Eighteen months into the COVID-19 pandemic and shipping bottlenecks are challenging companies to meet demand. The global outlook is uncertain, however, that does not mean doom and gloom, making way for a new thought process.

Euler Hermes’ newest research found that 15% of the UK’s SMEs are at risk of insolvency in the next four years. Additionally, the research also highlights the impact and success… read more →

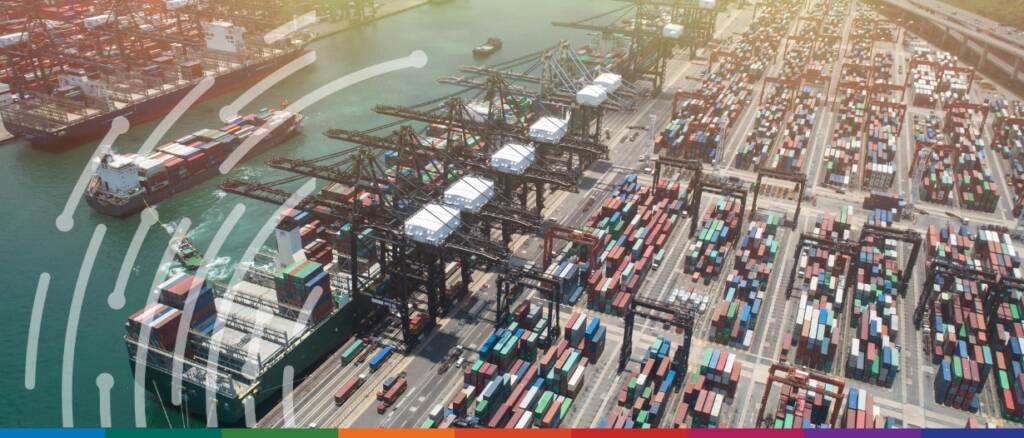

Global supply chains have been and continue to be deeply impacted by the changes that have taken place in the last 12 months. From the Suez canal debacle to the current shortage of HGV drivers in the UK, it is fair to say that the industry is, currently, facing significant challenges.

Our editor, Deepesh Patel sat down with Zencargo’s Sales Director, Sam Greenhalgh to discuss what changes need to take place to make the shipping industry more attractive to young professionals.

Your morning coffee briefing from TFG. Exports of intermediate goods sustain gains in Q1 of 2021 after rebound from pandemic, job slow down could lead the Federal Reserve to continue with stimulus, inflation could spark new financial crisis, China says US tensions threaten fight against climate change and UK labour crisis could last up to two years, CBI warns.

Your morning coffee briefing from TFG. COVID-19 vaccine transporter Reftrade secures major export win, lockdown-easing helps SMEs recover despite rising insolvencies, emerging economies cannot afford ‘taper tantrum’ repeat, says IMF’s Gopinath, business confidence in UK at four-year high but staff shortages a concern and UK launches £450m fund for energy network innovation.

World trade of goods has declined some 12% in the last year, representing a loss of $22 trillion USD of trade. Is it all doom and gloom for trade, or will we see a resurgence?

Your morning coffee briefing from TFG. Goods Barometer hits record high, confirming strength of trade recovery, UKEF backs first ever £430 million green transition loan, new World Economic Forum survey shows a mix of polarisation about the benefits of globalisation, global economic data disappointments add to rising growth angst, United States gives USD 600,000 to boost negotiating capacities in developing countries, Contour announces partnership with GSBN to drive digitisation in the global shipping industry and the UK rejects industry plea for visas for EU truck drivers.

TFG’s Joana Fabiao sat down with Victoria Cleland, the Executive Director for Banking, Payments and Innovation at the Bank of England for City Week 2021,

The UK agreed to the first partnership with ASEAN in 25 years. This partnership will lead to closer cooperation between the UK and the region on a wide range of… read more →