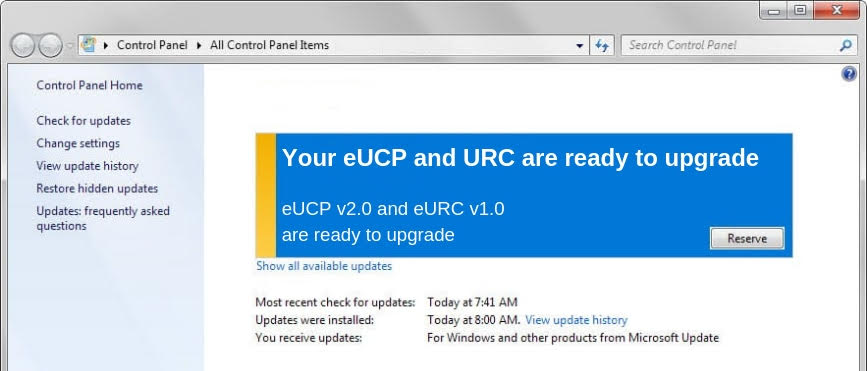

The International Chamber of Commerce (ICC) announced that it has accelerated attempts to digitalise of trade finance by releasing two new sets of enhanced rules, Uniform Customs and Practise for Documentary Credits (eUCP) and Uniform Rules for Collections (eURC 522).

Trade Finance Global (TFG) is delighted to announce a new educational partnership with FCI Academy – the centre of knowledge for receivables finance.

PARIS, 12th June. Today marks the release of the ICC Banking Commission’s 2018 Trade Register Report – again highlighting the low-risk nature of trade finance in comparison to other asset classes.

Here to discuss their recent report, Banking Regulation And The Campaign To Mitigate The Unintended Consequences For Trade Finance: is Olivier Paul, Director of Finance for Development at the ICC, joining us from Paris.

During Consortia 2019, Deepesh Patel heard from Chief Strategy Officer Dave Sutter from TradeIX, discussing the key requirements for the true digitalisation of trade finance, and what interoperability means for the networks and consortia within the blockchain / DLT trade space.

Fourteen leading global financial institutions have launched the Trade Finance Distribution (TFD) initiative to use technology and standardisation for the wider distribution of trade finance assets.

In 2018 the world factoring industry volume continued its upward trend with a total reported figure of over 2,767 billion euro representing over 6% growth compared to the previous year.

TFG exclusive podcast with komgo, we heard from CEO Souleïma Baddi talking about bringing blockchain and distributed ledger technology to commodity finance.

We heard from Nitin Gaur, Director of IBM Digital Asset Labs at the ICC Banking Commission’s Annual Meeting, on the benefits of blockchain / DLT for enabling trust, transparency and security

Trade Finance Global heard from Sean Edwards, Chairman of the ITFA at the NEARC (North East Asia Regional Committee) Seminar held in Beijing earlier this month.