Estimated reading time: 5 minutes

What is the outlook for commodity trading in 2024? Marsh’s Aaron Bailey and Christopher Coppock provide their views.

Outlook summary

- In the context of a record number of elections and macroeconomic challenges, 2024 will see volatility in the commodity market driven by a complex web of market forces, government and intergovernmental policy, unforeseen geopolitical developments, and climate impacts.

- These events are expected to present various credit, political, economic, supply chain, and climate-related risks, testing the ability of many traders and financial institutions to capture available opportunities.

- Strategic use of insurance risk capital sourced from a combination of credit and political risk, and surety bond, guarantee, and parametric markets can help create tangible value for stakeholders and enable trade, investment, and lending across the commodity value chain.

Factors shaping volatility in 2024

Geopolitics in 2024 will likely continue to drive commodity volatility. As noted in the 2024 Global Risks Report, three of the top ten risks in the coming years in terms of severity are geopolitical — social polarisation, lack of economic opportunity, and involuntary migration.

Many of the developments from 2023 will likely persist, including the Russia-Ukraine war, escalated tension in the Middle East, and further disruption to trade routes such as the Suez Canal.

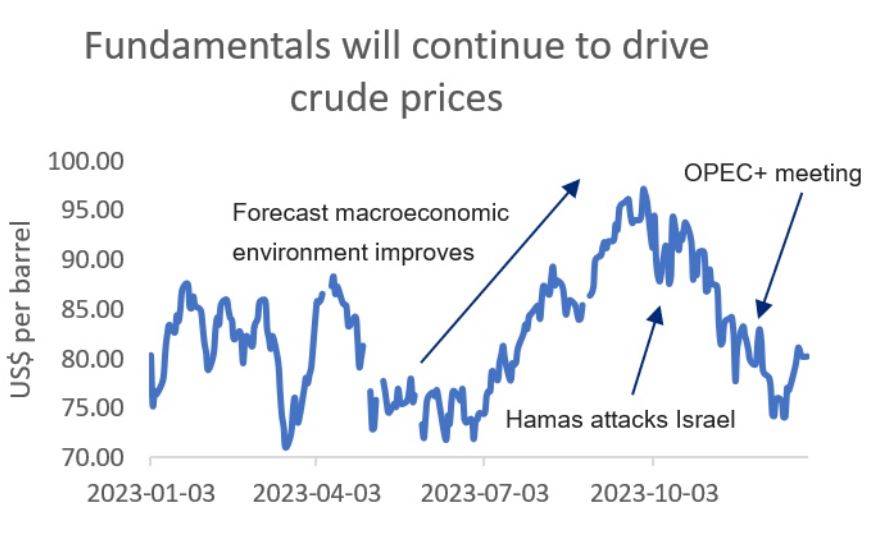

For energy markets in particular, the renewed focus on geopolitical events and the associated impacts, while understandable given the increased frequency of conflict in recent years, should not distract from the reality that structural forces will likely remain the most significant driver of price direction over the mid and long-term.

Oil prices moved relatively little after the October 7 Hamas attack on Israel and the delayed November policy meeting of OPEC+ compared to how prices tend to respond to demand indicators and macroeconomic uncertainty. It would take a seismic geopolitical event, or an escalation of existing events noted above, to have a similar and lasting price impact.

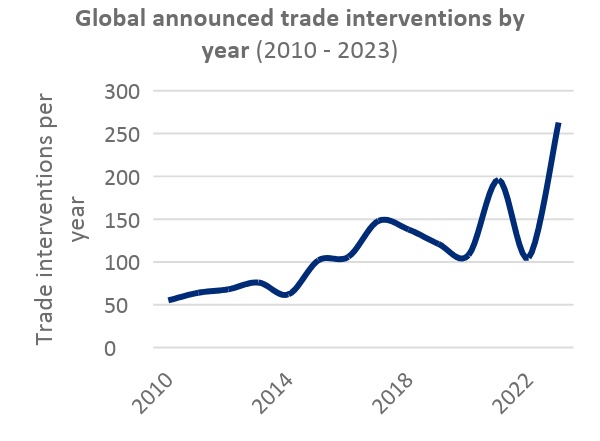

Government trade policies and climate events will likely be significant drivers of volatility in other commodity asset markets, particularly critical minerals and soft commodities. Two policy trends could potentially disrupt trade flows and influence the market for these commodities.

- The first trend is policies restricting the export of goods, such as India’s recent non-basmati rice export ban, which saw global rice prices increase by 16%, or the variety of raw metal export bans implemented in recent years.

- Two considerations will likely influence government decisions on similar policies in 2024. For soft commodities, governments may assess that climate disruptions could create a negative electoral result or affect political stability in their country.

- In contrast, for minerals, policymakers may weigh the potential to earn additional revenue by requiring in-country processing, regardless of the potential disruption to global trade.

- The second policy trend involves those that affect the import of goods, especially soft commodities. For instance, as of December 2024, the new EU Deforestation Regulation will penalise importers of specific products associated with deforestation activity. The policy is already impacting supply chains for soft commodities as traders look to de-risk their operations ahead of its implementation.

Source: Global Trade Alert

To an extent, the effects of government policies on commodity prices can be predicted in advance. Yet it is challenging to know which stakeholders across the commodity value chain will comply, which will seek alternative export markets, which will withdraw from the relevant market, and what the overall impact on prices will be.

Implications of volatility

Given the expectation of volatility across commodity markets in 2024 driven by market forces, geopolitics, and climate change, commodity traders and financial institutions may face distinct challenges in mitigating risk while capturing the full scope of available opportunities.

One challenge to consider is the impact of prolonged price volatility on internal counterparty credit limits. For instance, in Europe, in the two weeks following Russia’s invasion of Ukraine, oil, coal, and gas prices increased by around 40%, 130%, and 180% respectively.

This led to a market-wide liquidity strain, particularly for energy traders, who faced substantial margin calls and required additional financing to support trading.

At the same time, future trade levels were at risk of being limited due to credit concentrations driven by price risk. Many traders and financial institutions looked to the private credit insurance and surety bond markets for payment and performance risk solutions to support the management of credit concentrations, diversify their forms of collateral issuance, and support additional trade across both physical and financial markets.

Restrictive trade and investment levels stemming from a continuation of geopolitical volatility and subsequent country risk deterioration may also be complicated by the results of Basel IV discussions on asset classes and the benefits of risk mitigants.

In addition, while there is a strong demand for minerals in emerging and frontier markets, the heightened threat of discriminatory government action may limit capital deployment in new mining projects. Sources of potential losses to lenders and asset owners, such as the seizure of assets, currency transfer restrictions, or cancellation of concessions, may be mitigated through political risk insurance (PRI), which can support the flow of capital into new projects.

The impact of climate-driven events on financial risk is another important consideration. Climate-related disruption across supply chains and weather-related changes to crop yields and growing seasons will likely continue to represent a financial risk to many producers, traders, and financiers. The expanded adoption of global parametric insurance solutions is one potential route to provide protection against loss of revenue, increased costs, and physical damage resulting from adverse weather events.

In 2024 and beyond, the private insurance market will continue to play a key role in helping financial institutions and commodity traders mitigate investment and trading risk.