Today, Finastra announced a collaboration with S&P Global Market Intelligence focused on the corporate and syndicated lending market. The companies have agreed to collaborate and integrate their solutions for corporate… read more →

A recent report by Convera, a global B2B payments provider, predicts a substantial increase in the value of global services trade over the next five years. The Future of Trade… read more →

The financing partners of the Asian Development Bank (ADB) have committed $11.4 billion in cofinancing for ADB projects in 2022, aimed at enhancing the resilience of developing member countries and… read more →

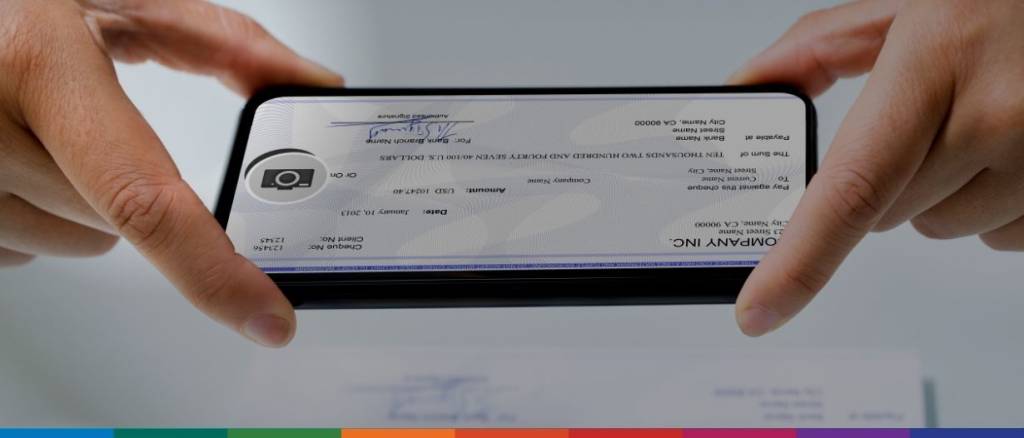

One of the difficulties related to international trade is the large volume of paper documents that make up much of the information flow between the different parties, including various documents such as invoices, bills of lading, certificates of origin, and customs declarations.

In response to the challenges posed by the COVID-19 pandemic and the recent crisis in Ukraine, the World Trade Organization (WTO) has introduced the Global Trade Data Portal. This initiative… read more →

Australia’s sports technology sector has attained a noteworthy milestone, now valued at AUS$4.25 billion ($2.78 billion), placing it on par with the country’s financial technology sector, according to a recent… read more →

The Brainy Insights, a market intelligence firm, has projected that the global invoice factoring market, valued at $2.74 trillion in 2022, is set to surge to a whopping $6 trillion… read more →

According to Reuters, Japan and the United States will issue a joint statement pertaining to technology collaboration, furthering their shared commitment to enhanced cooperation in the realms of advanced chips… read more →

Despite most industries witnessing digital leaps forward over the past decade, the world of trade has kept its focus on paper-based documentation. In fact, trade documents such as promissory notes, bills of lading, and performance bonds have remained relatively unchanged for centuries.

Today, HSBC unveiled a pioneering banking solution in Hong Kong, introducing point-of-sale financing for business-to-business (B2B) transactions. This offering will empower B2B sellers on online platforms to provide extended payment… read more →