By leveraging technology for insights, a banker can make well-informed decisions, in compliance with audit and ethics, which are in the best interest of the bank.

London, 27th May 2020 – Europe-wide research commissioned by innovative financial infrastructure provider Banking Circle has found that nearly two thirds (64.6%) of online merchants have needed extra finance in… read more →

86% of global banks surveyed are looking to use open APIs to enable Open Banking capabilities in the next 12 months Banks believe regulators are stifling innovation: almost half (48%)… read more →

Here the story has been less dramatic. After the initial collapse in the pound to a 35-year low against the USD and 11-year low against EUR, we’ve seen a recovery to a level slightly above the average since the Brexit vote.

Unexpected and unpredictable, COVID-19 has already made a huge impact on global economies and markets, including the currency market.

TFG explores the current fiscal stimulus as a result of COVID-19 and how it might affect UK SMEs, as well as the overall market reactions from Coronavirus

ISO 20022 is the messaging standard for all types of financial services messaging. Dominic Digby discusses ISO 20022 for trade finance.

TFG’s Editor Deepesh Patel spoke to Stacey Facter, BAFT’s Senior Vice President for Trade Products, during BAFT’s Global Annual Meeting, held in Frankfurt from January 13-15, 2020. Anti-money laundering (AML) and sanctions were key compliance themes at the meeting, so TFG caught up to discuss how these could be tackled moving forward, and what’s in stock for 2020.

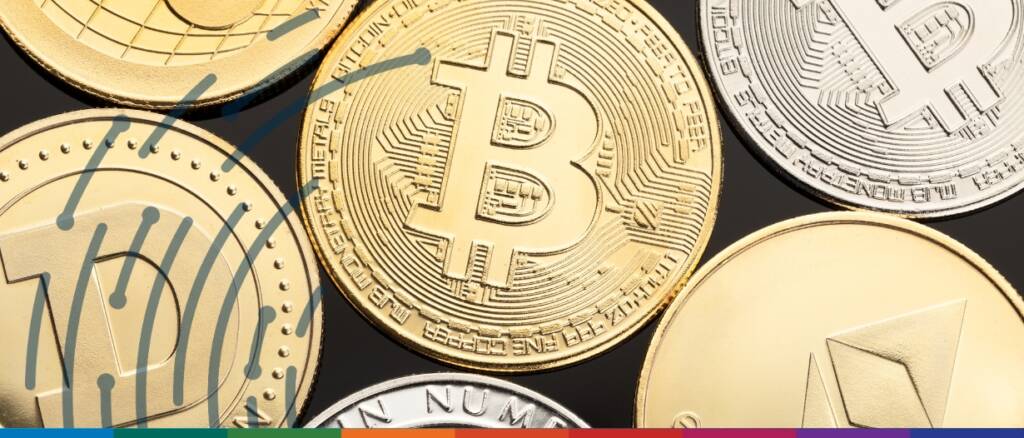

Currency is part and parcel of monetary policy, and a public mandate of the European Central Bank (ECB). TFG’s Editor, Deepesh Patel, spoke to ECB’s Yves Mersch about the possibilities of central bank digital currencies in relation to payment systems, faster transaction times and settlements. Separating the hype from reality; Mersch spoke to TFG about the regulatory consequences of central bank digital currencies. “We are tech neutral. We want to stay ahead of tech. Tech has to serve our purpose, not the other way around.”

American consumers are currently sitting on a fairly huge nest egg. Equity is at a higher level than ever before, and the personal saving rate has risen to a considerable 7.9% according to NASDAQ figures.