Co-chairmen of the British Exporting Association (BExA), Marcus Dolman and Geoffrey De Mowbray, discuss the challenges and support needed for UK exporting. In the face of unprecedented levels of political… read more →

Final analysis of data collated by the EU Federation for the Factoring and Commercial Finance Industry (EUF) shows that in 2018 factoring and commercial finance volumes in the EU grew overall by 7.9% to €1.73 Trillion, 80% of which was domestic business and 20% international.

“Having experienced the fulfilment of serving the public, you can be sure that I will seek to contribute again” – Baroness Rona Fairhead CBE in her letter of resignation to PM Theresa May

In 2018 the world factoring industry volume continued its upward trend with a total reported figure of over 2,767 billion euro representing over 6% growth compared to the previous year.

TFG took a deep dive into the world of commodity markets and oil prices in 2019. What’s been driving prices, and what is the impact of geopolitics on major commodity markets? TFG’s Ross McKenzie investigates.

Since its inception in 2015, OakNorth has gone from strength to strength. Indeed, last year the British challenger bank reported a 220% increase in profits from the previous year. So what is the story behind OakNorth and why is it growing so quickly?

Trade Finance Global heard from Stephen Hubble, Chief Analyst at Centtrip, on how even the largest businesses struggled to deal with currency volatility and market uncertainty as a result of the current climate.

TFG heard from Lionel Taylor and John Bugeja at Trade Advisory Network on the global outlook for trade, what’s changed, and how companies are shifting their supply chains to counter the macroeconomic and geopolitical challenges today

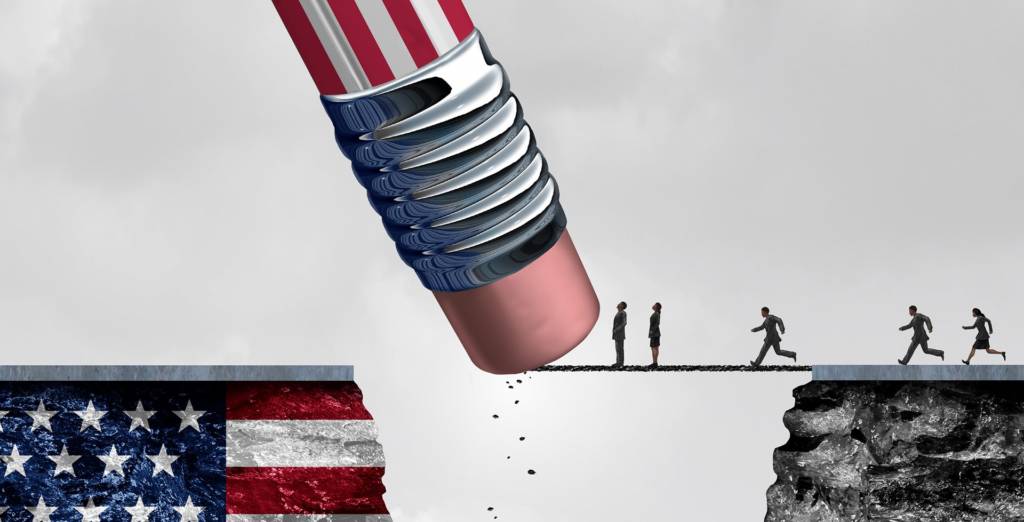

Is protectionism good or bad? It is indeed true that in the past, protectionism as a concept has been used with a net benefit, but often it is perspective that is key.

President Trump entered office in November 8th, 2016. Throughout his campaign, he held a very strong and very vocal position on the trading relationships that the US held with the rest of the world – that it was not good.