Estimated reading time: 8 minutes

- The collapse of traders like Hin Leong and Zenrock left banks struggling to recover payments made under letters of credit (LCs) for potentially fraudulent transactions, as the law largely protects LC payments as the “lifeblood of commerce.”

- However, the Singapore Court of Appeal clarified in Winson Oil Trading v OCBC that banks can refuse payment if a beneficiary knowingly or recklessly presents false statements.

- In case BCP v CAO, the Singapore High Court ruled that the CAO-Zenrock contract was not a sham, as both legitimate and circular sales transactions coexisted.

The collapse of traders like Hin Leong Trading Pte Ltd and Zenrock Commodities Trading Pte Ltd (“Zenrock”) left banks that made payments under letters of credit (LCs) out of pocket when their customers went under without reimbursing them. The banks in this predicament have, in a spate of recent cases, attempted to recoup payments under LCs made to beneficiaries whom they allege have received payments for fictitious trades. By and large, banks have had an uphill task when it comes to recovering or refusing LC payments. The law’s recognition of LCs as the “lifeblood of commerce” has permitted very limited instances of refusal to pay on LCs or recovery of sums paid under them.

A significant clarification for banks resisting LC payments came from the Singapore Court of Appeal last year (in Winson Oil Trading Pte Ltd v Oversea-Chinese Banking Corp Ltd and another suit [2024] SGCA 31). The Court of Appeal clarified that a bank may refuse payment for a presentation that the beneficiary not only knew to be false but also in respect of which it was reckless as to whether the statements it made to the bank were true or false. This is particularly acute in the oil trade where payment letters of indemnity provide representations as to the shipment of the goods and the title relating to it, which may turn out to be untrue.

Another significant decision on the subject of LC payments from the Singapore courts last year was Banque de Commerce et de Placements SA, DIFC Branch & Anor v China Aviation Oil (Singapore) Corporation Ltd [2024] SGHC 145 (“BCP v CAO”). This Singapore High Court decision makes a number of points of practical significance which we cover in this update.

Facts: Two parallel sales chains or one circular chain?

The Geneva branch of Banque de Commerce et de Placements (“BCP”) issued a letter of credit to finance Zenrock’s purchase of an oil cargo from China Aviation Oil (Singapore) Corporation Ltd (“CAO”). The LC was confirmed by UBS Switzerland AG (“UBS”). In line with the usual practice in oil trading, the LC permitted payment against a payment letter of indemnity (“LOI”) (instead of original bills of lading (“BLs”)) and invoice. UBS paid against CAO’s presentation of an LOI, and was reimbursed by BCP.

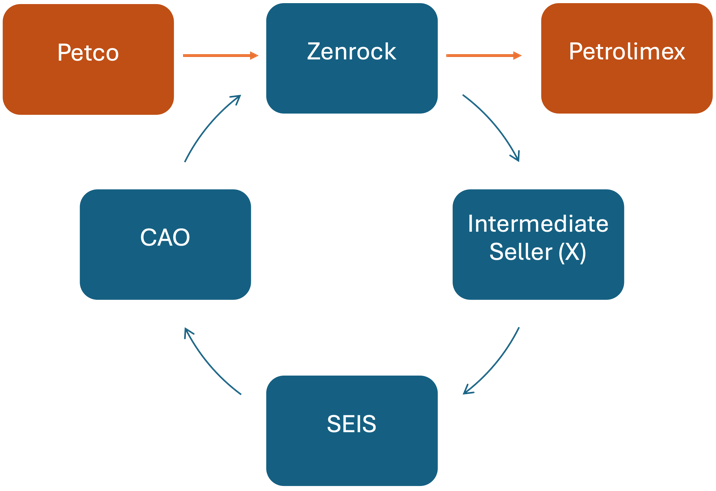

BCP sought to recover the sums it paid under the LC on the basis primarily, that the contract between CAO and Zenrock was a sham and/or fraudulent transaction, and hence that CAO had made fraudulent and/or negligent misrepresentations to BCP in its LOI. The sales chains for the cargo, as found by the Court, can be summarised as follows:

- A chain of sales involving Petco – Zenrock – Petrolimex (“Series A”). Title in this chain passed from Petco to Zenrock when the oil passed the flange connection between the delivery hose at the loading port and the vessel’s permanent hose connection. Title, however, passed from Zenrock to Petrolimex only upon receipt of the full contract price (which was due only 30 days after the bill of lading date).

- Another circular chain of FOB sales, Zenrock – Intermediate Seller – SEIS – CAO – Zenrock (“Series B”). Title for each of the contracts in Series B passed simultaneously when the oil passed the flange connection between the delivery hose at the loading port and the vessel’s permanent hose connection.

The thrust of BCP’s case was that the CAO-Zenrock contract was a sham and/or fraudulent transaction. As such, BCP alleged that CAO did not sell any physical cargo to Zenrock. Among other things, BCP argued that physical cargo only moved in the Series A chain, not the Series B chain. It accordingly argued that the representations in the LOI were false. These included representations as to

- The existence, authenticity and validity of documents which included the “full set of signed [BLs] issued or endorsed to [BCP Dubai] (the “BCP OBLs”)”,

- Entitlement to possession of the documents which included the BCP OBLs;

- Entitlement to possession of the cargo immediately prior to the cargo coming into Zenrock’s possession;

- CAO having title to the cargo immediately before title passed to Zenrock.

Zenrock was found to have acquired title from Petco before the Series B transactions commenced and was required to pass title to Petrolimex only after it was re-vested with title in Series B.

As such, the Series A transactions were found to co-exist with the Series B, instead of being mutually exclusive.

The evidence from the Court’s judgment supporting a co-existence of both trades appears to be grounded on the provision that title to Petrolimex passed on payment while the rest of the parties operated on title passing at the load port flange. It remains open for consideration if the same finding would have been found if all parties, including Petrolimex, operated on the basis of title passing at the load port flange – after all, only one party can have title at any time and the sequencing of the passing of title is critical.

Finding: Was the Zenrock-CAO Contract a sham?

One of the arguments asserted by BCP was that there was no physical shipment because the CAO-Zenrock contract was a sham. The Court disagreed with this assertion for a number of reasons, for example:

- CAO’s personnel gave evidence of having conducted due diligence and negotiations for both the purchase and sale leg of the transaction; exchanged deal recaps; and performed operational tasks concerning vessel nomination, the appointment of an independent surveyor to witness cargo loading and inspect its quantity and quality, and checking the documents presented under the purchase leg and documents to be presented to the LC bank under CAO’s sale leg to Zenrock.

- There was a legitimate commercial reason for Zenrock to conclude Series A and Series B transactions: to secure funds for an additional 35 days.

- The mere fact that the transaction was concluded speedily, and did not envisage the exchange of original BLs, did not point to it being a sham since it is not unusual for oil cargoes to be sold promptly, and it is industry practice for LOIs to replace BLs for oil trades.

- As a matter of industry practice, there was nothing unusual with a CAO not investigating the participants in the entire sales chain beyond its immediate buyers and sellers.

- As title passed simultaneously in Series B, Zenrock was revested with title, and had good title before it passed title to Petrolimex. There was accordingly no reason why Zenrock would have orchestrated a sham circular trade in Series B when it could have performed both the Series A and Series B contracts legitimately.

The Court found that on a proper interpretation, by way of the LOI, CAO represented that:

- The BLs had been issued (i.e., they existed, and were authentic and valid), but that

- They were unavailable in that they had yet to be issued or endorsed to BCP Dubai at the time of presentation, and

- The BCP OBLs would be endorsed to the order of BCP Dubai in due course (i.e., once CAO received them from its seller).

None of these representations were found to be false since BLs for the cargo existed and CAO was entitled to them under its contract with SEIS. Further, since the CAO-Zenrock contract was not sham, and the full sales chain was known, the Court concluded that CAO was entitled to possession of the cargo immediately prior to it coming into Zenrock’s possession, and had good title immediately before passing title to Zenrock.

The Court noted that BCP’s claim for misrepresentation failed for the additional reason that none of the representations in the LOI were made to BCP. The LOI was addressed to Zenrock, and in any event, presented to the confirming bank, UBS and not BCP.

Comment: Arguments on sham and shipment

This case confirms the arduous task that a bank resisting an LC payment bears and the importance of industry practice of the particular commodity in question in deciding whether a sale contract is a sham contract.

BCP’s argument that CAO did not ship any physical cargo to Zenrock was seemingly predicated on its position that the CAO-Zenrock contract was a sham and/or fraudulent transaction. This contrasts with how the banks argued the case in Winson. There, in alternative to arguing that the underlying sale contracts were sham, the banks also separately argued that the cargo was not shipped as described. The Court in Winson did not have to address the issue of sham as it was satisfied that the cargo was not shipped as described.

Given sham entails an enquiry into parties’ subjective common intentions, it is preferable for a party resisting payment to plead it as an alternative argument to an objective challenge regarding the underlying shipment, which may be easier to establish. However, the outcome in BCP v CAO is unlikely to have been different even if the underlying shipment was challenged since the Court found that the sales chains in Series A and Series B were not mutually exclusive.

It is further noted that BCP curiously failed to plead that CAO’s presentation under the LC was fraudulent, i.e., the fraud exception to payment under LCs. Rather, its pleadings focused on the fraudulent representations in the LOI, i.e., the tort of deceit. Whilst the Court noted that the elements of the fraud exception and the tort of deceit are similar, BCP was not allowed to rely on the fraud exception as the two causes of action have different juridical basis and CAO would be prejudiced if BCP is allowed to rely on the fraud exception. A payment LOI is often used as one of the documents needed for an LC payment. Careful consideration needs to be given to the interplay of these two documents when seeking to raise arguments based on fraud.