Estimated reading time: 4 minutes

Snoozefest!

Cast your mind back to the start of the year, and you might just remember that currency market volatility had fallen off a cliff as markets awaited the next moves from global central banks.

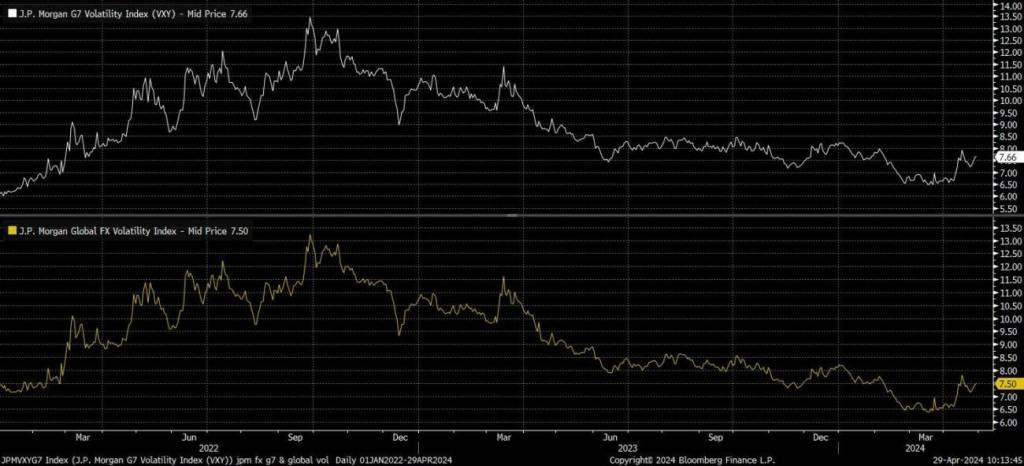

Coming into April, the JP Morgan G7 Volatility Index hit recently its lowest in more than two years, whilst JPM’s Global FX Volatility Index reached its lowest since Q4 of 2021 – that was back just before central banks embarked upon the most rapid monetary tightening cycle in forty years!

Market volatility picked up a little in April, and most analysts predict greater fluctuations to come as central banks lower interest rates at different speeds – any divergence here will drive FX prices!

Source: Oku Markets

Potential drivers of volatility

There are many factors that drive market volatility and cause directional movements in currencies, so whilst 2024 may have been slow out of the traps, there’s plenty to think about going forward.

You’re probably aware that 2024 is the election year, with around half of the global population set to take to the polls. Political instability is an obvious mover of markets as leaders and parties rip up and rewrite policies that affect business, foreign investment, and the local economy.

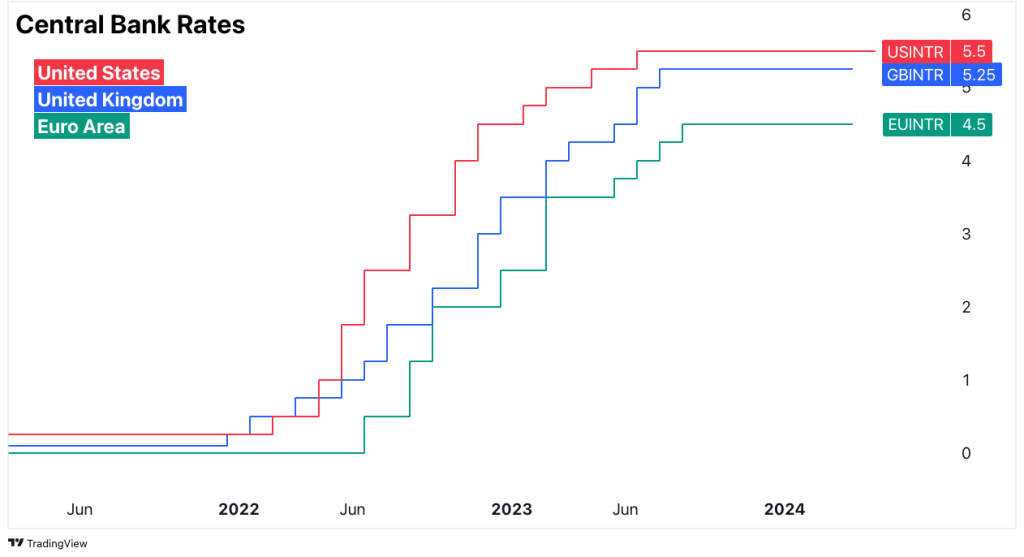

Arguably the biggest driver of FX prices is changes in interest rates as higher rates attract foreign investors seeking higher returns. The idea of interest rate “differentials” describes the difference in rates between two countries, and explains how one currency is favoured by investors over another. These rate differentials are also fundamental in how FX swaps (and therefore forwards) are priced!

So, as global central banks move from holding rates high to pulling them lower, to more normal territory as inflation eases, this will naturally create divergence in policy and change interest rate differentials over time. Speculation over the speed and pathway for rate cuts is a major driver in market sentiment – that’s why you’ll read and hear so much about central banker comments and speeches as investors seek clarity over what’s to come.

What about the economy? Of course, as economies adjust to currently higher interest rate environments, recover from a period of high inflation, and then adjust again to a state of lower, more normal interest rates, economic performance will be affected. The economic performance and future outlook for the UK, US, Europe etc., will contribute greatly to the bigger picture and the strength of their currencies, and all of this is largely unpredictable!

You can read more about the other drivers in my article for Trade Finance Global from 2022 here: https://www.tradefinanceglobal.com/posts/fx-market-definitions-drivers-difficulties/

Source: Oku Markets

Don’t get complacent!

This short article isn’t about why markets were seemingly very quiet and a detailed forecast of what might come down the road, it’s a reminder of how quiet markets might affect financial decision-making, and the traps to be aware of!

There are heaps of articles on cognitive biases, but three that we should all be aware of in times of market quietness are as follows:

- Complacency bias: you may become comfortable with prevailing market conditions, meaning you may underestimate risks or overestimate your ability to predict future market movements.

- Overconfidence bias: a tough one to accept but, you may overestimate your own abilities, knowledge, or judgement. Decision-makers might think they can predict market movements.

- Recency bias: you may give more weight to recent events and experiences when making decisions.

If you take one thing away from this article, it should be this: plenty of people make predictions about future asset prices, but nobody knows!

Stick to the plan

You can avoid any possibility of poor decision-making due to our cognitive biases or otherwise by implementing – and sticking to – a currency hedging strategy.

A clearly defined currency plan doesn’t need to be War and Peace, it just needs to cover off the basics of how much, how far, and how often to hedge.

With set rules, accountability is shared (usually by the Board, or Risk Committee) and the business remains insulated against any sudden spikes in volatility that might otherwise lead to financial losses and/or harmful business disruption.

As we move through May, we’ve already seen some very large currency price swings on an intraday basis as investors digest incoming economic data and rhetoric from central bankers.

Don’t get caught out, and don’t become complacent!

Plan for an unknown future, and protect your business!