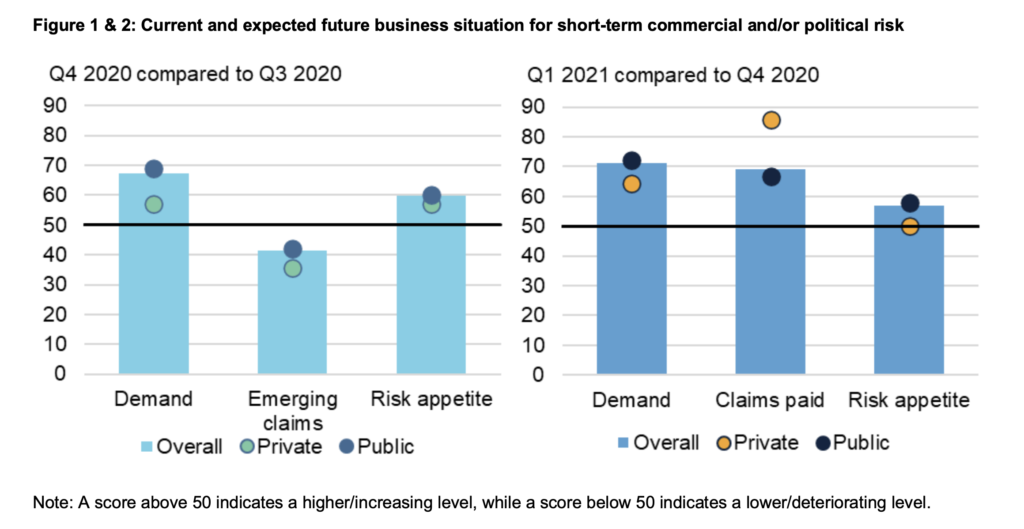

London 25th February 2021 – Results from the Berne Union Business Confidence Survey for the first quarter of 2021 indicate that demand for export credit insurance continues to increase, especially for short term business.

Export credit agencies (ECA) have reported increases in all business areas and note that the main drivers remain the strong appetite for liquidity and working capital, as well as continued sales.

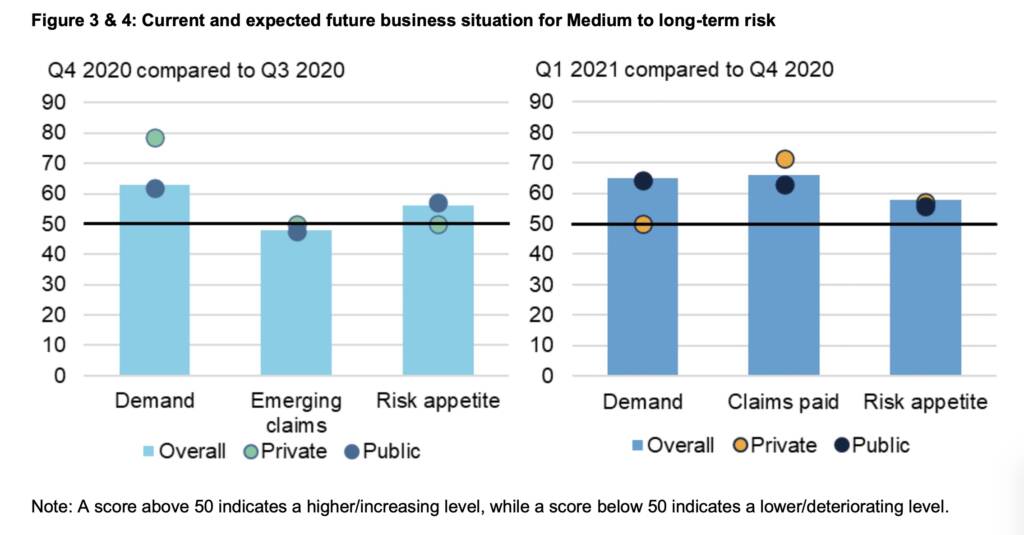

For the private market, increased demand for medium and long-term (MLT) cover in the final quarter of 2020 is now expected to even off in the first quarter of 2021

Although emerging claims were reported to have dipped at the end of last year, the aggregate expectation is for an increase in claims payments during the coming months, especially in short term business and for private insurers

Both public and private underwriters are balancing their risk appetite between measured optimism concerning the economic environment, and strong expectations that claims paid this quarter will likely increase.

President Michal Ron observes that: “the export credit insurance industry continues to play a vital role supporting the finance and liquidity of exporters during this challenging time. Many ECAs are entering an extremely busy period this year with a bolstered mandate, due to their role of delivering or supporting COVID response measures.”

Secretary General, Vinco David added: “public and private segments of the market are working well together to maintain risk capacity, as is evident from the reported stable risk appetite. As the anticipated claims begin to materialise we will see how market capacity to absorb this will develop.”