Ninety seven per cent of exporters questioned in a survey said they were optimistic about growing their businesses through international trade. We spoke to Institute of Export & International Trade… read more →

Introduction On January 24, the central bank of China raised the 1-year MLF interest rate by 10BP to 3.1%, 6 months MLF interest rate increase by 10BP to 2.95%, leading… read more →

For decades, the shipping industry has helped many countries improve their economic situation, allowing many businesses to acquire their much-needed resources and develop products demanded by the market. And it… read more →

Within the course of just over half a year, cocoa prices have experienced the extremities at both ends of the scale. July 2016 saw the price of the commodity soar… read more →

At Trade Finance Global we get asked a lot of questions around Letters of Credit, so we’ve put together a quick cheat sheet on LCs, payment times and the presentation… read more →

Trade loans are short-term facilities involving a borrower and a lender that importers, exporters, and domestic traders use to acquire financing.

The law underpinning financial products is inevitably very important when structuring a facility. The concept of trade finance law also adds a level of difficulty as we usually see a… read more →

The rise in trade-based money laundering (TBML), combined with the enormous regulatory fines and ongoing scrutiny from various government agencies, has created a need for enhanced financial transparency, specifically where… read more →

Shaun said: “The decision is a simple option of liability versus expense.” What is factoring or invoice finance? Short answer: “After raising an invoice, your company will receive a pre-agreed… read more →

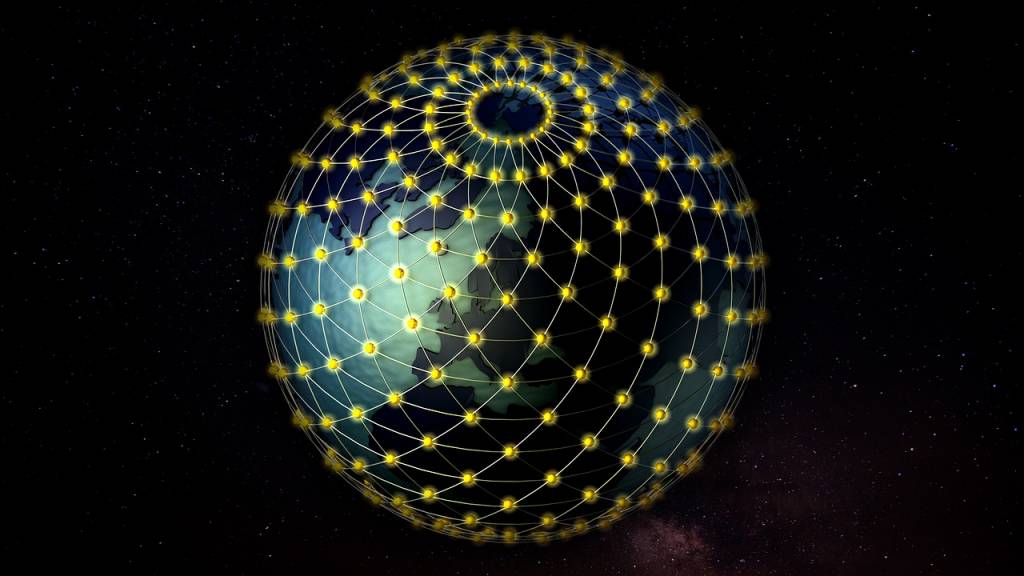

Blockchain and Trade Finance At the start of 2016 Trade Finance Global were cautiously optimistic for the blockchain being used as an application for trade and supply chain finance. But… read more →