Paris, February 9, 2021 – In its County & Sector Risk Handbook, Coface, a leader in credit insurance has predicted an uneven recovery across countries, sectors of activity, and income levels in its quarterly risk barometer.

Although the performance of China and other Asian economies is boosting global growth, the main global economies will not return to their pre-crisis GDP levels this year, the credit insurance leader predicted. This rise in inequality, along with public dissatisfaction with the government’s handling of the pandemic in many countries, is conducive to the emergence of more frequent potential protests and violence this year.

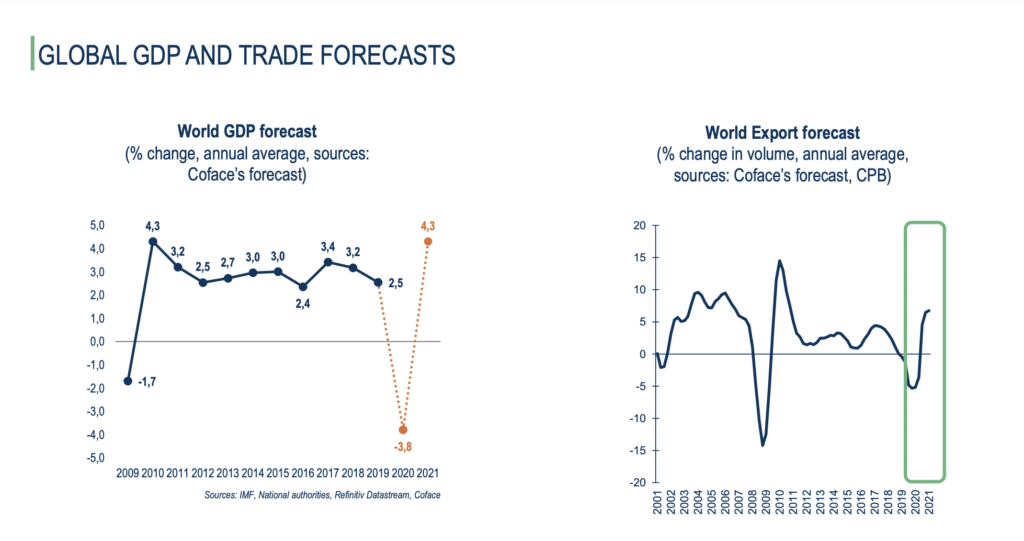

A year after the start of the Covid-19 pandemic, and the biggest global recession since the end of the Second World War, Coface estimates that world growth could reach +4.3% on average in 2021, while world trade would increase by +6.7% in volume (after -5.2% in 2020).

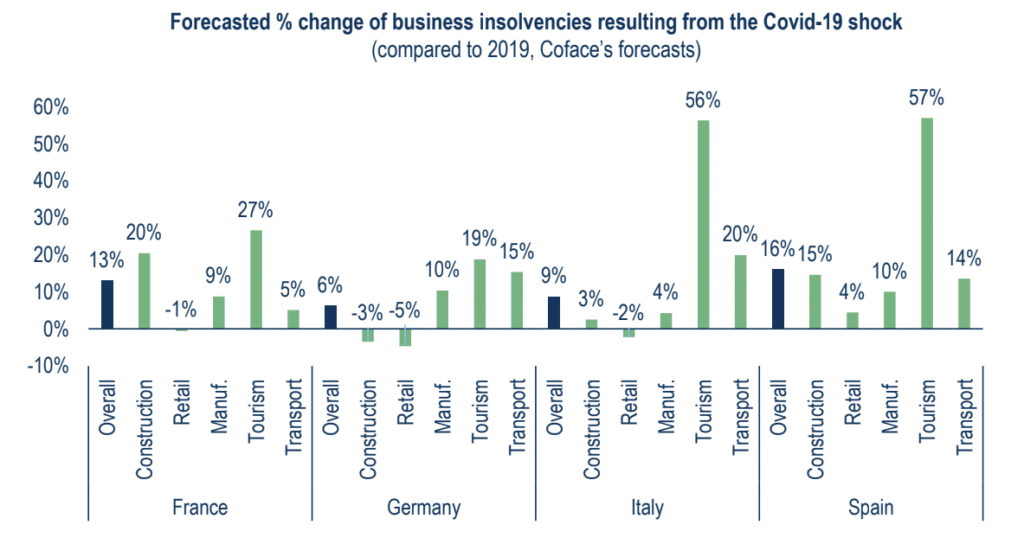

These projections assume that the major mature economies are able to vaccinate at least 60% of their population by the summer. Indeed, the resulting herd immunity could mark the end of stop-go cycles, i.e., successive episodes of containment that are harmful to economic activity. The drop in business failures in 2020 in all regions of the world (-12% worldwide, -22% in the eurozone, -19% in Asia-Pacific, and -3% in North America), can be attributed to government support plans, the continuation of which will allow many businesses to survive this this year. Nevertheless, despite the impact of these various government support plans, Coface anticipates that the shock observed in 2020 will lead to an increase in insolvencies in 2022, notably in Spain (16%, compared to 2019), France (13%), Italy (9%), and Germany (6%).

In its latest quarterly Barometer, Coface anticipates an uneven economic recovery.

- Strong inequalities between countries. While the performance of China and other Asian economies (e.g. Taiwan, whose country assessment is being upgraded) is boosting global growth, the major mature economies will not return to pre-crisis GDP levels this year. And among them, countries highly dependent on services activities (such as Spain or the United Kingdom) or that are lagging behind in the vaccination process will take longer to recover.

- Sectoral inequalities. Among the 23 improvements in sector assessments this quarter, almost half are attributable to the automotive sector, whose growth surprised favourably in the second half of 2020, followed by construction and chemicals. Unsurprisingly, many services activities will remain weakened long-term by the pandemic: the transport sector is the most affected, with 9 sector risk assessment downgrades.

- Increased income inequalities within countries. The least qualified workers, young people, and women have suffered more job losses than the rest of the population, the latter being over-represented in the most penalized service activities. Moreover, examples from previous epidemics in the 21st century underline that this increase in income inequality will be long-lasting and will foster more social unrest – with the latter occurring, on average, one year following the actual pandemic.