Estimated reading time: 4 minutes

Key drivers of economic development

In the Sultanate of Oman, the national economy has been positively influenced by the strategic efforts of institutions like Credit Oman, which facilitates international trade and mitigates risks associated with exports. This institution has been crucial in aiding Omani businesses to navigate global markets effectively, thereby contributing to economic diversification and growth.

Through offerings such as export credit insurance, insightful market intelligence, and effective risk mitigation measures, Credit Oman empowers Omani businesses to expand their global footprint, thereby significantly contributing to the nation’s economic growth and diversification.

Operational highlights of 2023

Credit Oman continues to amplify its impact on Omani exports and domestic sales through an extensive array of insurance services. These services are crucial in helping clients navigate both local and international markets, significantly reducing commercial and non-commercial risks.

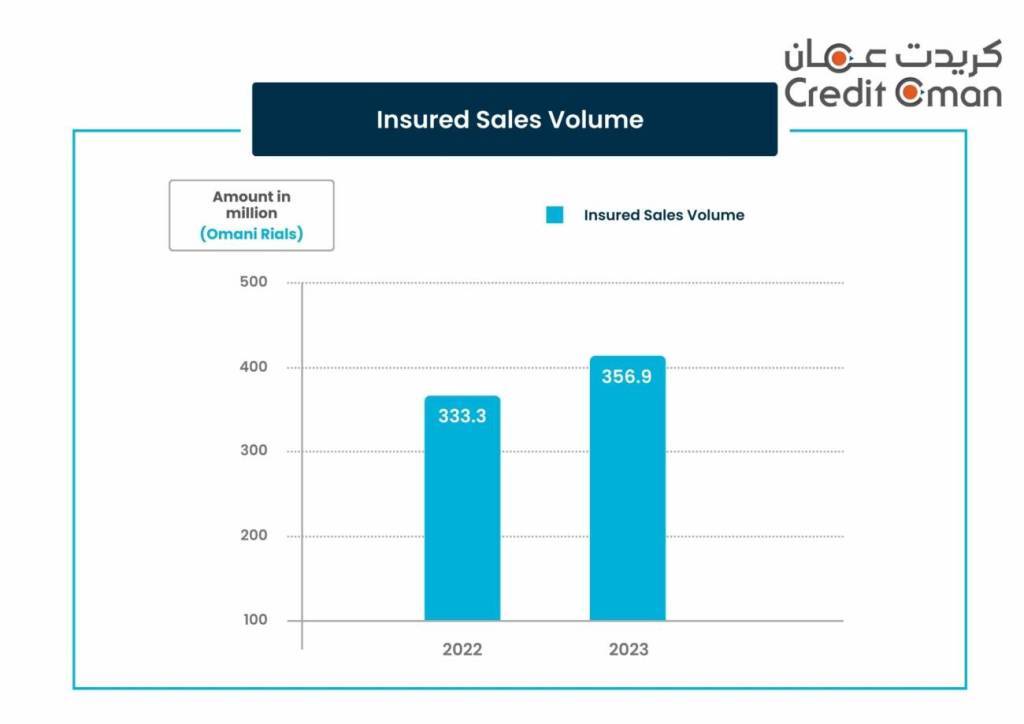

Over the past year, the institution has achieved 7% growth in the total insured sales volume, highlighting its successful strategies and dedication to economic enhancement.

We played a crucial role in driving economic development in the Sultanate of Oman and increasing Omani exports to reach all corners of the world. The insured export sales accounted for 6.62% of Oman’s total non-oil exports eligible for insurance.

The total insured sales volume for the previous year reached 356.9 million Omani rials, up from 333.3 million Omani rials, marking significant progress.

Expanding support and services

However, insurance is not the only tool used to support Omani exporters.

In 2023, the institution saw an increase in total insurance premiums, which soared to 1.17 million Omani rials, marking a growth rate of 17% from the previous year.

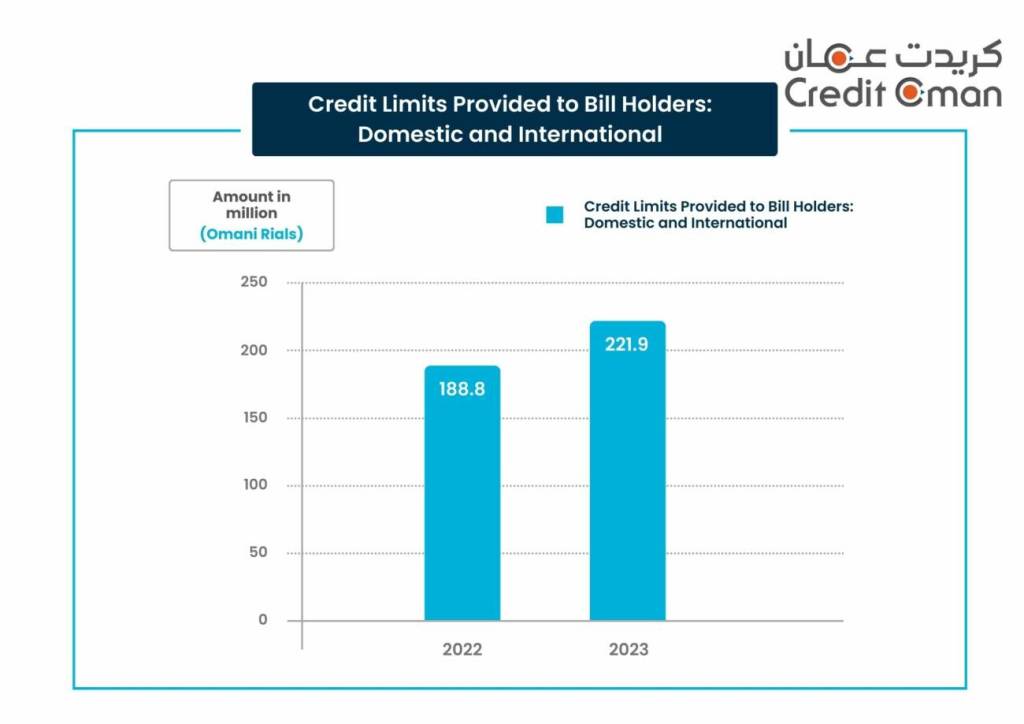

Additionally, there was a significant rise in the credit limits provided to bill holders for both domestic and international sales, which totalled 221.9 million Omani rials, up from 188.8 million Omani rials in 2022

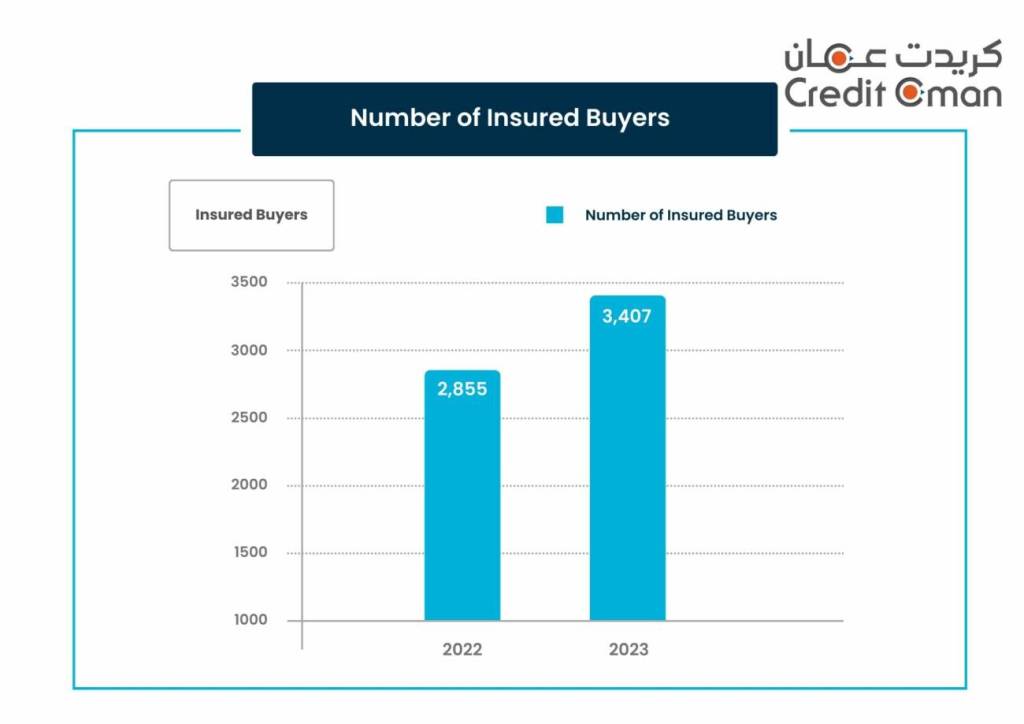

The number of insured buyers also rose by 19% in 2023, reaching a total of 3,407, compared to 2,855 in the previous year. These metrics demonstrate Credit Oman’s vital role in supporting the business community across various sectors.

Sector-specific achievements

In recent years, Credit Oman has successfully delivered innovative insurance services tailored to key sectors such as petrochemicals, mining, and construction materials.

Notably, the petrochemical and plastics sector witnessed a growth rate of 90% in insured sales, while the mining sector saw a remarkable 110% growth. The construction materials sector also experienced growth, albeit modest, with insured sales rising by 1%.

Key services enhancing Omani exports

There are several ways in which Omani exports are supported:

- Export credit insurance: Protecting Omani exporters against non-payment risks from overseas buyers, this insurance boosts exporters’ confidence to explore new markets and expand their business operations.

- Market information and intelligence: Offering vital insights into global market trends, trade regulations, and target market dynamics, this service equips Omani exporters with the knowledge needed to make informed business decisions and capitalise on growth opportunities.

- Risk mitigation measures: By assessing the creditworthiness of international buyers, providing guarantees, and facilitating payment collections, Credit Oman minimises trading risks, encouraging exporters to engage confidently in international trade.

Credit Oman continues to be a cornerstone in the development of Oman’s economic landscape, promoting trade, enhancing export capabilities, and securing the business environment through tailored insurance solutions. Its efforts not only support the diversification of the Omani economy but also strengthen Oman’s position in the global marketplace.