Trade Finance Global (TFG) sat down with Ameriabank to discuss how shifts in the global trading ecosystem have affected the Armenian economy.

During a panel at ICC Austria’s Trade Finance Week, moderator Tomasch Kubiak, policy manager at the ICC Global Banking Commission, spoke with panellists Gabriele Katz, director of global transaction banking at Deutsche Bank; Angela Koll, senior business expert for trade and supply chain finance at Commerzbank; and David Meynell, owner of TradeLC Advisory and senior technical advisor to the ICC Global Banking Commission.

At what point can a business acknowledge foreign exchange (FX) in their procure to pay (P2P) process, and at what cost?

Your weekly coffee briefing from TFG: TFG and Tinubu’s virtual tradecast now on demand

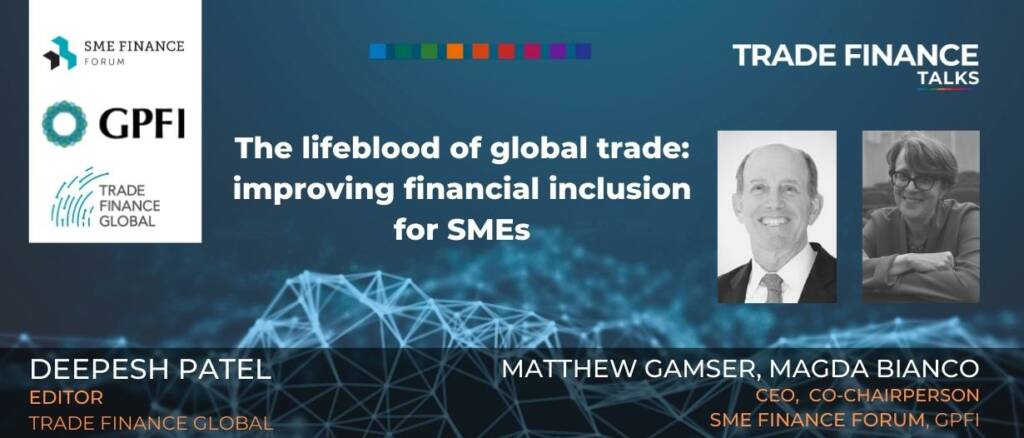

TFG spoke to two leading policymakers at the G20 on how to improve financial inclusion for SMEs.

Standard Chartered has successfully completed an industry-first pilot testing of a trade financing validation service provided by MonetaGo over SWIFT, to mitigate the risks of duplicate trade finance fraud on… read more →

To the untrained eye, trade finance can seem like an intimidating assortment of industry terms and acronyms that were designed to be confusing. Those in the industry know that confusion… read more →

When considering the world’s best mobile phone markets, your mind likely jumps to cities like Tokyo or Toronto, long before it reaches the likes of Kinshasa or Kampala.

Lloyds bank announced that they reached a key milestone in digitising trade by completing the UK’s first digital promissory note purchase. The transaction was completed using Enigio’s trace:original technology, in… read more →

There has been a huge boom in transformative trade technology in recent years. As more companies have focused on creating software that can be applied across multiple industries, there was… read more →