COVID-19 altered consumer-buying habits overnight and heightened the shipping industry’s vulnerability to handle an influx of demand. Eighteen months into the COVID-19 pandemic and shipping bottlenecks are challenging companies to meet demand. The global outlook is uncertain, however, that does not mean doom and gloom, making way for a new thought process.

A shift in consumer buying habits

With the ever-evolving technology, consumers are accustomed to having products readily available to them through services, such as Amazon’s two-day delivery, next-day grocery delivery. However, nearly 80% of manufactured goods are shipped via cargo-carrying vessels with a supply chain process that is digitally lagging compared to e-commerce advances.

In the second half of 2020, online demand skyrocketed triggering shipping bottlenecks as suppliers were unable to meet demand promptly due to:

- stretched production resources

- insufficient shipping capacity

- ports being unequipped to handle an influx of imports.

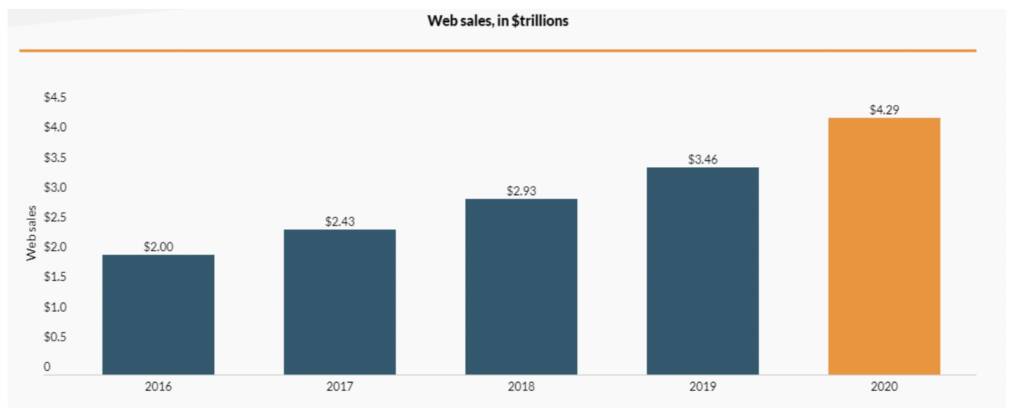

Between 2019 and 2020 alone, there was a 24.1% increase in e-commerce retail sales, and an increase of 114.5%, or $2.29 trillion from 2016 to 2020.

At the onset of the pandemic, panicked consumers stocked their pantries with dry goods, cleaning supplies, toiletries, and vitamins via online retailers, while other sector’s sales tanked. With government intervention, global trade rebounded and consumer spending returned to pre-pandemic levels, but with a surge in e-commerce and demand for Asia-made goods. Consequently, putting pressure on companies ability to meet demand with manufacturing operations strained in Asia due to COVID-19 protocols and reliance on the “just-in-time” supply chain method.

Ocean-containers shipping rates and global commerce

Global trade ceased in March 2020, however, quickly rebounded in June 2020. Ultimately exacerbating the shipping industry’s inability to support the extreme demand for goods manufactured in Asia and imported to the US and Europe. Major port congestion and build-up of containerships in the US and Europe delayed turn-around time and increased shipping rates.

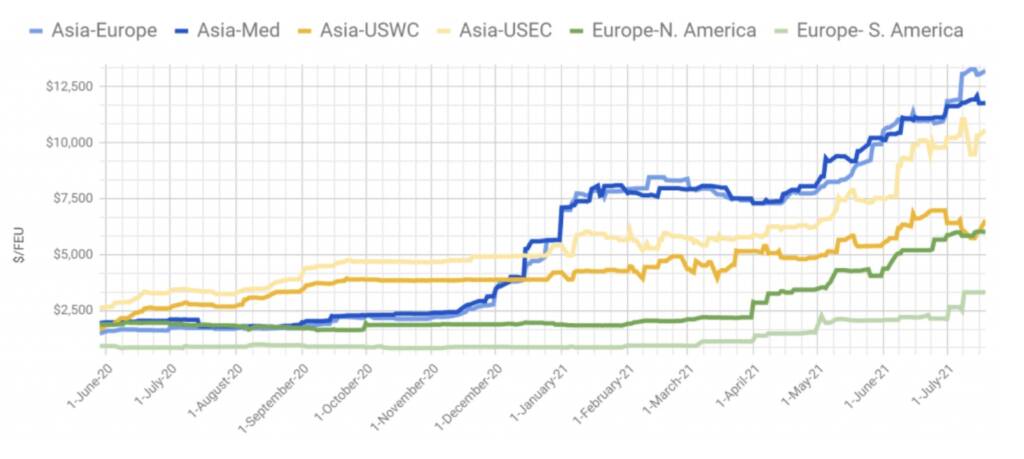

Global shipping rates, on average, remained consistent over the last five years, however, the shipping industry is at a crucial turning point with global rates increasing 466% over one year with the ocean container rate averaging at $10,174/FEU as of July 2021 (Figure 2). Over recent weeks’ the average ocean-container rate for transits from Asia to the US increased to nearly $20,000/FEU since last year, per Freightos, and quoted rates have reached $32,000 per container. While the container rate from the US to Asia increased by 270% over a one-year period, the US demand for Asia-made goods is causing a shortage of container capacity from Asia as containers remain empty in the US ports.

Shipping rates are at the foreground of corporate management discussions as rates influence bottom-line profits and in certain sectors, shipping rates are now accounting for 50% or more of the total retail value. Global commerce historically relied on low shipping costs, however, as rates continue to rise, commodities could be priced out as the consumer price is not viable for companies. Prices continue to climb with production shortages in Asia stemming from COVID-19 variant outbreaks and no end in sight to the port backlog and limited container capacity.

Port congestion and canal bottlenecks

COVID-19, port congestion turning to port delays, and canal bottlenecks have all contributed to the rise of ocean container rates and challenge the status quo of the global supply chain.

- The pandemic challenged vessel and port operations with heightened protocols to limit the spread of COVID-19. Looking back to early 2020, COVID-19 forced crews to remain on board a vessel well over their contract expiry due to strict requirements imposed by governments. Port workers were also required to endure additional protocols to ensure the safety of port employees and avoid COVID-19 port shutdowns.

However, in recent weeks, the delta variant is spreading throughout the world and specifically in major Chinese cities. Positive cases at two major ports in China resulted in partial operation suspension. With port suspensions, container rates will continue to climb and cause supply chain volatility, strain on crew operations, and port suspensions throughout 2021.

- The uptick in e-commerce demand coupled with COVID-19 protocols and port suspensions has created an unsustainable port environment. Specifically, the influx of demand for goods from Asia to the US and Europe has resulted in port blocks and transit delays. The Los Angeles and Long Beach ports – the largest US gateway for ocean-going trade – had 37 vessels anchored as of late August, with an average 5 to 8 day wait time to enter the port.

Moreover, there is a major backlog at the US’s east coast and southern ports as railways and trucks are overextended adding to container dwell time. Port congestion is not only elongating delivery time to buyers, but it is further adding to the container shortage as vessels carrying thousands of containers sit anchored off the coast.

- The Suez Canal is the world’s busiest maritime trade route with an easy passage from Europe to Asia. Passage through the Suez Canal came to an abrupt halt in March 2021 when the Ever Given, one of the largest class of containerships, grounded for six days. The Ever Given caused months of supply chain backlog as hundreds of vessels were stranded in the Suez Canal or were forced to transit around the Cape of Good Hope. The ripple effect was felt globally as buyers missed contract deadlines and damaged goods aboard stranded vessels.

While many companies rely on the “just-in-time” method to save on storage costs, instances such as the Suez Canal bottleneck exemplifies the flaws in this system. It is crucial to note the Suez Canal, while the most relied on maritime trade route, is not the only trading bottleneck; the Strait of Hormuz, Strait of Malacca, and the Panama Canal are clear bottlenecks that could cause major disruption to global trade should one be clogged.

These factors all contribute to the future uncertainty of the shipping industry – being container rates, the profitability of commodity sectors and upward pressure on consumer goods pricing, and the viability of global trade as it stands today. Container rates would need to continue to multiple for global trade to lose benefit, but with the current container rates, companies will struggle to maintain the necessary profit.

Future outlook and mitigation

For decades, container-carrying companies were on a mission to acquire smaller competitors, leaving shippers with fewer options and allowing carriers to determine container rates. This paved the way for rates to explode during the COVID-19 pandemic. With the global pandemic continuing, container rates will remain high in the near future with uncertainty in 2022, depending on the path of the pandemic. As companies look forward, these considerations will be key to mitigate disruptions in the future:

- Supply chain diversification. Many corporations have outsourced manufacturing operations to Asia, specifically China, and to keep the viability of the “just-in-time” supply chain approach, corporations should consider alternative outsourcing hubs while monitoring tariffs and trade wars.

- Monitor government involvement to predict future disruptors. When shipping internationally, internal due diligence is prudent to understand the implications of government regulations and proposed legislation to head off business interruptions.

- Digitizing the shipping industry. While the view is long-term, digitization can lead to offsetting higher costs with increased e-commerce buying habits, along with real-time inventory visibility.

Black swan events are challenging to determine, and in recent decades, more frequent. Being proactive and analysing alternative supply chain approaches, government regulations, and the benefits of digitization will allow companies to predict and mitigate business inhibitors.