Estimated reading time: 7 minutes

SWIFT MT799 versus MT760

MT760 is a digital message that is sent between banks and used for issuing or requesting a letter of credit or documentary credit.

MT799 is a message with the aim of showing funds or proof of deposits – not as a method of transferring funds or making an undertaking to do the same.

Both are interbank message types that are used on the SWIFT system to enhance financial institutions’ communication.

On this page

- What is a SWIFT MT 799?

- What is a SWIFT MT 760 bank guarantee?

- What is the difference between SWIFT MT 799 and SWIFT MT 760?

- Key differences (summary)

- How does SWIFT messaging work?

- SWIFT messaging types

- What does a SWIFT message look like?

- SWIFT free format messages

- Are SWIFT MT communications used widely?

- More information

SWIFT MT 799 and SWIFT MT 760 bank guarantee – All you need to know

The SWIFT MT 799 is a free format SWIFT messaging type that banks use securely communicate information regarding bank guarantees (demand guarantees) and letters of credit (documentary letters of credit).

MT 799 is not used for transferring funds or even for promising to transfer funds.

Rather, it is primarily used for showing proof of funds or proof of deposits.

As this is a free format message type, banks are able to send various types of messages to other SWIFT member banks before they send any funds, guarantees, or letters of credit.

Find out more about SWIFT MT 799 here.

SWIFT MT 760 is a messaging type used by institutions to either issue or request a letter of credit or documentary credit from another institution.

Since these documents involve either actual payment or guaranteed future payment, MT 760 messages require much more information than MT 799 messages.

Once the MT 760 message is sent, the institution will ring-fence the necessary funds for the ultimate transaction to be completed.

Find out more about SWIFT MT 760 here.

Banks, practitioners and businesses often confuse the term SWIFT MT 760 and the SWIFT MT 799.

Why wouldn’t they, the messages are sent in the same mode, by banks, within the same industry, but there are a number of differences.

MT760 and MT799 are often mentioned when working with Bank Guarantees or types of Documentary Credits.

The SWIFT MT 799 is the message format used for correspondence sent in relation to Bank Guarantees.

The SWIFT MT 799 acts as a straightforward confirmation, which sets out that funds are present to cover a specific transaction.

The reasoning behind the format and method of the proof of funds is so that it conforms to the message type used in the SWIFT Category 7 “Treasury Markets & Syndication”.

It is perceived as a verification tool and acts only as a bank-to-bank SWIFT electronic verification.

Key differences (summary)

| SWIFT MT 799 | SWIFT MT 760 |

|---|---|

| Pre-advice communications between banks | The message used to block funds |

| Confirmation message (2-way response) | Collateralises assets via a SWIFT guarantee |

| Often construed as proof of funds | Potential for a 1-2% fee for blocking |

| Unauthenticated message | Often seen as a bank guarantee or equivalent |

SWIFT is a communication service that acts as a messenger between banks and other financial institutions.

The service uses consistently formatted codes to identify its more than 11,000 member institutions, making it easy for members to transmit information to other member institutions.

For example, imagine a scenario where a Canadian company with an account at a TD Bank branch in Ottawa needs to pay an invoice to a German supplier with an account at a Deutsche Bank branch in Berlin.

In order to make this payment, the Canadian company only needs to provide TD Bank with the SWIFT code for the supplier’s bank in Berlin and the supplier’s account number with that bank.

Now, as long as TD Bank and Deustchebank have a commercial relationship, this payment can easily be made from one institution to the other.

This is just one example of the more than 220 message types that are grouped together into nine different categories.

SWIFT messaging types

There are nine different categories of SWIFT message types:

- Category 1 message type (MT 1xx): customer payments and cheques.

- Category 2 message type (MT 2xx): financial institution transfers.

- Category 3 message type (MT 3xx): treasury markets, foreign exchange, money markets, and derivatives.

- Category 4 message type (MT 4xx): collections and cash letters.

- Category 5 message type (MT 5xx): securities markets.

- Category 6 message types (MT 6xx): treasury markets and precious metals.

- Category 7 message types (MT 7xx): documentary credits and guarantees.

- Category 8 message types (MT 8xx): traveller’s cheques.

- Category 9 message types (MT 9xx): cash management and customer status.

MT 799 and MT 760 are a part of category 7.

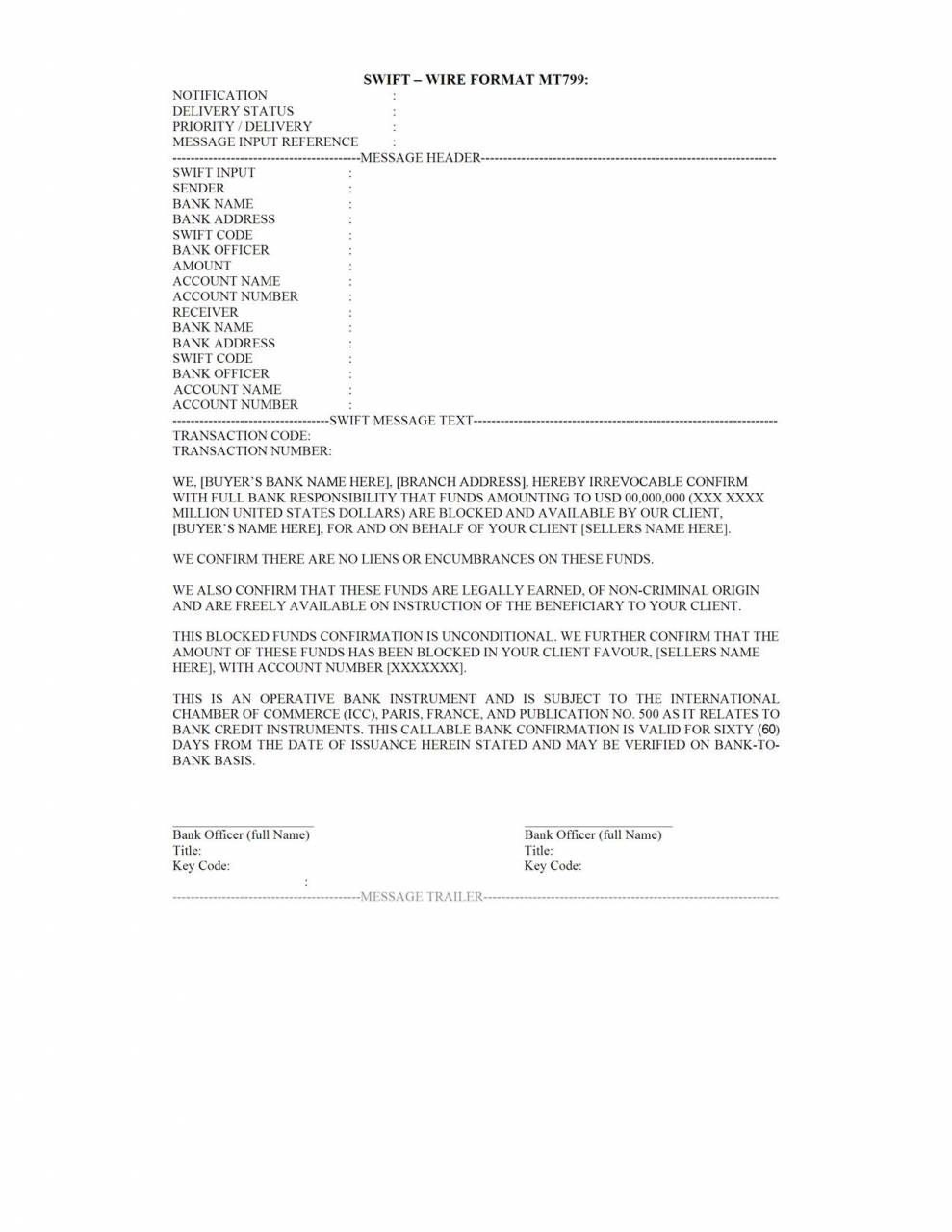

A SWIFT MT message consists of the following blocks or segments:

{1:} Basic Header Block

{2:} Application Header Block

{3:} User Header Block

{4:} Text Block

{5:} Trailer Block

Sample: SWIFT MT 799

SWIFT free format messages

These types of messages are sometimes referred to as “free format messages”.

One of the main differences between the types of messages is the exchange of a BKE authenticator used in a MT 799; so a test key is coded into the messages sent and received.

MT 799 is very similar, but there is no test code and so the message is unauthenticated and has less value unless the message is confirmed.

Sometimes the chosen form of communication is the SWIFT MT 760 message when the SWIFT MT 799 could be a satisfactory bank confirmation.

It is important to note that this message type will be sent prior to the signing of agreements and issuance of instruments.

However, it is also important to note that for a SWIFT MT 799 to be sent, many financial institutions will have a minimum size of account or transaction required.

The process of a MT 799 is that it is usually received by the funder of the seller; then that recipient institution will normally send a proof of product to the buyer’s financial institution.

The trade will then progress.

Payment is then usually made through a wire payment (MT 103) or documentary letter of credit.

The SWIFT system has over 11,000 financial institutions that send and receive financial statements.

The MT 799 and MT 760 are the most widely used SWIFT messaging types and they are usually used just for corresponding between banks and on larger transactions.

MT 799 serves more as a notification tool that is transmitted before a MT 760.

After the MT 760 is sent, banks ring-fence the specific funds needed for the transaction.

More information

View our guides on other Messaging Types:

1 | Messaging Types (MT) – Introduction;

2 | MT 760;

3 | MT 798;

4 | Difference between MT 760 and MT 799;

5 | MT 799;

6 | SWIFT Website;

Incoterms – All you need to know

The Incoterms are a series of pre-defined commercial terms designed to help prevent confusion in foreign trade contracts by clarifying the obligations of buyers and sellers.

While they are in heavy use today, their origin dates back to the early 20th century.

![The difference between SWIFT messaging types: MT799 and MT760 [UPDATED 2025] The difference between SWIFT messaging types: MT799 and MT760 [UPDATED 2025]](https://www.tradefinanceglobal.com/wp-content/uploads/2022/07/The-difference-between-SWIFT-messaging-types-MT799-and-MT760-UPDATED-2022-1.jpg)