The opening salvos in the trade war between the US and China have already been fired. The US unveiled plans for a 25 per cent tariff on steel and 10… read more →

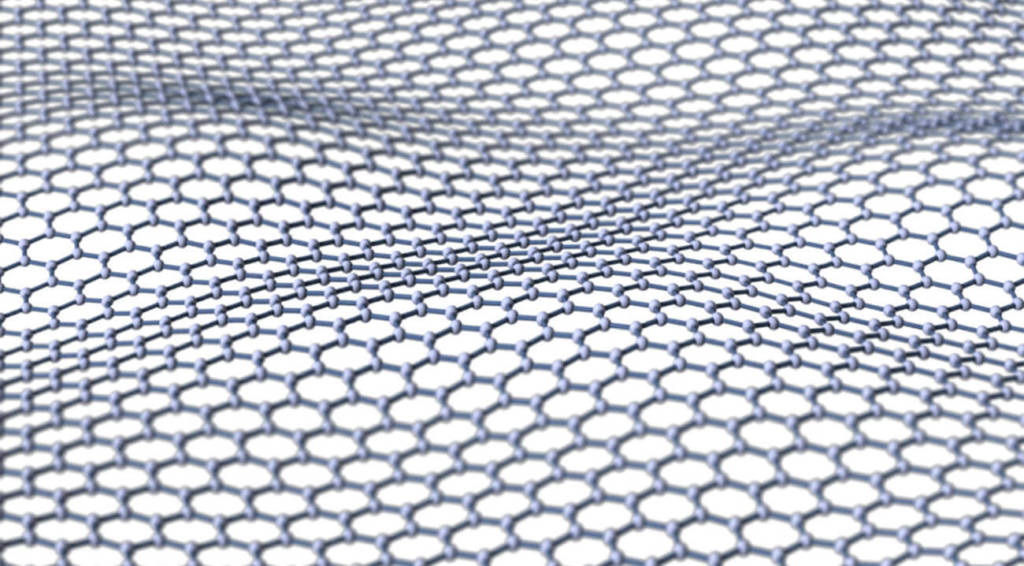

A new material has been discovered and its properties are so incredible, that new technologies emerged using it, revolutionizing the human life for the next century. While this sounds like… read more →

The invoice finance market is poised for disruption through distributed ledger technologies and cryptocurrencies. TFG recently spoke to Dror Shapira, CEO of INVioU about their platform which uses AI and… read more →

It is understandable that aluminum buyers are nervous about future price movements after falling nearly 9% in price from their high in early January. Aluminium markets took almost a 10%… read more →

US caustic soda markets are expected to see strong performance in 2018, with more exports and higher pricing, according to an analysis report by Olin Corporation, the world’s largest chlor-alkali… read more →

While electricity is produced and used at the same time, national electricity companies need to be able to satisfy demand at any given moment. By enhancing current interconnectors and building… read more →

Google and Facebook have got a big storm coming with the new tax reform on digital enterprises, which is going to target their revenues instead of much smaller profit figures,… read more →

Access to finance is essential for SMEs because it allows them to expand, thrive and ultimately create jobs. Thankfully, various alternative funding options provide SMEs with a choice when it comes to overcoming financial… read more →

What’s the process for getting construction finance? Construction finance usually occurs in a few steps, normally done online: These can include: The main benefits of construction finance can be… read more →

We spoke to Johnatas Montezuma, a shipping expert and specialist in complex supply chain solutions for some useful incoterms and shipping suggestions for first time exporters. A supply chain expert… read more →