Exporters Dare to Dream

The renewed downside impetus in the British Pound at the start of October has left many questioning where the limits to sell-off lie.

The Pound has achieved fresh 31 year lows against the US Dollar on Tuesday October 4th.

In Dollar terms, therefore, UK goods are arguably at 31-year lows on the international market place.

And it’s not just in Dollar terms that UK produce is looking discounted as the currency tests five-year lows against the Euro and is at it’s lowest level against the New Zealand Dollar since 1976.

In short, the picture surrounding the UK currency is a negative one, particularly if you are looking at a foreign holiday or are an importer.

Yet, for exporters these are indeed good times.

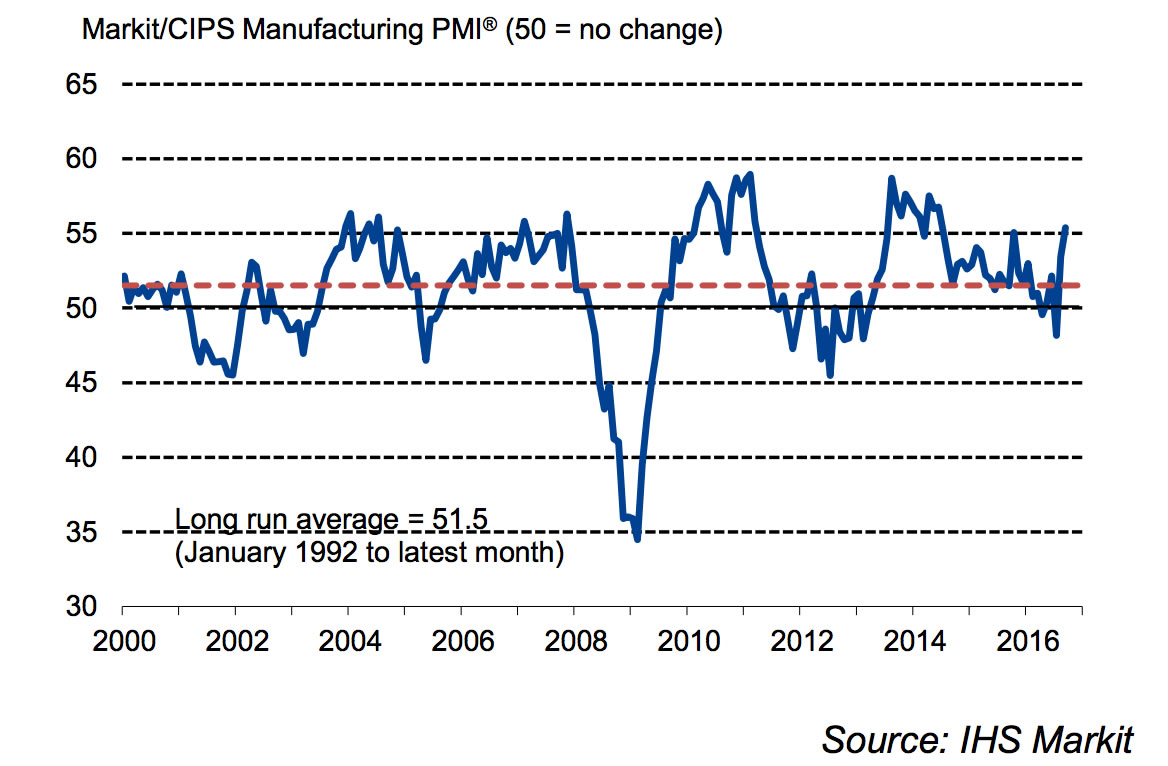

On October 3rd IHS Markit at the CIPS recorded the joint strongest increase in manufacturing activity in the Manufacturing PMI’s history.

The reading at 55.4 confirms a sector that is growing at a rate not seen since 2014 thanks to the domestic market remaining a prime driver of new business wins.

Image: Markit/CIPS Manufacturing PMI Source: IHS Markit

However, Markit report that the weaker Sterling exchange rate also drove up new orders from abroad.

“The weak sterling exchange rate remained the prime growth engine, driving higher new orders from Asia, Europe, the USA and a number of emerging markets,” says Rob Dobson, Senior Economist at IHS Markit.

And, it appears that even better exchange rates for exporters lie ahead with bearish sentiment on the Pound becoming even more entrenched.

How Low can the Pound Go?

Driving Sterling lower is the latest news from the Tory party conference is that Theresa May has indicated the Brexit her party opts for is one that delivers full autonomy for the country.

This is good on paper, however there are some notable side-effects, number one being that taking control of the UK’s borders also means being denied full access to the European single market.

Of course, some access will ultimately be delivered, but for now the uncertainties are not being welcomed by currency markets.

“We think that any recovery is likely to be futile at this juncture with fears of a hard-Brexit continuing to build,” says Kathleen Brooks, Research Director at City Index. “A move down to 1.25, and even 1.20 is now a possibility for GBP/USD. The all-time low for GBP/USD from March 1985 is 1.05.”

City Index do say they don’t expect to return to these lows – back in 1985 the pound only briefly dipped to 1.05 before recovering sharply.

“However, 1.20 could be the next resting place for cable,” says Brooks.

Others are however not quite so negative.

For instance, Fawad Razaqzada, Market Analyst with Forex.com says he believes most of the Pound-negative news is now out of the way.

“While one could argue that it may be a bit premature to start feeling bullish on the pound again, most of the negative news is out of the way now. We had the initial Brexit vote shock, then the Bank of England’s response in the form of a rate cut and re-introduction of QE, and now we know that the Article 50 will be triggered before April next year,” says Razaqzada.

Don’t Panic about the Pound

The GBP has been trading in the 4% range after the 10% hit on the Brexit vote in June.

Expect more of the same says Aurelija Augulyte at Nordea Markets who is another analyst who is not convinced that Sterling will reach an all-time nadir this time around.

Noting that current lows are a result of the UK PM Therese May telling the annual Conservative conference that the Article 50 will be triggered by the end of March next year.

“We don’t think this is news nor a sufficient reason to panic – the UK data and policy decisions will be drivers in the near term,” says Augulyte.

While the GBP has not recovered after the June vote, UK financial markets have remained resilient, thus the shock to the economy is limited to confidence suggests Augulyte.

The GBP is already undervalued by most long-term measures; the PPP suggests the GBP/USD cross is some 10% too low relative to fair value.

Therefore, the prospect of a Sterling recovery remains in the offing.

The consensus forecast for the GBP/USD at year-end is 1.27.

Therefore exporters looking for even better exchange rates should seriously consider covering at least some of their exposure.