London. Trade Finance Global (TFG) is delighted to announce it’s partnership with Surecomp’s latest free webinar: Next Gen Trade Finance Digitization.

Geneva. Sucafina SA (the “Company”), a leading sustainable Farm to Roaster coffee company, is pleased to announce that it has successfully closed a 2-year Sustainability-linked Senior Secured Borrowing Base Facility… read more →

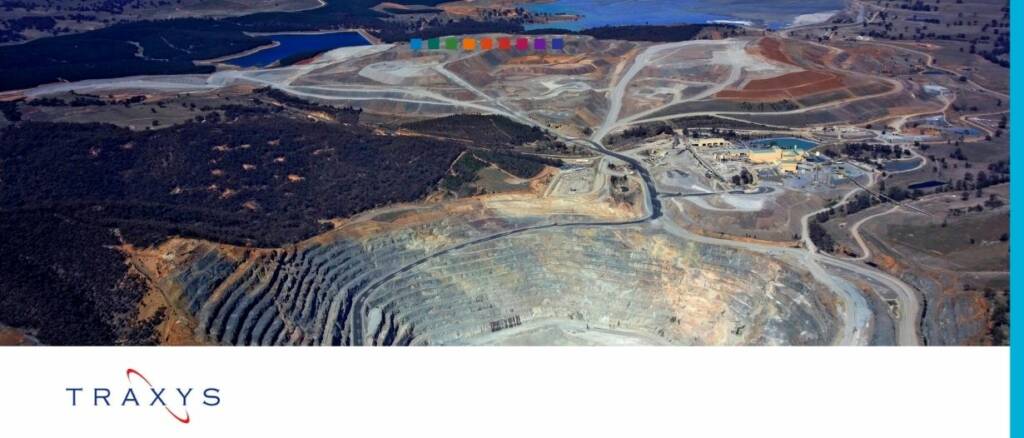

Traxys Sarl, a leading global physical trader and merchant in metals and natural resources, is pleased to announce the successful signing on 4th May 2021 of its flagship multicurrency syndicated… read more →

If you blinked and put your feet up this bank holiday weekend, you probably missed out on a few important milestones for digitalizing trade.

Finastra has announced BANK OF AFRICA, a pan-African financial group, has selected Conpend’s TRADE AI app from its open innovation platform, FusionFabric.cloud. The app extends the functionality of Finastra’s Fusion… read more →

MSC customers will be able to receive the bill of lading electronically, without any change or disruption to their day-to-day business operations. MSC customers will be able to receive the… read more →

SWIFT’s upcoming SR 2021 release is set to bring some significant changes to trade finance messaging standards – specifically those relating to guarantees

HSBC India and HSBC UAE have successfully executed a blockchain-enabled, live trade finance transaction between Tata Steel Ltd. (India) and Universal Tube & Plastic Industries Ltd. (UAE). This is a… read more →

ITFA, a leading trade finance industry body, has released an in-depth guide to Structured Letters of Credit. These are instruments which provide substantial funding to trade in emerging markets, but … read more →

By integrating the DLPC structure into trace:original documents, the benefits of a payment undertaking supported by BAFT’s best practices can be enjoyed while avoiding the potential drawbacks of a closed consortium.