This article deals with the digital transformation of the banking operations of guarantees and documentary credits to shift from the paper-based and labour-intensive models to a digital trade ecosystem.

Traditional guarantees and documentary credits

Documentary credits (also referred to as letters of credit) and demand guarantees are trade finance instruments that have been used for a long time to mitigate the risks associated with global trade by reconciling the divergent needs of exporters and importers, allowing them to transact with confidence across borders. A guarantee is an irrevocable undertaking issued by a bank upon its client’s instructions to pay the beneficiary a stated sum of money upon presentation by the beneficiary of demand in a documentary form that complies with the terms of the guarantee. A beneficiary usually requests a guarantee to secure compensation in case of contractual non-performance by the bank’s customer. A guarantee is different from a documentary credit which is a performance-related payment instrument. A documentary credit is a written undertaking by a bank given to the seller (beneficiary) at the request of the buyer (applicant) to pay a stated sum of money against the presentation of documents complying with the terms of the documentary credit.

Sticking with paper

Both documentary credits and guarantees have been heavily reliant on paper documents and manual processes for decades. This reliance usually has drawbacks, including the cost and time required to prepare, transmit, and check documents. Moreover, these paper documents may be subject to errors or fraud because of the number of parties involved and the complexity of trade finance transactions. Therefore, it is here that technology needs to be employed to improve these fundamental tools of the trade finance sector.

Emerging technologies, such as blockchain, artificial intelligence (AI), and cloud computing, are changing how banking operations and trade finance are originated, transacted, and settled. The digitalization of trade finance looks for opportunities to bring technologies to the world of trade to reduce reliance on paper-based and manual processes and improve the customer experience. The trend toward digitizing documentary trade finance instruments is not new. Throughout the last decade, many financial institutions launched initiatives to automate trade finance transactions.

The impact of COVID-19 on trade finance

The COVID-19 pandemic has underlined the need to accelerate the digitization of trade finance due to a lack of physical employee presence at the usual places of business, coupled with the inability to print and transport paper documents. According to the ICC Digitalisation Working Group’s report, Digital Rapid Response Measures Taken by Banks Under COVID-19, the principal disruptions for the trade finance industry have been related to the transfer of paper documents and negotiable instruments and the requirement for authorized signatures.

As a result, digital solutions have become an important tool to overcome COVID-19 challenges, including working from home, as well as staff and clients’ difficulties handling paper documents. According to SWIFT Watch, despite the decline in documentary trade finance by 11% throughout 2020, SWIFT’s Digital Trade Channel solution usage increased by 72.4% in 2020, illustrating the appetite among corporations for digitization.

The adoption of digital technology in trade finance

The 2020 ICC Global Survey on Trade Finance indicated that 83% of global banks have a digital strategy for trade finance. Although only 17% of the banks stated that they successfully implemented digital solutions. Accordingly, the shift towards implementing digital solutions in trade finance seems to be underway; however, it needs to accelerate in response to the COVID-19 crisis. The following digital technologies are seen as catalysts to accelerate the digital transformation of the banking operations related to traditional trade finance instruments by shifting from paper-based and labour-intensive models to a more modern digital world. None of these technologies should be considered as an optimal digital solution for trade finance operations. These technologies are not digital islands, but each of them relies on the capabilities of others to deliver its most powerful benefits.

Distributed Ledger Technology

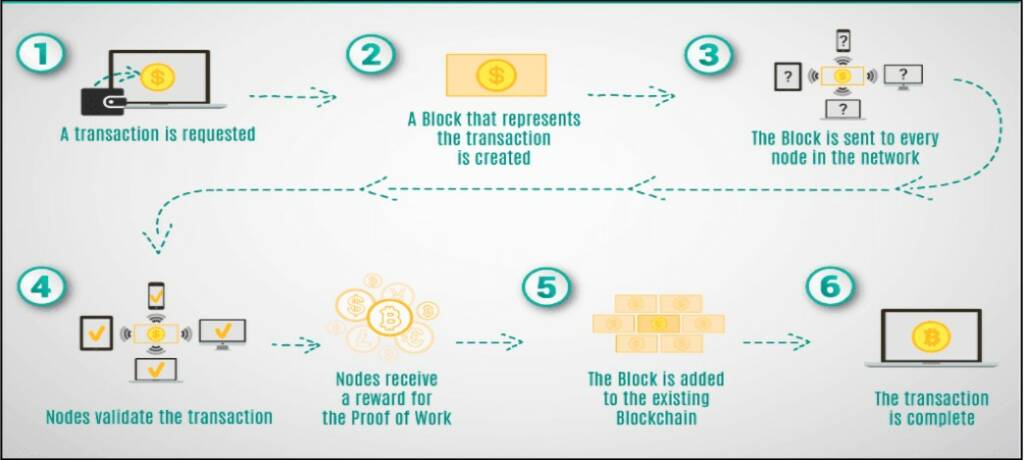

Distributed ledger technology (DLT) (also referred to as blockchain) is a decentralized, distributed record of transactions in which the transactions are stored in a manner that all parties to the network can trust, although the specific mechanism used to facilitate that trust varies from one platform to another. Figure 1 shows how a proof-of-work blockchain network works.

DLT can play an important role in digitizing paper-based documentary credits, and demand guarantees. DLT can address inefficiencies in letters of credit and guarantees operations related to the need to issue, handle, store, exchange, and manage physical documents by introducing electronic issuances, exchange, and documentation. DLT embodies all the necessary data of a transaction in a digital document, which is updated and can be viewed by all participants on the network almost instantly.

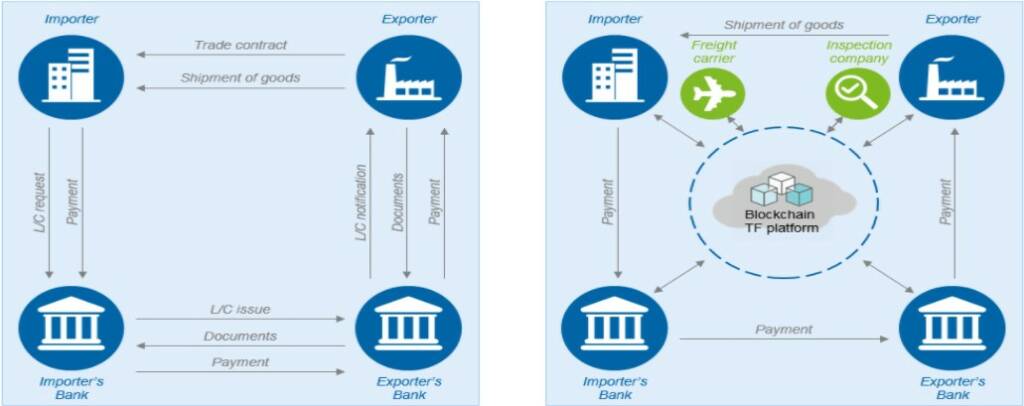

DLT technology offers the ability to conduct peer-to-peer transactions, provide complete transparency for all counterparties, and instant access to information. Trade finance tools built on DLT have the potential to provide end-to-end digitalization for documentary credits and demand guarantees transactions. Figure 2 illustrates the difference between traditional and blockchain-based documentary credit.

According to the Trade Finance Global and World Trade Organization co-publication DLT in Trade: where do we stand?, there are at least 44 DLT projects currently active. The development of trade finance DLT platforms is currently being carried out by several large banking consortia collaborating with technology providers such as IBM Hyperledger or R3 Corda. Five consortia have carried out the most advanced developments of DLT platforms to date, namely we.Trade, Marco Polo, Contour, Komgo, and eTradeConnect.

Although DLT seems promising, there are several factors that hamper the rapid expansion of these platforms including:

- Only a few platforms offer solutions designed for traditional trade finance products, while others have decided to develop solutions supporting open account trade transactions.

- Integrating banks and other counterparties (i.e., inspection companies, freight forwarders, customs, etc.) from various countries into specific platforms requires time & cost. These platforms can only be fully efficient and beneficial to customers if they reach sufficient size and market coverage.

- The lack of global digital standards for trade to be used by these platforms hinders the interoperability and communication between them.

For these reasons, DLT appears to have the potential to revolutionize trade finance in the medium term.

Optical Character Recognition (OCR)

Optical Character Recognition (OCR) technology allows paper documents to be scanned and converted into digital formats. OCR digitizes paper documents so that they could be electronically edited, searched for, and used in other digital processes. Documents processed with the OCR solution offer the users recognition of characters or entire texts and then the possibility to select data contained in the document based on keywords. The most beneficial effect of OCR implementation for documentary trade finance is significantly reducing the time associated with paper-based document processing.

According to a 2020 ICC Global Survey, 28% of banks use OCR for data extraction and creating searchable documents, including banks active in trade finance, such as HSBC and Standard Chartered. Furthermore, when OCR technology is integrated with AI and natural language processing (NLP) technology, OCR may add the ability to automate necessary anti-money laundering (AML) searches required for guarantees and documentary credits transactions. However, despite the advantages of OCR, experts argue that the best accuracy level reached using this technology is 85-90%. That means human intervention and manual effort may still be needed to double-check, correct, and clean data.

Robotic Process Automation (RPA)

Robotic Process Automation (RPA) enables full process automation based on implementing software that repeats employees’ routine activities and eliminates manual operations such as data entry or saving and uploading documents. RPA can monitor and classify documents and extract relevant data, update the core banking system with relevant data, and manage compliance checks based on specific conditions. RPA can create reports by auto-filling available report formats to create reports without errors and minimum time. RPA, when combined with OCR, could be used to automate several routine processes in the trade finance department to free up employees to work on more critical tasks that require human judgments.

Experts argue that RPA can:

- reduce operating costs,

- enhance the efficiency of the internal processes of banks,

- lower the risk of potential errors, and

- reduce the average time for handling a guarantee or documentary credit transaction.

Nevertheless, it is crucial to keep in mind that not all processes qualify as RPA candidates. While rule-based and labour-intensive processes are perfect candidates for RPA, processes that require validation or human judgment may not be a good fit.

Application Programming Interfaces (API)

Application programming interface (API) is a software intermediary that effectively allows two applications to interact with each other. APIs act as bridges between banks and the third-party applications or programs that their clients use. The application of APIs in the banking sector allows a direct exchange of information between banks and the interfaces used by their clients (i.e., programs or applications). In doing so, banks become open platforms that may provide their customers with various functions that are developed or offered by third parties. Banks are extensively leveraging the potential of external service providers through APIs, creating an improved customer experience. Several banks now allow their clients to apply for guarantees and documentary credits via online platforms through API.

In September 2019, HSBC released an API that enables its partner banks to issue bank guarantees at the request of their customers in markets where they do not have a presence. This API allows HSBC partner banks to build applications for their customers, enabling them to have visibility of the status of their guarantees on their banking platform, even though HSBC issues and delivers the guarantees. Once the guarantee has been issued, it can be downloaded as a PDF document from the platform. ING Bank and Standard Bank were the first two banks to issue bank guarantees using this technology.

Potential benefits of trade finance digitalization

Trade finance practitioners argue that implementing digital solutions in trade finance could have various benefits for financial institutions. The following points capture areas that can be affected by the digitalization of trade finance transactions:

Trade finance operations

Most banks worldwide may still be far off from fully-automated trade finance operations, but even a partially transformed process can streamline the bank’s processes to reduce transaction time and cost, decrease the probability of errors in documents, and – by substituting automation for repetitive tasks – free up time for other functions that add value for clients. By digitizing documents, banks and corporates would diminish the need to collect, scan, and re-key data, leading to greater efficiency in trade finance operations. Replacing the current paper-based model for demand guarantees and documentary credits with an automated, tamper-proof data storing process may result in cost reductions for all parties involved in these transactions.

Credit risk assessments

Digitalization of trade finance can provide richer data, which could impact the quality of credit risk assessments of the trade finance clients. For example, big data analytics enabled by AI tools can enhance the customer due diligence process by retrieving data about the client from online sources such as digitized financial accounts or social media and allow an automated interpretation of such data. In turn, this could promote financial inclusion by providing better trade finance access to small and medium enterprises (SMEs).

Compliance procedures

Another benefit of digitizing trade finance operations is related to automating crucial functions within the areas of AML, Know Your Customer (KYC) and compliance checks required for guarantees and documentary credits. This would make compliance with global and domestic regulations more straightforward and easier to demonstrate. There are ongoing efforts to develop central KYC databases, like SWIFT’s KYC Registry, in order to provide client information to a larger group of finance providers, thereby reducing redundancies and costs. 61% of the respondents of a BNYM survey in 2019 viewed centralized KYC databases as the most effective technology solution for addressing compliance issues.

Challenges facing the digitalization of trade finance

Despite its claimed benefits, digitalized trade finance faces constraints to broader adoption. The following points highlight the main challenges related to the digitalization of documentary trade finance:

Partial automation of the process

Most automation and digitalization initiatives usually focus on reducing operating costs and covering certain internal bank processes (e.g., data capture and sanctions screening) instead of digitizing the entire trade finance transaction. Figure 3 shows the percentage of documentary trade finance processes with no human intervention. The average automation of the banking processes for guarantees and documentary credits is only 6-8%. This implies that most of the processing required for guarantees and documentary credits is still dependent on paper documents and manual, labour-intensive procedures.

The cost of adopting digital technology

The 2020 ICC Global Survey on Trade Finance indicated that the adoption of digital technology seems to be more limited among local and regional banks than global banks. This result may be attributed to the great efforts and costs required to upgrade banks’ technology infrastructure, which represents a key hurdle in digitizing trade finance. Large banks usually enjoy substantial financial capabilities and technical economies of scale and can invest heavily in their innovation activities to protect themselves from the adverse effects of disruption. On the other hand, small banks may face difficulties securing the necessary investments required for the digital transformation of their operations.

The need for legal systems to recognize digital documents

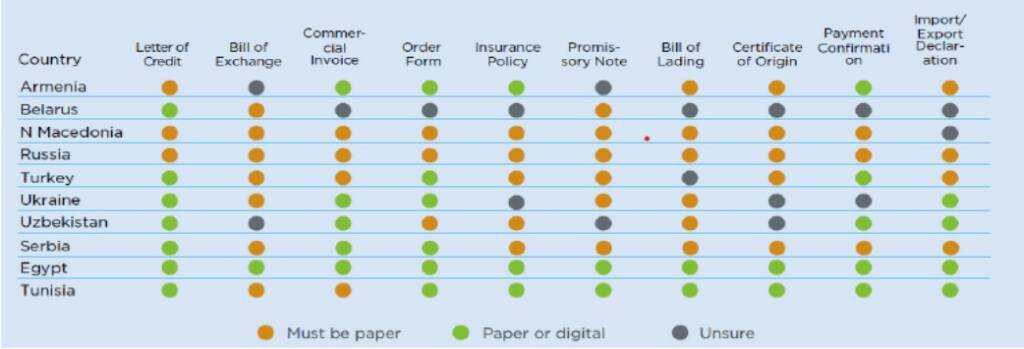

Customs procedures in many countries still rely on paper documents, manual and inefficient processes in processing trade transactions. This has led several organizations to question why they should lay out the significant capital investment necessary to digitize their processes when paper requirements along the chain still bog down their digital work. The challenge with electronic documents -such as electronic bills of lading- is whether they are legally valid. According to the Global Express Association’s Customs Capability Database, 64 of 139 countries annually measured do not accept or electronically process the data required to release shipments in advance of their arrival. Figure 4 reveals the inconsistency across different legal jurisdictions regarding the requirements for trade finance documents to be in paper form.

Governments and policymakers worldwide are required to examine how the legal and regulatory environment needs to evolve to accommodate greater digitalization of trade finance while providing the same level of certainty and risk mitigation afforded by paper-based predecessors. Without significant regulatory support, the effectiveness of individual banks’ efforts to move toward digital solutions will be limited. Meanwhile, moves by economies such as Singapore in adopting the UNCITRAL Model Law on Electronic Transferable Records (MLETR) into domestic legislation, and the G7 economies in committing to adopt electronic trade documents, indicate that the international legal framework for global trade is likely to shift quickly.

Lack of international digital standards

Another obstacle to the digitalization of trade finance is the lack of international digital standards for data, which impacts the development and adoption of technologies such as API and DLT. However, this looks set to change. In 2020, the ICC launched the Digital Standards Initiative (DSI) to develop digital trade standards to facilitate interoperability among the various technology platforms that have entered the trade space over the past few years.

Summary

Given the complex nature of documentary trade finance, banks must seize the opportunity to transform their trade finance operation to compete successfully in the future. Given the complex nature of documentary trade finance, banks must seize the opportunity to transform their trade finance operations to compete successfully in the future. In the coming period, banks need to look at the increasing demand for digital solutions with a broader vision and feed the capacity gap in the traditional trade finance sector by investing in new processes and technologies.

Paper will not disappear overnight, however, adopting technologies like DLT, RBA, OCR, and API can improve workflows and reduce the reliance on paper documents and manual procedures related to the processing of demand guarantees, documentary credits, and other trade finance instruments. Experts argue that digitizing documentary credit and guarantees will not only reduce transaction time and costs but also increase regulatory compliance and enable more engagement of SMEs in international trade and e-commerce.