In the wake of the ICC Uniform Rules for Digital Trade Transactions (URDTT) recent launch, we explore the meaning of a digital trade transaction – underlying assumptions, regulatory framework, and future expectations.

Digital Trade Transaction

As the world transforms and adapts to new realities and digital technologies, so does the trade community. We are at the early stages of the digital trade transaction journey, focusing on the building blocks that will underpin this transformation and that will pave the future path.

In this sense, defining a ‘digital trade transaction’ seems like the right place to start. There is no universally accepted definition of a digital trade transaction. OECD offers the following description, where digital trade transaction “encompasses digitally-enabled transactions of trade in goods and services that can either be digitally or physically delivered, and that involve consumers, firms, and governments. That is, while all forms of digital trade are enabled by digital technologies, not all digital trade is digitally delivered.”

This is perhaps the most common interpretation. The challenge in trade is that the vast majority of goods are produced elsewhere, often overseas, and then physically delivered to buyers – therefore, not all transactions can be fully digital. Technology such as 3D printing may enable buyers to ‘print’ products locally in the future, however, this is not a reality just yet. Furthermore, the delivery of trade transactions is typically accompanied by a mass of physical documentation – more specifically, 4 billion documents are circulating in the trade system, according to ICC figures. These documents contain the critical information about the transaction itself, as well as recording the rights and obligations of the parties involved.

The development of technologies to digitise, connect, and automate trade creates new possibilities to move trade closer to the “digital at source” reality. Through the collaboration of solutions that create an ecosystem, there are new channels that facilitate the greater movement of data previously reserved for physical interaction only.

Well-known examples include the digitisation of documents of title, which today can be created as a secure digital document or simply an electronic record on a shared database or ledger. The open application programming interfaces (open APIs), cloud, distributed ledger technology, and other technologies drive the transparency and ease of access to data.

The digital trade ecosystem, however, is still missing a common regulatory framework. Some industry players have already built their own rulebooks, while the industry as a whole catches up.

Uniform Rules for Digital Trade Transactions

In June 2017, the International Chamber of Commerce (ICC) Banking Commission assembled a Working Group on Digitalization in Trade Finance. This broadly included two streams: the creation of common rules and practices and the acceleration of digital adoption in trade finance.

One of the Working Group’s specific tasks was to create the Uniform Rules for Digital Trade Transactions, also referred to as URDTT for short. The objective was to “Develop a high-level framework for rules and obligations covering the use of Electronic Records to process Digital Trade Transactions.”

The URDTT is the first ICC framework of its kind, with the Working Group having finalised the draft earlier this year following a number of iterations based on guidance received from the ICC National Committees.

“Voting concluded on 29 June 2021 for the adoption of the URDTT Version 1.0. We received over 1,500 comments from ICC National Committees, each responded to individually. The use of version numbers will allow for a more focused and shorter revision of the rules as and when technological advances are made or where market trends develop or expand from time to time,” said stream advisor Dave Meynell.

The first version of the rules has been approved and is now generally available. The unprecedented amount of feedback received from ICC National Committees globally highlighted the great importance of this work, aiming to establish a commonly understood and accepted set of principles to address the uncertainty associated with digital trade transactions.

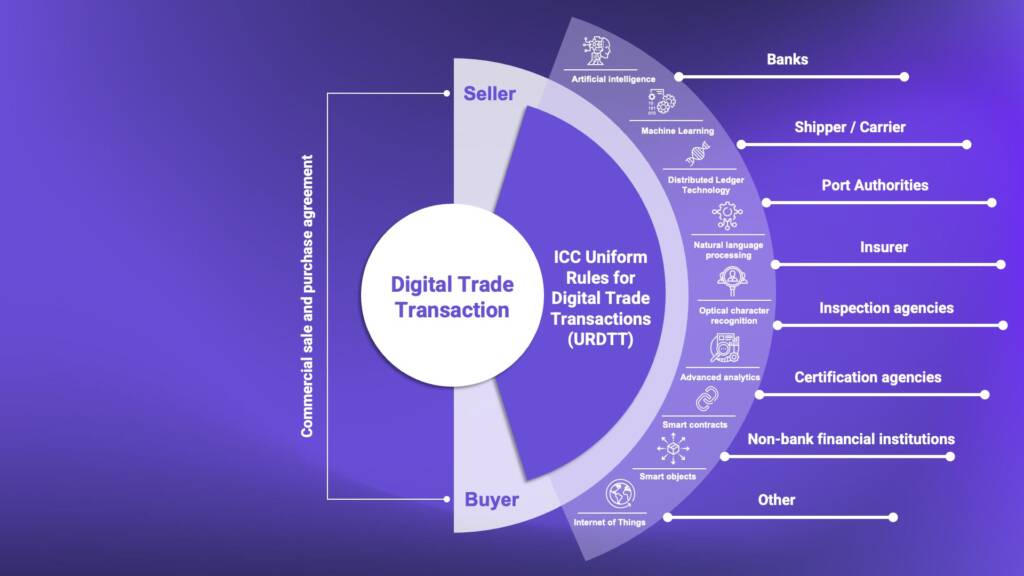

The URDTT Working Group’s concluding comments explained: “In order to appreciate the true value of the URDTT, we need to think beyond traditional instruments; think beyond traditional rule-making; think beyond existing ways of doing business. The URDTT are intended to govern across a digital landscape, taking into account recent developments, not only in distributed ledger technology but also the use of artificial intelligence, natural language processing, machine learning, data analytics, smart contracts, smart objects and the Internet of Things, all of which will have a material impact on the ways in which we do business in future.”

Into the thick of it

The URDTT takes the view that a digital trade transaction is conducted in a fully digital environment, remaining agnostic towards the underlying technology and messaging standards. Where full digitalisation is not possible, due to regulatory or other requirements, parties can agree on how to handle such elements of the transaction separately, as this is not covered by the URDTT.

Critically, a distinction is drawn between a digital trade transaction and the underlying commercial sale and purchase agreement for goods and services. This also addresses the earlier point about the physical aspect when delivering goods. Instead, a digital trade transaction is defined as a process which facilitates the use of electronic records to evidence the underlying commercial contract and enforce the payment obligation. It is important to note that the performance of parties under the commercial agreement is not ruled by URDTT.

The payment obligation and payment undertaking are the two elements of the URDTT that are worth highlighting. The buyer payment obligation transforms from conditional to unconditional upon compliance with the terms and conditions of the digital trade transaction; in other words, upon submission of the appropriate electronic records. Similarly, bank and non-bank financial institutions can add their payment undertaking, which is subject to compliance with the terms and conditions of the digital trade transaction.

The approach under URDTT extends into the corporate, financial institution, and bank arenas, as well as addressing the growing community of non-bank providers of financial and technology services. Practical issues, such as non-compliance or data corruption of the electronic record, are captured to help parties establish the right practices for a successful interaction in the area of digital trade transactions.

The Rules have also been designed to be compatible with the widely discussed and praised UNCITRAL Model Law on Electronic Transferable Records (MLETR), specifically around electronic commerce, electronic signatures, and electronic transferrable records.

Novelty vs necessity

Across the world, global supply chains and international trade continue to grow. The COVID-19 pandemic has brought the “new normal” of dynamic workplaces and highlighted the importance of digitalisation to the trade industry. There will be bumps in the road, and there is no denying that there will be changes to the existing regulatory frameworks as the industry evolves. The first version of URDTT is only the beginning and, naturally, iterations over time are to be expected.

The wider adoption of digital practices is slower than perhaps desired, but it is on the right track. Initiatives to digitise trade and supply chains, such as the ICC Digital Trade Standards Initiative (DSI) and the ITFA Digital Negotiable Instruments (DNI), are leading the way. Regulatory frameworks have been widely identified as a missing piece to enable further digital transformation. The adoption of electronic standards via UNCITRAL Model Laws, the ICC eURC and eUCP, and now URDTT frameworks help to address some of the current constraints. These are the fundamental building blocks that market participants should take an active interest in, as they will shape the new digital trade of tomorrow.

Most important are the benefits that trade digitalisation unlocks, delivering ‘trade for good’. The ICC has recently estimated that the adoption of electronic documents in trade will generate £24.6 billion in SME trade by 2024 – a significant 25% increase. Wider adoption of digital standards combined with solutions such as ICC Tradecomm marketplace, powered by Finastra, will support greater prosperity worldwide.

In short, to answer if a digital trade transaction is a novelty or a necessity – it is certainly the latter.