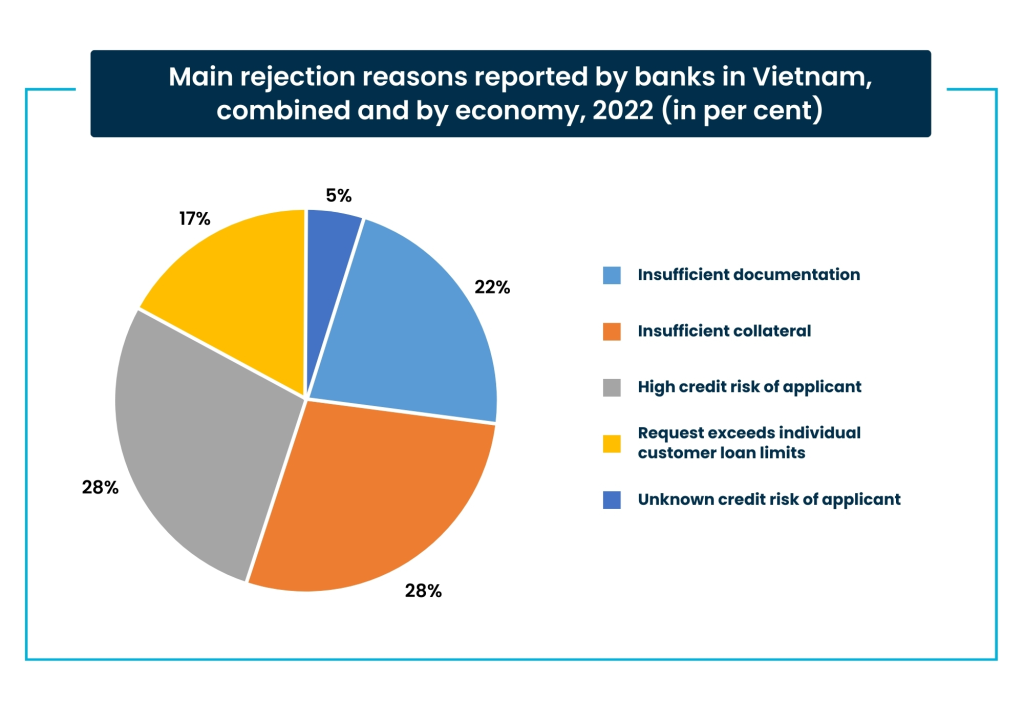

When seeking trade finance, SMEs in Vietnam face high rejection rates. According to IFC, the primary reasons include insufficient collateral (28%), high credit risk of applicants (27%), and inadequate documentation. SMEs lack established organisational structures, adequate record-keeping practices, sufficient collateral, and ample credit histories, so they often struggle to produce acceptable credit files.

Consequently, 70% of SMEs in Vietnam experience difficulties in accessing working capital and frequently resort to using their own funds or borrowing from informal sources at higher costs. This inability to secure trade finance hinders the growth of key sectors. Moreover, local banks often refrain from offering SCF due to perceived insufficient demand, further widening the financing gap for SMEs.

From struggle to success: Financial solutions for Vietnam SMEs

To effectively support SMEs, banks should expand their customer base to include SMEs in dynamic sectors such as chemicals, machinery, and electronics. Knowledge sharing and advisory services about the available trade finance products and how to engage with providers are essential and could significantly improve access to trade finance for SMEs in the aforementioned sectors and beyond. Technological solutions also play a vital role. Banks should develop more advanced internal credit risk assessment systems for smaller companies and new entrants in the trade finance markets. Digitalisation can help reduce the processing costs of trade finance instruments, which remain high in lower-income countries.

To support SMEs, the Bank for Investment and Development of Vietnam (BIDV), Vietnam’s biggest bank in terms of total assets, has implemented several practical solutions. The ‘Trade Booming’ incentive program aims to reduce the financial burden on SMEs and streamline their international transactions. It offers:

- Fee incentives: up to 100% fee reduction;

- Preferential loan interest rates; and

- Free and simplified international transfer documentation services.

Additionally, BIDV has integrated digital trade finance services into its internet banking platform, BIDV iBank. This platform provides SMEs with convenient and efficient access to trade finance solutions, enabling them to manage their trade transactions online with greater ease and transparency.

Technology-driven solutions and automation in SCF programs allow banks to scale SME finance, improve working capital for the whole chain, and ensure sustainable supply chains. By leveraging the strength of the anchors’ supply chains, banks can shift risk from SMEs to larger anchors and use alternative data, such as trade and commercial data, to assess risk more accurately.

In Vietnam, a more inclusive financial ecosystem is possible through collaboration with large enterprises to approach, market, and sell products and services to SMEs, along with online SCF software programs for supply chain enterprises, aiming to provide a range of utilities.

—

While Vietnam’s SMEs face significant challenges in accessing trade finance and SCF, banks can take actionable steps to bridge this gap. By broadening their customer base, leveraging technology, and implementing targeted support programs, banks can play a crucial role in nurturing the development and global expansion of SMEs in Vietnam.