At the end of March, Lloyds Bank released its latest report exploring supply chain resiliency across the global market. The report comes as internationally operating firms continue to face the… read more →

The 52-page ICC DSI report identifies and defines the key data elements held within each of the seven identified key trade documents: namely, the certificate of origin, customs declaration, packing list, bill of lading, commercial invoice, warehouse receipt, and insurance certificate.

A new insight brief series from the Global Maritime Forum identifies four actions that maritime and shipping industries can take now to support shipping’s transition to a sustainable and resilient… read more →

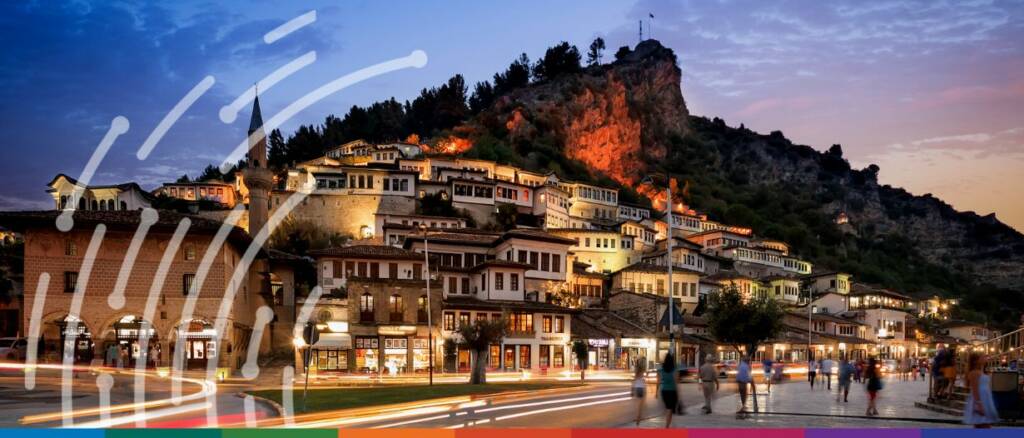

Looking to further international trade, Tim Reid, CEO of UK Export Finance (UKEF) met with Albanian Prime Minister Edi Rama, and Finance Minister Deline Ibrahimaj to finalise a £4 billion… read more →

Nine ocean carriers recently committed to 100% adoption of an electronic bill of lading (eBL) by 2030, with a waypoint goal of 50% adoption within five years. It is a significant step along the road to digitalisation, one that heralds a future for container trade processes that are simpler, more sustainable and more resilient.

Over the next 12-24 months corporates in Asia Pacific are looking to move more of their supply chains closer to home. According to HSBC’s latest report ‘Global Supply Chains –… read more →

Today the Digital Container Shipping Association (DCSA) announced a commitment for its members to transition from paper bills of lading to electronic bills of lading by 2030. The switch is… read more →

On the 9th February, Swiss-based commodities trader Trafigura alleged that it had been exposed to “systemic fraud” to the value of $577 million of nickel, in relation to UAE-based businessman Prateek Gupta’s London trading company TMT Metals Holdings Ltd, and companies connected to him.

Increasing volatility in global supply chains means shipping lines must undergo a radical restructuring to survive, according to A.P. Moller-Maersk A/S. Ditlev Blicher, president of Asia-Pacific for the shipping line… read more →

Your Monday morning coffee briefing from TFG: RELEASED – Trade Finance Talks – Sailing into 2023: Navigating the new year To agriculture and beyond: a look at how IoT technology… read more →