Estimated reading time: 8 minutes

As world economies continue to grapple with the pandemic of Covid-19, businesses across the globe are forced to rethink and transform their business strategies to manage the disruption caused in their supply chain. As the Asian Dragon, China, also known as “The Worlds’ factory” takes baby steps towards recovery, many companies are now contemplating pulling out of China. The question that now hangs in the balance is, can emerging economies in Asia like India, Vietnam, and Indonesia seize the opportunity, or is China irreplaceable?

China’s manufacturing success

China’s story of emerging as a manufacturing hub is inspirational. Ranked lowly in the seventh place till the 1980s, China overtook the United States by 2011 to become the world’s largest producer of manufactured goods. China offered a large working population base – a source of cheap labour, propelled by a strong business ecosystem and government support in the form of friendly tax and labour market laws [source]. Other contributing headwinds included a competitive currency policy, superior infrastructure and connectivity, setting up of special economic zones/industrial parks and opening up of foreign investment which spurred export-oriented manufacturing.

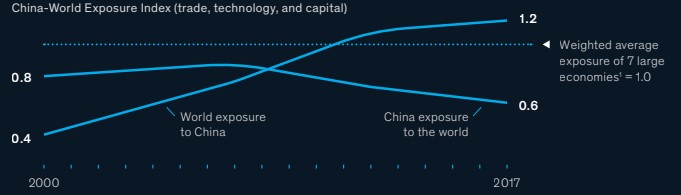

As a direct result, China became the world’s largest trading nation in 2013 and now plays a pivotal role in integrating the world as the largest producer of high-value components. According to a report by McKinsey Global Institute,

“China has been reducing its exposure to the world while the world’s exposure to China has risen.”

Is China’s dominance under threat?

Labour costs in China have shown an increasing trend since 2015. Even before the trade war, companies have been contemplating on how they should not lay their eggs in one basket and de-risk their supply chain.

After the election of Donald Trump as President in 2016, a major trade war kicked off between the two countries. Trump called for tighter enforcement in anti-subsidy and anti-dumping cases and imposed tariffs on imports which led to a similar retaliation by China. By Feb 2020, $550 billion of US tariffs applied to Chinese goods and $ 185 billion of Chinese tariffs applied to US goods [source]. The tension has now further escalated since the eruption of coronavirus.

Impact of Covid-19

In an interview with CNBC, the CEO of Coca Cola Co. James Quincey recently stated, “The supply chain is creaking around the world” [source]. The statement aptly describes the impact of Covid-19 which has struck at the core of global value chain hub regions including China, US and Europe. With several countries imposing partial or full lockdown, international borders of over 100 countries have been sealed resulting in movement of goods, people and capital coming to a screeching halt.

China has been on the receiving end of the global backlash for alleged mishandling of the crisis. As reported by Reuters on 4th May, an internal Chinese report warns Beijing of the rising wave of hostility that could put major stress on China’s ambition to become the largest economic superpower [source]. According to the report, anti-China sentiment is at its peak. After Trump’s order, US firms like Apple, Google, HP, and Dell Technologies are all planning to pull out production facilities from China amid concerns of rising costs. The Japanese government has revealed an economic stimulus package of $2.2 billion to Japanese companies to shutter their manufacturing plants in China. Members of European Union plan to cut dependence on Chinese suppliers.

Is it a blessing in disguise for China’s neighbours?

Several countries like Vietnam, India, Indonesia, Thailand and Bangladesh are set to benefit from the mass exodus of companies from China. Vietnam got the first-mover advantage as companies like Samsung, Nike, Adidas have already shifted their manufacturing base to Vietnam. As many as 27 US factories are being relocated from China to Indonesia which has gained significantly due to low labour costs, better infrastructure and huge land freeing up incentives. India is working aggressively through its embassies abroad to identify companies scouting for options and recently announced a slew of economic reforms to improve India’s ranking in ease of doing business. Mr. Venkatesh Seshadri – Head Supply Chain Consulting at Confederation of Indian Industry expects at least 10% of the manufacturing capacities moving out from China to come to India.

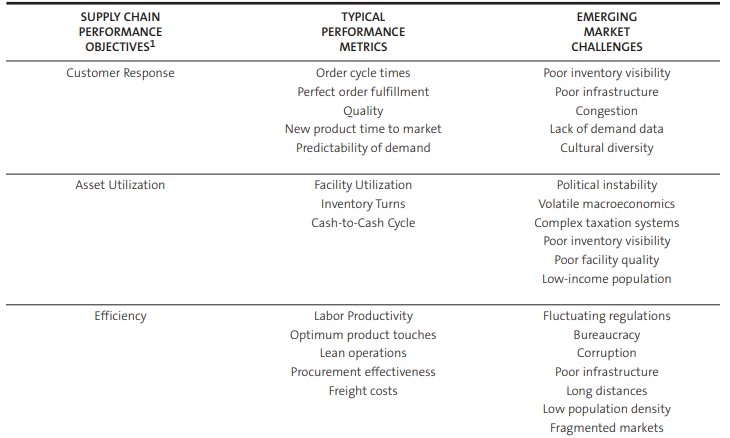

These markets harbour appeal in terms of business opportunities but they come with obvious challenges. Some of these challenges have been highlighted as below in the research paper of MIT scholar Mr. Edgar Blanco – Winning in Emerging Markets: Five Key Supply Chain Capabilities

While it remains to be seen if the above bottlenecks can override the cost of shifting business out of China, several industry experts warn that doing so will not be easy at least in the near term. At a time when companies are looking to conserve cash, the cost of migration may not allow this transition to be immediate. Mr. Patrick Winter, Managing Partner at Ernst and Young said in an interview with CNBC,

“China is making huge investments in technology, artificial intelligence, robotics and blockchain and manufacturing high quality competitive products” [source].

Hence, even if companies move out of China, they will have to come back for at least some stages of production. As per Mr. Alan K. L. Wong, CEO of Global Trade and Supply Chain Finance Advisory based in Hong Kong,

“China is almost irreplaceable in the foreseeable future given that the world depends on China for materials, equipment and even skilled workers.”

Supply Chain Financing in emerging markets and role of technology

Despite the challenges, this is an opportunity for neighbours of China in emerging markets to up their game in terms of building infrastructure and bringing economic reforms in areas of land, labour and taxes. Since global credit crisis of 2008, financing of supply chain has gained major momentum over the years. It is especially a boon for countries where there is lack of credit and liquidity. Supply chain financing (SCF) is a short term credit facility extended by banks/ financial institutions to the vendor (supplier) or distributor (dealer) of a large corporate, usually investment grade. The facility is transaction-based and gives a line of credit to the supplier or distributor which are usually small and medium enterprises (SMEs) The benefits for SMEs are access to capital at cheaper rates, enhancing buyer-supplier relationship, ensuring stable flow in supply chain, reduced costs and improved profitability. For financiers, the risk of exposure on SMEs is offset by the advantages brought in by diversification of risk, increased penetration, ring-fencing of cash flows of the corporate and increased cross-selling opportunities.

As per a finding by Asian Development Bank, the trade finance gap in emerging economies is an approximate of $1.5T due to limited access to SMEs which is expected to widen further to $2.5T in 2025. Supply chain finance driven by technology platforms like can give a boost of $1 T by automating the invoicing and settlement process leading to reduced transaction costs, improved efficiency, lower risk and greater transparency. Economies like India, Vietnam and Indonesia are poised to benefit strongly with rapid adoption of Blockchain/ DLT technology due to low bank penetration, high credit risk and less stable business ecosystem. However, the authorities need to act fast and address the challenges of providing a reliable and secure regulatory framework along with seamless implementation. If administered effectively, technology can truly help us usher in a new era of globalization with emerging markets in Asia at the forefront.

This article was written by a member of TFG’s 2020 International Trade Professionals Programme. Find out more here.

Disclaimer: The views that have been expressed on this page are that of the author, which may or may not be in line with Trade Finance Global or, LIBF’s view.