Female-owned export companies are being unfairly excluded from receiving trade finance loans, and more needs to be done to remove gender bias from the decision-making process, according to experts at this year’s World Trade Symposium.

The Secretary General of the International Chamber of Shipping (ICS), Guy Platten, admits there’s still work to be done to decarbonise the commercial shipping sector.

TFG’s Deepesh Patel sat down with Lynette Thorstensen, board chair at Fairtrade International, to discuss the digital divide, ESG in global trade, and how technology is helping to shape the global (fair) trade landscape.

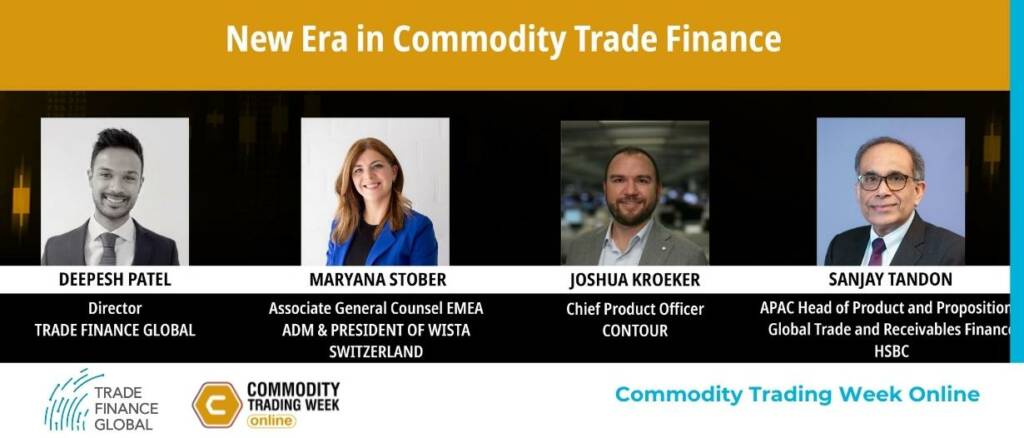

In partnership with City Week, TFG hears from Josh Kroeker, Contour; Maryana Stober, ADM & President of Women’s International Shipping & Trading Association and Sanjay Tandon, HSBC about a new era in commodity trade finance.

TFG has launched a trade finance video series in partnership with ITFA, following a series of interviews filmed at the 2021 ITFA Annual Conference in Bristol, England.

In 2020 the global factoring industry saw a 6.5% drop in volume – its largest one-year decline on record.

In partnership with Reuters Events, TFG’s Deepesh Patel spoke with Greg McNab, Tasneem Krueger-Vally, and Adam Hearne on the impact of the landmark climate conference on the commodities sector

After another year of disruption for much of the global economy in 2021, one sector that has emerged mostly unscathed – except for one high-profile collapse – is supply chain finance.

After another tumultuous year for trade finance in 2021, the industry is set to face a number of challenges – both old and new – as we head into 2022.

Speaking to Trade Finance Global, Pillow said she has overseen major changes as head of communication at ITFA, not just in the way the association presents itself, but also in terms of its reach and scope.