Estimated reading time: 8 minutes

40% of Britons want to exercise more in 2024, according to Forbes. For many, this means going to the gym, which has almost as many acronyms as trade and supply chain finance.

Many workout acronyms are centred around incremental, steady progress, as well as TFG’s predicted theme for 2024.

As with these gym exercises—we predict the next 12 months to be a year of growth—slow, steady, incremental.

Year-ahead predictions are increasingly difficult. The uncertain macroeconomic conditions of late often have a snowball effect on seemingly unlinked phenomena.

As we begin the new year, it’s a fitting time to look forward to, or at least ponder what lies in stock for trade, treasury and payments.

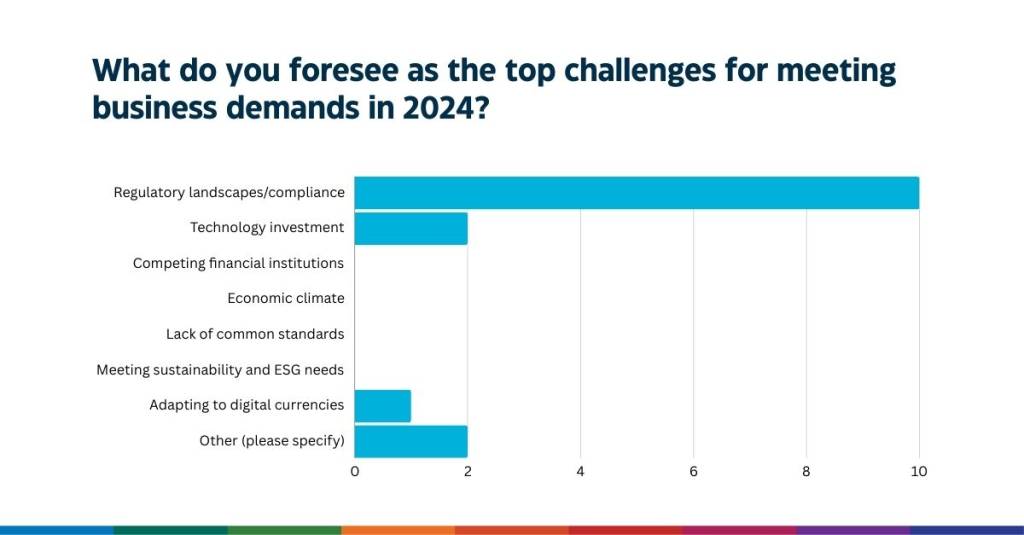

With this in mind, Trade Finance Global (TFG), reached out to a handful of brave (and strong) experts in international trade, trade finance, supply chain finance, and trade credit insurance with one simple ask: to predict the 12 months ahead.

We asked them what trends to look out for and what challenges we might anticipate in the year ahead, and received a range of responses to that end.

2023 could be summarised as an alphabet soup of acronyms and terms that most people hadn’t heard of 5 years before; Gen AI, digital islands, COP, and ETDA.

2024 looks similar according to many experts TFG spoke to, but we needed to understand the complexities and uncertainties that define these areas, gathering insights to shape a clearer picture of what to expect in 2024.

The result is a compilation of predictions and perspectives from those who know these industries best, offering a glimpse into the potential trends and developments that could help us prepare, shape and future-proof trade, supply chain and credit insurance, at least for the next 12 months.

Uncertainty will underpin the macroeconomic landscape (again)

Like 2023, the global environment for trade is expected to continue to be challenging in the year ahead.

We expect another workout cycle of macroeconomic and geopolitical uncertainty, which many have termed ‘the new normal’.

Trade volumes tend to correlate with trade, receivables and supply chain (payables) finance, with the exception of changing interest rates and market confidence.

With many experts predicting a continued economic slowdown in 2024, with some possibility of a global recession, the outlook for trade finance is uncertain. It will depend on an array of factors, such as central bank monetary policy, China’s continued economic slowdown, energy prices, and geopolitics (notably if Trump gets elected in the United States).

Rebecca Harding, Managing Director, Rebeccanomics, said, “Commodity trade finance is caught in the slipstream of events in the Middle East and the Russia – Ukraine conflict. It is likely to be volatile through the year although profitable if oil prices stay high.”

Uncertain macroeconomic conditions such as these, however, tend to amplify credit and liquidity pressures, often causing firms to take protective action.

For businesses, particularly credit-reliant micro-, small-, and medium-sized businesses (99% of the global workforce), the effects can be disastrous. Once lending appetite goes down, so too does cross-border exports, real economy job creation, and wealth creation.

Johanna Wissing, Board Member, Head of ESG at ITFA, said: “Lenders around the globe are looking to cut costs, which would usually trigger layoffs, however, there is a severe lack of talent in trade finance, not just at banks, but across insurers, brokers, traders, asset managers, and fintechs.”

Significant job cuts and reduced risk appetite within this sector could have compounding consequences. Access to working capital would be constrained.

Consequently, companies are expected to face higher costs and tighter credit conditions, making access to trade finance more challenging.

Richard Wulff, Executive Director, ICISA, said, “Elections (not least those in the US) will have consequences on trade and business. I expect a continuation of rising insolvency numbers because of this and because of continued after-effect of Covid. The rising trend of interest rates is halted, but I am not confident that we will see any meaningful decreases in rates. This does not help the business community.”

To add more uncertainty, 2024 expects at least 64 elections around the world, and the USA’s presidential election holds the most uncertainty; the election’s outcome may have a significant impact on free trade and geopolitical tensions worldwide.

Supply chain finance expects lackluster growth

Some exercises are fairly easy to progress in. The number of miles you can run or cycle in a set period of time, weighted leg exercises (think squats, burpees, sprints). Others, often dumbbell-related, are harder to progress in; chest press, shoulder press, and bicep curls. 2024 is synonymous with the latter, sluggish growth across the board for trade and supply chain finance.

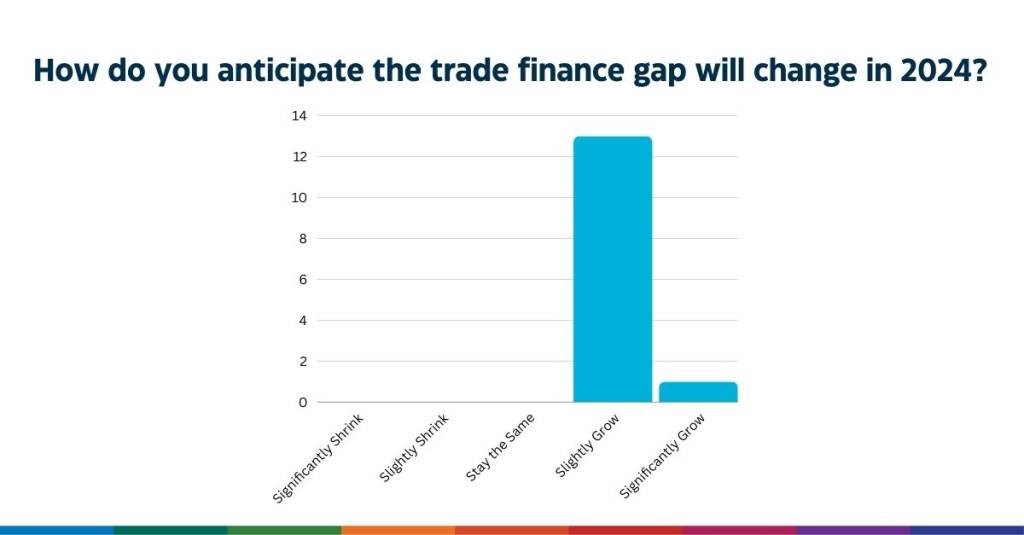

There is little disagreement that the trade finance gap will have grown in 2023 (the report is expected to be published in mid-2024), although some believe it will grow significantly, while others predict it will grow only slightly.

Flat market conditions will lead to tightened liquidity and increased derisking (by way of cutting correspondent banking relationships), putting pressure on the availability and price of trade finance products. These conditions will cause non-traditional financiers to have a much more prominent role as the industry continues uprooting norms and simplifying products.

Sean Edwards, Chairman of the ITFA, said: “I expect supply chain finance (SCF) to get structurally cleverer and to start moving into, or at least exploring, newer areas such as purchase order and inventory financing.”

There is a general expectation that open account trade – including payables and supply chain finance – will continue to grow the most in the year ahead owing, to a tight economy, amplifying the desire for liquidity. However, this view is not universal.

Rudolf Putz, Head of the Trade Facilitation Programme (TFP) at the European Bank for Reconstruction and Development (EBRD), said, “I expect that in 2024, the growth of receivables and supply chain finance will slow down due to lower economic growth and more cautious lending and risk cover provided by banks, factoring companies, and insurance underwriters.”

Standards and frameworks will take centre stage

Environment, social, governance (ESG) and digitalisation will also remain critical priorities for trade finance in the year ahead. However, the emphasis in both areas will be on developing and promulgating robust standards and legal reform to allow for open and sustained progress for years to come.

No single initiative or technology can solve the industry’s challenges in isolation, as highlighted in the International Chambers of Commerce Wave 2 framework, released during COP28 in UAE. The main priority in 2024 must, therefore, be maintaining slow, steady, and sustained progress.

Sean Edwards said: “Digitisation, despite or maybe because of recent failures, will continue to gain pace but only slowly. It is here to stay, but I don’t expect an “AI Revolution”, just as I didn’t expect a blockchain revolution.”

Technology-agnostic solutions that can adapt to rapidly changing digital conditions will be more vital than ever.

Increased demand will drive growth in trade credit insurance

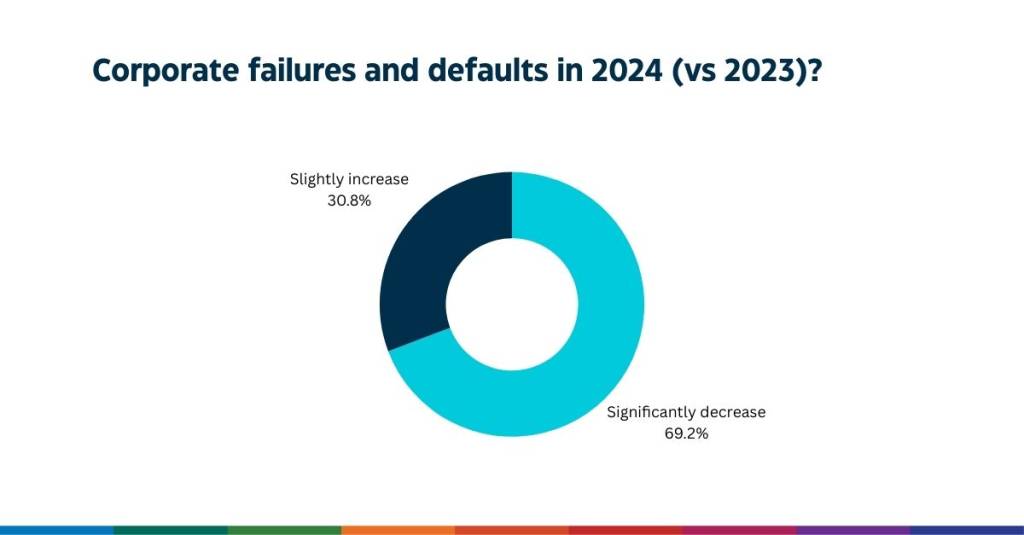

There is a general consensus among experts in the trade credit insurance (TCI) landscape that corporate failures and defaults will slightly increase in 2024 compared to 2023.

Many believe this will lead to more normalised claim ratios – similar to those seen before the pandemic – and may result in insurers reducing credit limit acceptance ratios. The market is also poised to become more fragmented, with market share increasingly shifting away from the “big three” and towards more niche credit insurers.

Chris Hall, Head of FI Sales, Financial Solutions at WTW, said: “TCI will remain a growth market with carriers continuing to offer aggressive commercial terms and increased risk appetite to meet expected continued increase in global demand.”

This demand will likely be driven by new trade agreements and a reshuffling of the global economic order, increasing supply chain complexity and elevating the importance of counterparty risk.

Azzizza Larsen, Alexia Boutin-Somnolet, Petra Bockmayer, Vince McCue at Marsh said, “Increasing overdues and claim events will lead to further normalisation in claim ratios to 2018-2019 levels and result in reducing credit limit acceptance ratios by insurers.”

However, insurers also anticipate higher loss ratios, which could lead to increased premium rates.

Insurers will continue investing in credit information and credit risk assessment tools, which will help expand market penetration as corporates and financial institutions increasingly rely on the industry for qualitative insights on obligors’ default probability.

Wulff added, “I firmly expect that trade credit insurance companies will keep capacity at a level that will satisfy the market, but will become pickier when it comes to risk quality. The capitalization and professionalism of the industry gives me the confidence that the market will continue to function well to the benefit of our clients and the economy as a whole.”

Finally, financial institutions’ anticipated derisking of accounts receivable portfolios is likely to trigger an increased demand for trade credit insurance.

—

It is clear that a landscape of complexity and opportunity awaits.

Adding in a bit of growth, the themes of 2023 will resonate with 2024.

The winners: tradetech and insurtech aimed at monitoring and reporting on fraud and risk, making the credit process faster and cheaper, non-bank financial institutions and funds, private credit, SCF.

The losers: large lending banks focusing on the documentary trade business, particularly those exposed to the US market, those solely banking on short term wins from AI, digital islands (and those stuck on them).

The year ahead will demand resilience and adaptability, as companies face tighter credit conditions and a competitive environment.

Key focus areas like robust ESG frameworks, digitalisation, and technology-agnostic solutions will be crucial in navigating these uncertainties.

As trade, supply chain and credit insurance continue to adapt to global changes, its role in supporting and shaping the future remains as vital as ever for the real economy.