Estimated reading time: 7 minutes

The International Credit Insurance & Surety Association (ICISA) has released its 2023 industry results, highlighting key trends and developments in the trade credit insurance and surety bond markets.

ICISA represents 95% of the world’s private credit insurance business, with nearly €3.2 trillion in trade receivables insured and billions in infrastructure guaranteed.

Trade Finance Global dives into the report’s findings and features insights, speaking exclusively to Richard Wulff, Executive Director of ICISA.

ICISA plays a crucial role in supporting global trade and economic development.

By bringing together the world’s leading credit insurance and surety companies, ICISA ensures the protection of trade receivables and guarantees construction and service projects globally.

The association serves as a safe harbour for trade and investment, providing security and stability amid economic uncertainties.

Key findings from the 2023 industry results

The 2023 industry results reveal several important trends:

- Surety Highlights:

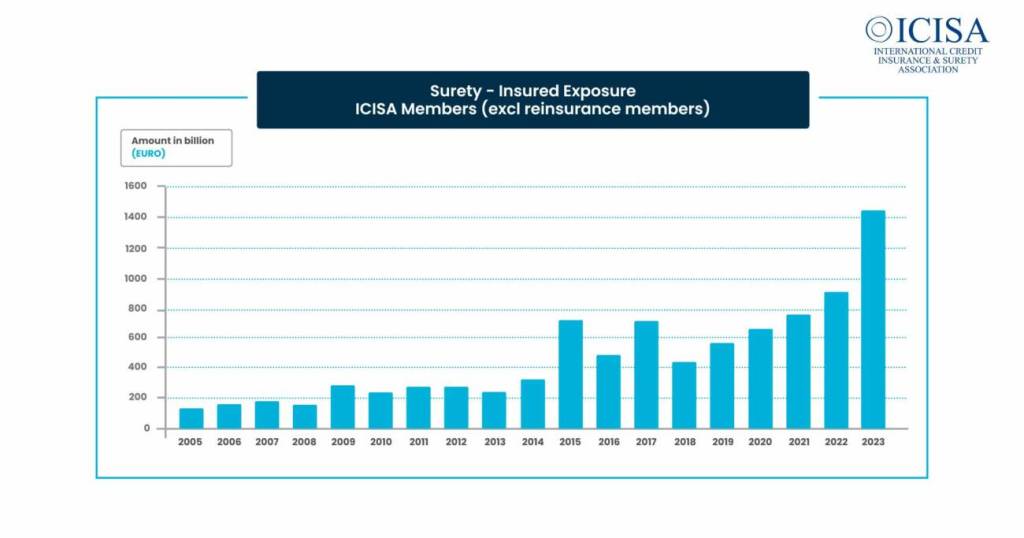

- Insured exposure increased by 7.7%, reaching €1.4 trillion.

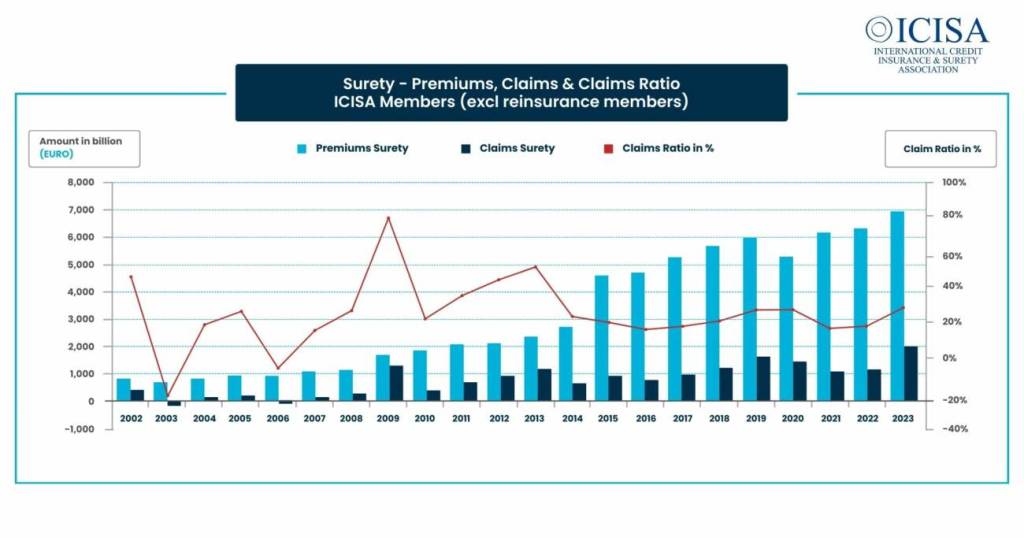

- Premiums written rose by 8.9% to €6.9 billion.

- Claims paid surged by 68.5%, totalling €2 billion.

- The rise in premiums written reflects increased demand for surety bonds, which provide guarantees for the completion of construction and infrastructure projects. The growth in insured exposure indicates a broader market acceptance and reliance on surety products to mitigate risks in these sectors (ICISA).

- Trade Credit Insurance Highlights:

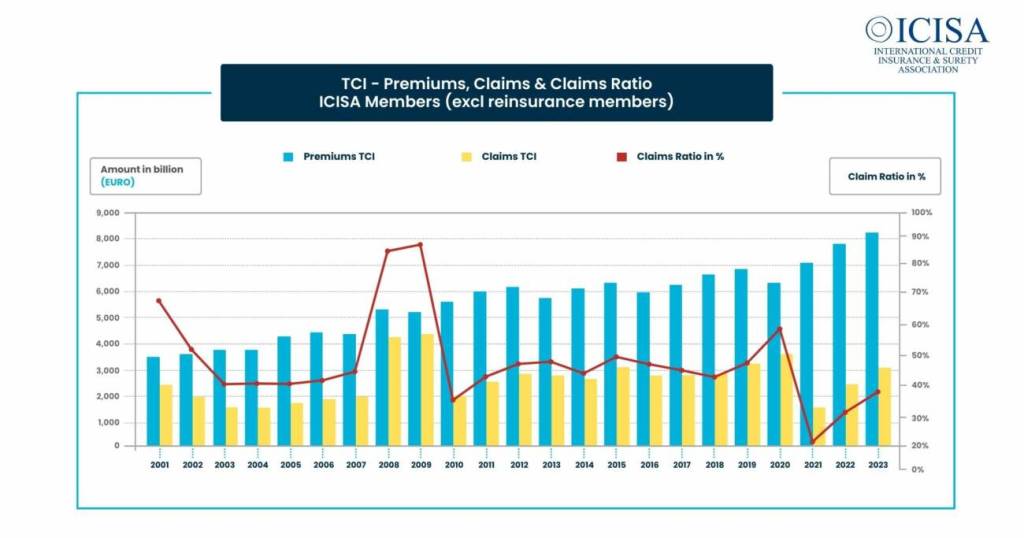

- Insured exposure grew by 4.5%, totalling €3.2 trillion.

- Premiums written increased by 5%, amounting to €8.2 billion.

- Claims paid rose by 11.4%, reaching €3.2 billion.

- The increase in trade credit insurance exposure and premiums highlights the critical role of these products in protecting businesses from the risk of non-payment, ensuring liquidity and financial stability (ICISA).

Surety bonds play a critical role in guaranteeing project completion and protecting against contractor default.

The increase in surety claims paid, which surged by 68.5% to €2 billion, highlights the difficult economic conditions contractors and other principals face today. Equally, it highlights the value that sureties provide to the economy by mitigating losses when defaults occur.

Similarly, the trade credit insurance sector has seen substantial growth reflecting the demand from businesses for protection in uncertain times.

Trade credit insurance protects businesses from the risk of buyer non-payment, ensuring that suppliers receive payment even if the buyer defaults.

This insurance is crucial for maintaining cash flow and allowing businesses to extend more favourable credit terms to their customers.

Increases in both insured exposure and claims for both TCI and surety markets clearly demonstrate the challenging economic environment we face where defaults are more frequent. Strongly capitalised and stable TCI and surety markets are essential for economic resilience in such periods (ICISA).

Impact of macroeconomic factors

The global economic landscape, marked by high interest rates, rising costs, the energy transition, and geopolitical tensions, has significantly influenced the trade credit insurance market in 2023.

Wulff said, “There is no doubt that the risk awareness of clients has increased. The risk of insolvency has increased notably over the past couple of years, leading to a steep increase in business failures within the OECD area. This has many causes such as interest rate increases and supply chain disruptions due to political events (exports from Ukraine, the Israel-Hamas conflict impacting Red Sea routes etc.). This has put the spotlight on our industry and the professionalism in underwriting risk for the benefit of its clients.”

Technological innovations in trade credit insurance

The rise of ‘Insurtech’, including AI and digital platforms, has transformed the trade credit insurance sector by improving risk assessment and operational efficiency.

Wulff said, “We see the impact on both the product/distribution side as well as for internal processes. Initiatives of insuring business transacted on B2B platforms fit into the first category. Integrating AI into underwriting and claims processes fits into the second. The sector will continue to develop in line with the availability of new technologies to optimize cover and speed to serve customers in the best possible way.”

Environmental and Social Governance (ESG) initiatives

ICISA members are increasingly integrating ESG principles into their operations, reflecting a growing awareness of sustainability in financial services.

Wulff said, “Sustainability principles are incorporated and deeply rooted into our members’ business. From underwriting guidelines (which sectors to promote, which to avoid) to investment practices. And it is not simply a matter of environmental impact. ICISA members are conscious of the need to monitor human rights, governance and social issues within the value chain they are involved in.

It is not to be underestimated that acting responsibly also has an impact on the attractiveness of our sector to new talent. Especially younger employees of our members demand action from their employers to act responsibly and improve our society. These employees are vital to our members as they possess current skill sets that are necessary to continue to innovate.”

Challenges in the surety market

The surety market faces challenges such as regulatory hurdles and market demand fluctuations. ICISA members are actively addressing these issues to maintain market stability.

On the current challenges facing the surety market, Wulff said, “The inflationary pressures that we have seen have had a major impact on the expense base of contractors, a major cohort of clients of our surety members. This has impacted the prices of building materials as well as wages and labour availability generally.

“This has weakened many contractors’ balance sheets, making them more vulnerable to negative situations where they can no longer fulfil bonded contracts. Our members have worked tirelessly to find solutions that are palatable for the beneficiary of the bond (who wants the contracted work done). On a longer-term horizon, and especially in Europe, a multitude of regulatory, political and economic factors limit opportunities to start new construction projects. This is to the detriment of the construction sector as well as to the public at large, for instance for people looking for an affordable place to live.”

Future outlook for trade credit insurance

Looking ahead, the trade credit insurance market is poised for growth, driven by emerging markets and technological advancements. However, potential risks remain, requiring continuous innovation and adaptation.

Wulff said, “We are very optimistic for the future. Our members have shown themselves to be resilient and to be able to serve their clients in a fast-changing environment. Risks will remain and pop up from time-to-time, but this is what we do best. This is our reason for existence – to mitigate risk and to help clients rebuild after loss events.”

Women in Trade Credit Insurance

ICISA has launched the Women’s Surety Network and the Women in Credit Insurance initiatives, reflecting a commitment to diversity and inclusion in the industry.

These programmes aim to support and promote women in the field, fostering a more inclusive industry environment.

How will industry initiatives actually impact gender diversity? Wulff said, “Attracting and retaining talent to our industry is vital for its development and the ability to deliver maximum value to customers and shareholders alike. Uniformity in talent leads to suboptimal outcomes. Gender diversity initiatives like WICI and WSN address part of this. We see our members hiring diverse talent, and these initiatives support them.”

ICISA welcomed three new members: Export-Import Bank of Thailand, Interamerican, and RenaissanceRe.

These additions strengthen ICISA’s network and enhance its capacity to support global trade and investment:

- Export-Import Bank of Thailand: Plays a key role in driving Thailand’s trade and investment strategies.

- Interamerican: A leading insurance company in Greece, enriching our network with experience of Greek and neighbouring surety markets.

- RenaissanceRe: Based in Bermuda, adds to the expertise within ICISA with an innovative focus on risk management and financial solutions (ICISA) (ICISA).

Supporting the global economy

Despite economic challenges, ICISA members continue to provide essential support to the global economy.

The increase in trade credit insurance exposure and surety claims paid reflects the industry’s resilience and its critical role in mitigating risks, ensuring liquidity, and fostering economic stability.

The 2023 ICISA industry results underscore the pivotal role of credit insurance and surety bonds in facilitating global trade.

As the industry navigates economic challenges and embraces technological innovations, ICISA members remain committed to supporting economic development worldwide.