Recent news reports have suggested that the European Union Parliament will likely retain treatment of certain trade finance instruments at a credit conversion factor (CCF) of 20% instead of increasing it to 50%, but trade finance specialists tracking the ongoing proceedings have said that the EU banking community needs to remain extremely cautious.

The MLETR (Model Law on Electronic Transferable Records) is a revolutionary solution that aims to transform the trade finance industry by providing an open framework for digitising trade documentation.

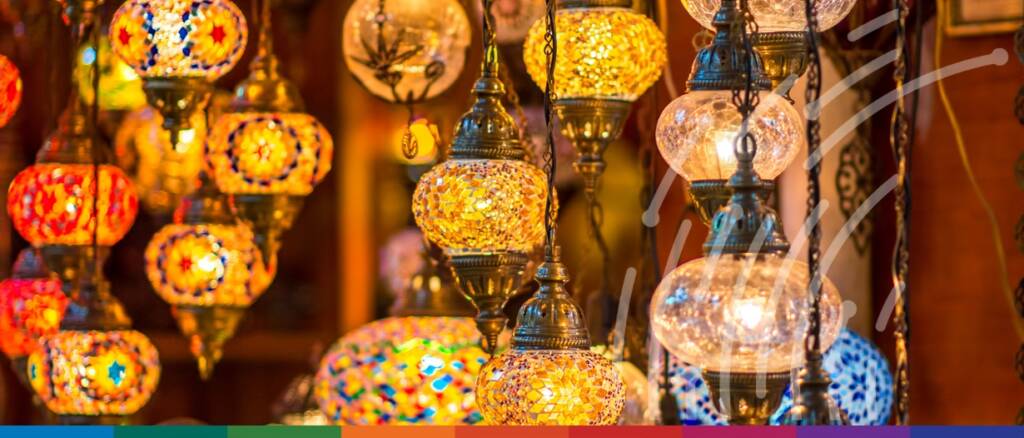

Dubai’s undeniable growth in trade, logistics and the financing of international commerce has made it one of the most desirable trade destinations in the world. This is why I invested more time with members of the ITFA Middle East committee in 2022.

Persistent structural gaps within and between the world’s economies will decisively influence trade in the years ahead. This was one of the key findings in the latest Future of Trade report.

The 52-page ICC DSI report identifies and defines the key data elements held within each of the seven identified key trade documents: namely, the certificate of origin, customs declaration, packing list, bill of lading, commercial invoice, warehouse receipt, and insurance certificate.

TFG spoke to the Honourable Mary Ng, Minister of International Trade Export Promotion, Small Business and Economic Development to discuss the Canadian government’s role in international trade and supporting women in the workplace.

As we have seen over the past few years, progress is not linear. In almost every aspect of life, two steps forward are often accompanied by one step back.

While at the ITFA and BCR: Trade & Investment Forum 2023, Trade Finance Global’s Deepesh Patel was happy to sit down and talk to Lord Holmes of Richmond MBE to discuss what the UK government is doing to support this digital transition.

This past week, Trade Finance Global (TFG) stopped by the inaugural ITFA and BCR: Trade & Investment Forum 2023 to learn more about making trade an investible asset class.

After COVID-19, the commodity trade finance industry experienced a period of great recovery. Trade finance covers a broad range of financing arrangements for the production, exporting and selling of commodities.