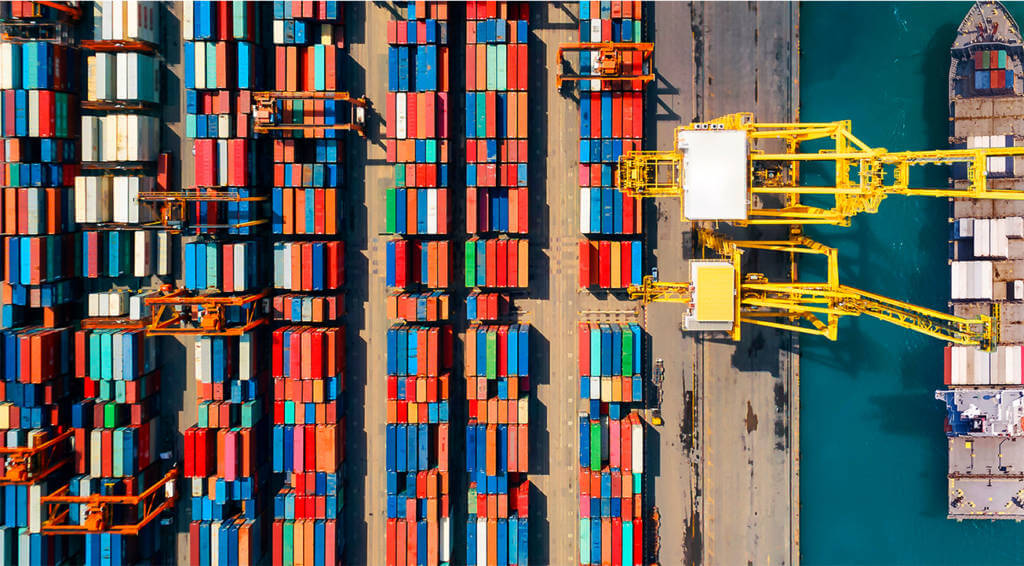

PARIS, 12th June. Today marks the release of the ICC Banking Commission’s 2018 Trade Register Report – again highlighting the low-risk nature of trade finance in comparison to other asset classes.

Trade Finance Global caught up with Charles Nahum at Finacity, looking at the state of the trade receivables securitisation markets in 2019

Bank of America Merrill Lynch’s Baris Kalay explores what it takes to implement a successful supply chain finance program.

Stenn International’s Kerstin Caroline Braun addresses the $1.5tn trade gap, and discusses how non-bank financing can help bridge the gap.

International law firm Sullivan has advised ITFA (the International Trade and Forfaiting Association), on its recently published guide to accounting and legal issues under International Financial Reporting Standard (IFRS) 9 for the trade receivables and supply chain finance industry.

With the departure of we.trade’s cofounder Roberto Mancone – TFG investigates the significant challenges on the road ahead for the blockchain platform.

In April of 2019, Surecomp launched Surelab – a new innovation lab created with the sole purpose of centralising the digitisation initiatives

TFG heard from Lionel Taylor and John Bugeja at Trade Advisory Network on the global outlook for trade, what’s changed, and how companies are shifting their supply chains to counter the macroeconomic and geopolitical challenges today

Within the current macroeconomic and geopolitical climate, there

are significant opportunities to enhance Anglo-Chinese relations. Brexit and the China-US trade war have fundamentally changed the chessboard.

Trade Finance Global heard from Dr Rebecca Harding, CEO of Coriolis Technologies on a data focussed trade outlook between China and UK corridors, and why this partnership matters.