While a growing portion of the industry starts to seize the opportunities of measuring and managing emissions, many commodity traders still hesitate. Why undertake the complex process of carbon accounting, if it’s hard, if it’s not a legal requirement, and if it only draws attention to their high-carbon products rather than their competitors?

News on the invasion of Ukraine, inflation and recession have swept into all offices, living rooms and public spaces in the past year. In other words: Macroeconomic considerations have prevailed, and we have all had to adapt to a new reality – not least in my work with sustainable finance.

At the forum, Trade Finance Global (TFG) spoke with Pamela Coke-Hamilton, the Executive Director of the International Trade Centre (ITC), to explore the impact of crises, capacity building, and support for women-led businesses and youth in trade.

(Geneva/Ulaanbaatar) – The International Trade Centre (ITC) today released a multimedia report on transforming economies with connected services, with a spotlight on landlocked countries. The report spotlights four types of services, known… read more →

One of the difficulties related to international trade is the large volume of paper documents that make up much of the information flow between the different parties, including various documents such as invoices, bills of lading, certificates of origin, and customs declarations.

First Abu Dhabi Bank (FAB), the UAE’s largest bank and a global financial powerhouse, strengthens its trade product offerings by introducing the Supply Chain Finance (SCF) programme in KSA, expanding… read more →

To successfully digitalise Bills of Lading, the three necessary foundations are law, standards and technology. Without their proper application, any eBL SaaS platform, notwithstanding the attractiveness of the business model, is unstable.

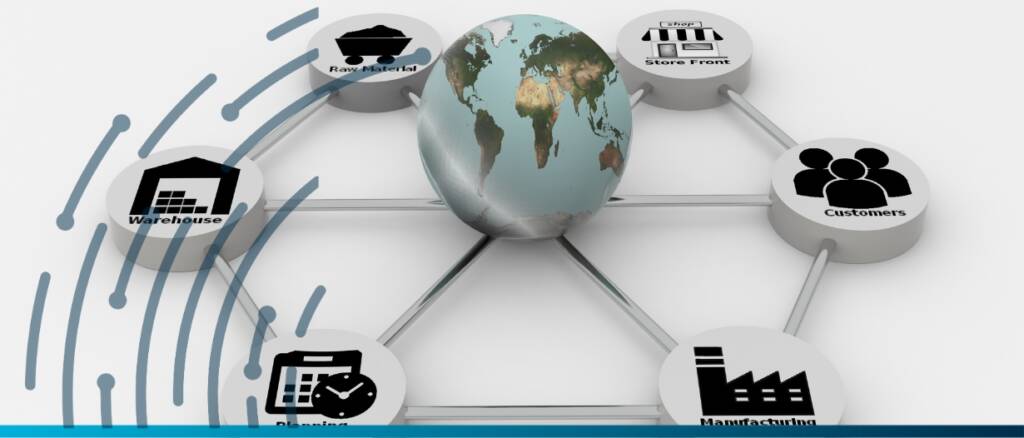

Fast fashion brands are looking at technology to help improve supply chain sustainability and meet their environmental, social, and governance (ESG) targets.

The sustainability commitment paradox, a new research report by Standard Chartered, reveals that despite 54% of global companies surveyed being willing to prioritise positive environmental and social impacts over financial… read more →

For many SMEs, the financing gap is always a major concern. It is reported that financing shortages count for more than half of SMEs’ problems. This issue is important for national policymakers, and financiers, as SMEs are major drivers of economic growth, employment, and social development in all economies, but especially in developing countries.