2020 marks the 21st anniversary of the Certificate for Documentary Credit Specialists (CDCS). LIBF’s experts in trade finance – Mike Backhouse, Alex Gray and David Morrish – explain why the… read more →

The London Institute of Banking & Finance (LIBF), the Bankers Association for Finance and Trade (BAFT) and the International Chamber of Commerce (ICC) are celebrating the 21st birthday of the… read more →

There is a common miss-conception that four or five multiple banks must be involved to manage letter of credit transactions. These multiple banks include credit issuing banks, advising banks, negotiating banks, confirming banks, and reimbursing banks. What is less understood is that these “banks” are functions, not necessarily physical banks. The trade finance functions these banks perform in a transaction can be done by separate banking institutions or by one bank under UCP 600 guidelines (Uniform Customs and Practice for Documentary Credits, ICC Publication 600).

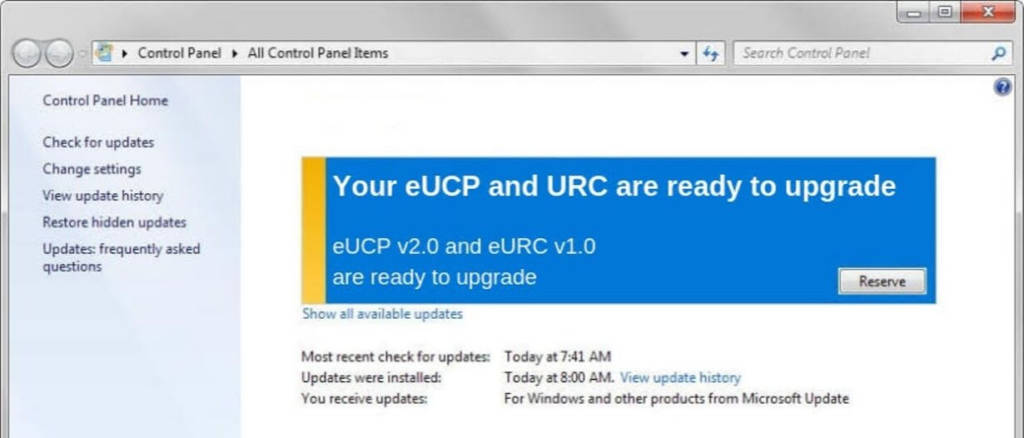

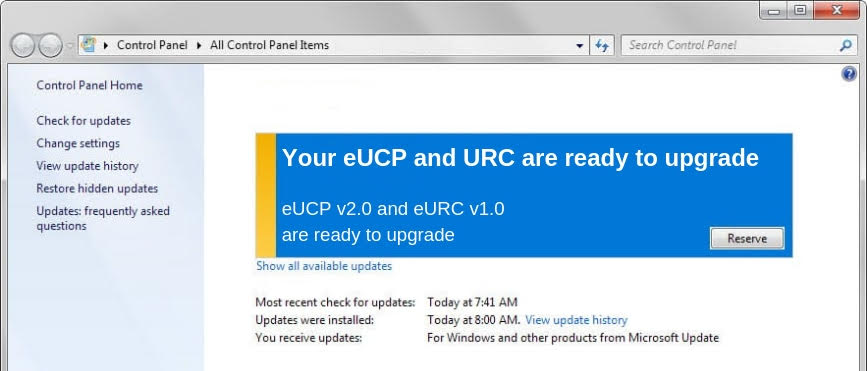

On 1 July 2019, the long-awaited revised internet eRules and guidelines for online trade finance finally arrived for banks, importers, exporters, freight forwarders, chambers of commerce, customs brokers, logistics companies and carriers, to prepare and present electronic records for documentary letters of credit in lieu of or in conjunction with paper documents.

Change is not just coming; change is here today, now. The impact of using electronic trade documents instead of hard copies of bills of lading, invoices, packing lists, and certificates to settle trade transactions via the Internet will be as profound to global trade finance as the containerization of cargo was to logistics.

The International Chamber of Commerce (ICC) announced that it has accelerated attempts to digitalise of trade finance by releasing two new sets of enhanced rules, Uniform Customs and Practise for Documentary Credits (eUCP) and Uniform Rules for Collections (eURC 522).

Introduction to Letters of Credit Did you know, SMEs account for 99% of UK business, and 46% of them experience some form of cash flow problems? Most trade in the world… read more →

Letter of Credit FAQs Documents accepted as present An issuing bank could use the term ‘documents accepted Does this mean: The only requirement under such an expression (which is undefined… read more →

From Xenocurrency to Yield, Voltron to UCP, we’ve got you covered in Part 2 (N to Z) of our Trade Finance A to Z series. An A to Z of… read more →

We spoke to Head of Global Trade & International Banking, Francisco Javier Fernández de Trocóniz at BBVA about the first blockchain based trade transaction between Europe and Latin America, following their… read more →