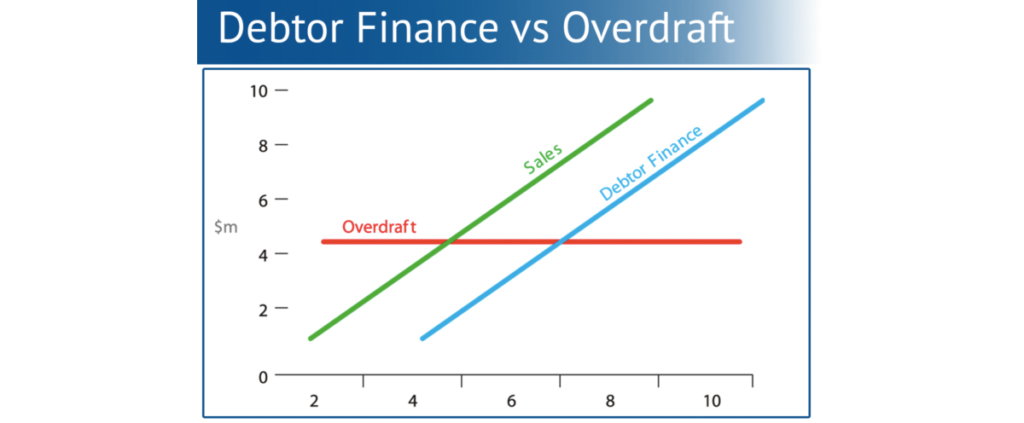

South African SMEs usually look to overdraft facilities to fund cash flow needs. Risk appetite, collateral requirements and inadequate facility size remain key challenges in accessing these facilities. Debtor Finance is a simple, viable alternative to consider for relatively quick access to working capital funding.

The SME financing landscape in SA

“A bank is a place that will lend you money if you can prove that you don’t need it.” ― Bob Hope

The contribution of SMEs to the South African economy remains crucial, accounting for approximately 50% to 60% of the country’s workforce and around 34% of the GDP (The MSME Voice, IFC, 2020). Access to finance remains a hurdle that hampers growth and sustainability for SMEs. A 2018 study by FinFind focusing on SMEs in the formal sector, estimated a credit gap of between R86 billion and R346 billion.

These studies suggest that SMEs are wary of debt and view financial institutions as transactional partners rather than business partners. This can be partly explained by limited awareness of funding options beyond traditional loans, which options can be viewed as mainly transactional and rigid.

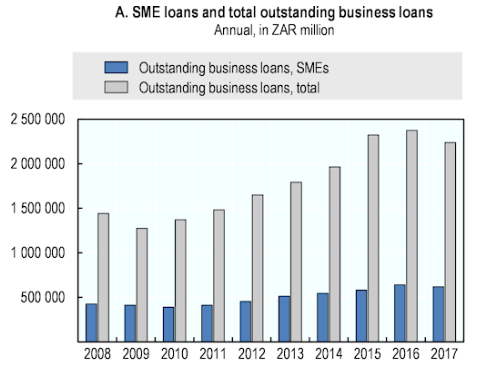

OECD has SME credit exposure to banks in 2017 accounting for 28% (R617 million) of total business loans with owner funded capital the most widely used source of funding, followed by investments by family and business partners.

Add to this that the SMEs in these studies are very likely customers and suppliers to each other too, facing similar pressures from a cash flow management perspective. Expect this scenario to be amplified in the current restrictive trade environment due to the Covid-19 pandemic response measures implemented globally and in South Africa. SA Government has in 2020 announced a R100 billion guarantee to banks to lend to SMEs, however, the Banks will apply their lending frameworks. So where to now if the overdraft increase is declined?

Debtor Finance as alternative

An introduction to debtor finance – what are the products and how do they work?

Debtor finance, also referred to as Invoice Finance, offers a form of advance against a company’s debtors’ book, or accounts receivables book. It is known by various names, including Invoice Discounting, Invoice Factoring, Receivables Finance, Receivables Discounting. There are basically two types of Debtor Finance:

- Invoice Discounting

- Factoring

The Trade Finance Global portal for Debtor Finance delves into more detail around the options and structures available in terms of these two types of funding, which you can access by clicking here.

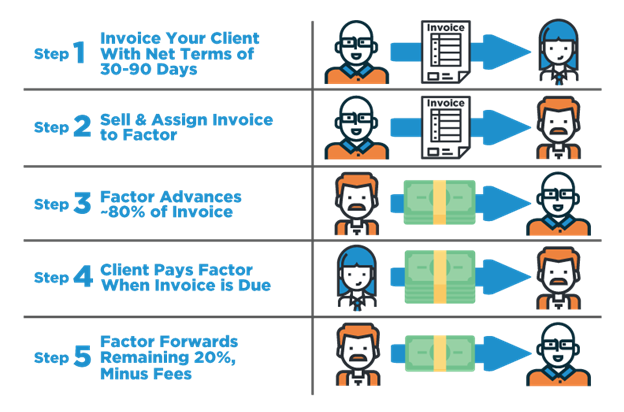

The key difference between Factoring and Invoice Discounting is around administration of the sales ledger. With Factoring, the factor (the institution advancing funds against invoices) is involved in the administration of the company’s sales ledger, which includes issuing of statements to the company’s customers and telephoning them if necessary, whether to confirm invoices and deliveries or to follow up on debts that are past due. With Invoice Discounting, the company retains control over the administration of its sales ledger.

The premise is simple: instead of waiting for cash from its credit customers, the company can access up to 80% of that cash up-front, against qualifying invoices and/or debtors.

ARTICLE: Expert Interview – Factoring and Receivables Finance Predictions for 2020 – Peter Mulroy, FCI

For SMEs, the most common form of Debtor Finance available in South Africa is Factoring. Simply put, the company raises an invoice in its normal course of business. A copy thereof, along with proof of delivery, is sent to the factor, who advances an agreed percentage. When the customer pays the invoice to the factor-designated account, the factor will deduct its fees, its accrued interest, and the advance from the remitted sum before paying over the balance to the company.

These facilities are normally “with recourse” facilities. If an invoice or invoices remain unpaid for a period of time beyond what is specified in the debtor finance agreement, the factor has recourse to the company for the advanced funds, meaning it can reclaim the money from the company.

It is critical to note:

- Debtor Finance is not a way to recover monies related to invoices that are unpaid beyond agreed terms and are now proving difficult to recover.

- Factors will administer the sales ledger according to the company’s agreed credit terms with their customers.

- Simplicity and Capacity

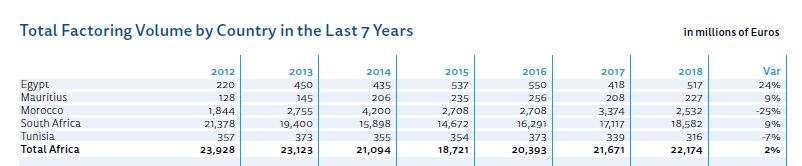

Debtor finance is one of the simplest ways to sustain a business and fund its growth and is widely used across the globe. It has been growing consistently over the last decade globally and in Africa in particular, with South Africa leading the way, even though Africa remains well behind the globe in its use of this form of advance.

FCI estimates 5% growth in debtor finance worldwide in 2019, with South Africa growing at around 11%. Growth aside, the whole of Africa comprises < 1% of the global factoring market, indicating substantial room for growth.

- Cash Advance, not a credit line

Debtor finance is not a line of credit – it’s a sale of an asset, as opposed to a loan facility. Lenders advance funds against unpaid, verifiable invoices where those invoices are still within agreed payment terms.

- Cash Cycle Shortened

It allows access to cash tied up in accounts receivable and provides certainty and improved control around the cash flow cycle.

- Minimize risk

Debtor administration and collections are often part and parcel of the funding offer, with the funder acting as a credit controller. This frees up principals to focus on growing the business and softens the risk of default.

- Balance sheet criteria

Balance sheet and income statement criteria are not as rigid compared to bank loans.

- Transparent cost structure

The cost structure is transparent. Funders offer either an upfront discount fee or a combination of discount fee and interest rate. Additional bank fees not accounted for in overdraft cost calculations include annual review fees, non-utilization fees and limit excess fees.

How does the process work?

The process below is described for a typical Factoring transaction, once all the paperwork is signed and facilities become active.

Which SMEs can qualify?

There is overlap between banks and non-bank lenders with how they assess viability for funding, but non-bank lenders tend to be less rigid, while still taking care not to engage in reckless lending practices. Key areas of consideration when assessing debtor finance requests:

- Quality of the Debtors

As the primary source of repayment, funders need to be comfortable with the health of the debtors. Some of the key questions considered are:- What is the number of debtors and how many are in good standing?

- Concentration (percentage of unpaid invoices per debtor)?

- Are any debtors also creditors?

- Related entities?

- Gross Profit Margin

Experience suggests that SMEs with gross profit margin of 25% and more realize benefits more easily from debtor finance.

- Paper Trail and Flow

Valid invoices and confirmable, signed proof of delivery are non-negotiables.

What does an “ideal” Debtor Finance Customer profile look like:

Debtor finance should be considered for SMEs that:

- Supply products or services to companies, with payment terms up to 120 days from invoice date.

- Are trading for at least 6 to 12 months (preferably 12 months)

- No consignment or “sale or return” terms.

- Have no contractual obligations at a future date, e.g. progress payments, retentions, etc.

The industries for which this funding option is best suited:

- Manufacturing

- Transport and Logistics

- Engineering

- Wholesale and Retail

- Printing, Plastics, and Packaging

- Business Services, e.g. accountants, auditors,

NB: This does not mean it won’t be suitable in other industries.

What’s in it for SMEs?

- Minimal collateral

Cession of debtors’ book and guarantees from the principals of the SME are usually required. Where the client risk or debtor risk profile necessitates it, additional collateral may be asked for. Other assets, such as stock and property, are free to be leveraged to raise other forms of funding.

- Less rigidity around financial ratios

Balance sheet weighting is not as critical a factor as for bank loans, though preference is for viable, profitable, healthy businesses.

- Credit Control

The debtor administration and collection service include credit history and rating checks on debtors, lowering (not ruling out!) risk of debtor default.

- Flexible

The facility grows with the business. Funding limits are more fluid and adjust to changes in revenue due to it being available only on confirmed sales (i.e. invoiced and delivery confirmed). This lowers the overall default risk for funder and SMEs alike.

- Higher funding limits

Debtor finance lenders ordinarily advance up to 80%. This compares favorably with the 30% on offer for Overdraft facilities underpinned by debtors’ books. (see “Example 1” below)

- Focus on expansion and growth

An oft-heard scenario can be avoided: The business owner calling their customer on the 8th to follow up on payment that was due by the 1st of the month and then again on 20th to know if new orders will be placed that month. The lender becomes an extension of the sales ledger administration team.

- Competitive advantage

Prospect for new business with confidence. This is especially key where balance sheets and personal wealth positions don’t allow collateral to be available for increased bank loan facilities.

- Cost-effective

At face value, debtor finance seems costly. The risk seen in the SME sector has seen the gap between total cost of Overdrafts and Debtor Finance decrease in the last decade. Costs can be recouped through ability to:- Access supplier discounts for early settlement or bulk materials and stock purchases

- Early settlement discounts to SME customers can be reduced/scrapped

Case Studies and Examples

Case Study 1

An SME in the plastics industry approached a debtor finance institution for growth funding. The debtors book was ceded to a listed entity (their main creditor). The debtor finance house and the SME met with the listed entity and negotiated the release of the book subject to the debtor finance house collecting the book and paying the listed entity as a preferred creditor. The SME agreed to this and a tri-partite agreement was signed. The additional funding unlocked by having the cession released resulted in 1) the listed entity being paid on or before the monthly due date, and 2) the extra cash unlocked enabled the SME to enjoy significant growth.

Case Study 2

An SME that provided logistics management services needed additional working capital to cater for growth with their largest customers, who paid 30 days from statement date. Allocating more cash resources to service these customers placed pressure on the ability to service creditor and salary obligations. Growth opportunities were also parked for at least 12 months, to avoid a cash crunch and keep staff and creditors comfortable. Requests for overdraft increases were declined due to bank’s parameters not being met, despite additional collateral being available in the form of property. A Debtor Finance facility was considered and approved. The unlocked cash saw the alleviation of the cash flow pressure and enabled the business to continue with their growth trajectory. Within 5 years of taking up the debtor finance product, the business had grown (10-15% per annum) to a stage where their main customer bought them out and brought the operations into their group.

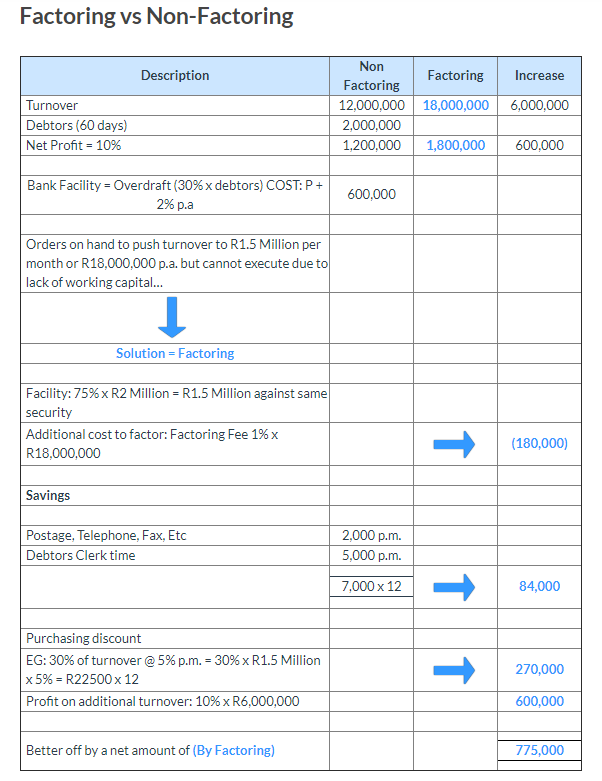

Example 1 – Factoring vs Non-Factoring

In the above example, the overdraft limit couldn’t be increased to enable fulfillment of orders to take business from R12m to R18m turnover per annum. Net impact was R775,000.

Conclusion

Increased access to appropriate funding mechanisms for SMEs that aids their growth would provide a positive boost to economic growth. With Commercial Banks more risk averse and viewing the SME sector as a higher risk sector, with increased costs associated with servicing the sector, it reduces the potential for approval of bank facilities for SMEs. A viable alternative is necessary. Debtor finance offers that alternative without creating a debt obligation. It offers a predictable cash flow structure and enables SMEs to continue meeting their obligations. This predictability around cash flows coupled with the administrative component promotes more effective cash flow planning and control, further enabling better management of operations and allowing business owners room to focus on business growth and development.