Looking at the bigger picture of international trade flows and supply chains is crucial when looking at helping businesses access finance. We heard from Tony Brown at the Annual WOA Convention, discussing the world of open account pre- invoice, including purchase orders, transportation, distribution and pre-shipment finance.

Trade and supply chain finance is at the forefront of innovation as there are currently many pain points for corporate clients and banks. As the industry moves towards a platform model, we heard from Accenture’s Cecile Leruste on thee major transition and megatrends going on in commodity finance.

We interviewed Geoff Brady, Head of Global Trade & Supply Chain Finance (GTS) at Bank of America Merrill Lynch. We talked about the physical and financial aspects of the supply chain management, about the importance of Blockchain Consortia in the trade finance space and the BAML’s agenda for the rest of the year.

TFG heard from Joel Schrevens Global Solutions Director of China Systems about the state of the trade and supply chain finance ecosystem. Established in 1983, China Systems is a leading trade services solutions vendor. The company is fully focused on providing an integrated front-end and back-office platform catering for internal and external deployment at a domestic, regional or global level.

Existing systems are woefully inefficient, siloed or still paper-based and many of them have not improved for decades. The Marco Polo Network is working with Financial Institutions, Corporates and Technology & Service Providers to remove the barriers preventing them from operating at their best.

(Maldives, October 9th, 2019): The International Islamic Trade Finance Corporation (ITFC), has signed a major US$1.5 billion framework agreement with the Republic of Maldives. The five-year framework agreement, signed by… read more →

Singapore-based Finaxar, announces the partnership with Global eTrade Services (GeTs), a global trade platform company. Finaxar provides its unique Lending-as-a-Service to financial institutions, trade and e-commerce platforms using data-driven methods to provide the fast, tailored financing solutions for SMEs.

We spoke to the winner of the Queen’s Award for Enterprise & International Trade, Imran Arshad, founder of Eventuri, in a podcast series for Trade Finance Talks. The UK exports vehicles and vehicle companions to more than 160 countries worldwide, that’s 81.5% of all vehicles produced in the UK.

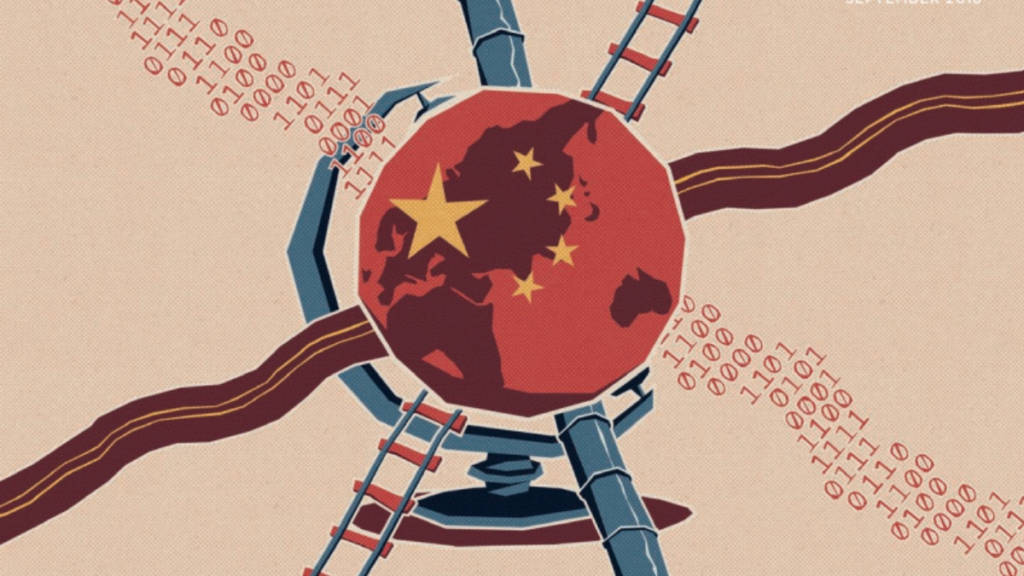

History’s most ambitious and extensive infrastructure project is currently underway. If successful, China will become the world’s undisputed Centrepoint of trade. However, such a triumph will not come easily.

Trade Finance Global caught up with Charles Nahum at Finacity, looking at the state of the trade receivables securitisation markets in 2019