The need for digital trade finance has never been clearer.

Today’s volatile market poses many challenges for trade finance banks and their corporate clients, including supply chain disruptions, rising costs, ongoing compliance demands, risk of fraud and growing ESG scrutiny.

But removing the paper from trade finance comes with challenges, and financiers have to weigh whether to buy their solutions through a third party, or build their own capabilities in-house.

Last week, Deepesh Patel, editor at Trade Finance Global, spoke to Enno-Burghard Weitzel, SVP Strategy, Digitization & Business Development at Surecomp, in a webinar entitled “Taking trade finance digital – buy vs build.”

Adopting digital solutions

In today’s digital era, banks and corporations face challenges in optimising trade finance processes. Surecomp conducted a survey to evaluate digital solution adoption and identify issues.

Patel and Weitzel discussed the findings, examining options for banks to tackle these challenges by deciding whether to create digital trade finance solutions in-house or outsource them.

Trade finance has long relied on traditional methods and relationships. As the global economy becomes more digital, it’s crucial for institutions to adapt their trade finance operations.

Digitalisation offers a chance to streamline processes, increase efficiency, and improve customer satisfaction. Benefits include reduced costs, faster transactions, and better risk management.

However, the journey toward digital transformation is challenging. Institutions must decide whether to invest in existing platforms from external providers or build custom digital solutions in-house. This “buy or build” dilemma holds significant implications for long-term success and competitiveness in a rapidly evolving trade landscape.

Surecomp’s survey findings: Discontent and desire for improvement

To gain a better understanding of the current state of play, Surecomp conducted a survey of banks and corporates to assess their adoption of digital trade finance tools and identify struggles and growth opportunities.

The results unveiled a significant level of dissatisfaction among banks and corporates with their current trade finance processes.

A notable 41% of banks expressed discontent with the time taken to issue finance approval to their customers, with 35% of them being not happy “at all.”

Similarly, 45% of corporates reported being unsatisfied with the time it takes to receive approvals from their financiers.

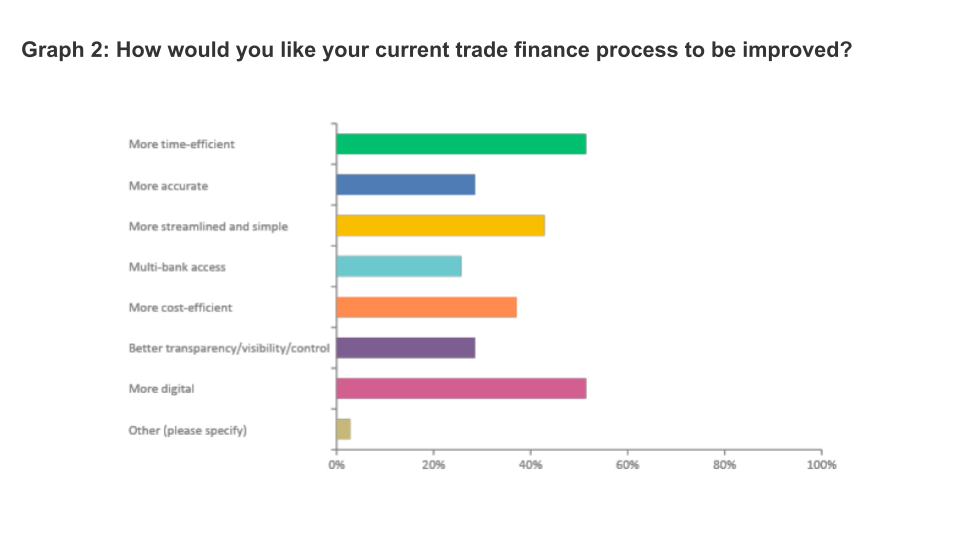

Unsurprisingly, both banks and corporates shared a desire for improvements in their trade finance processes. The top responses in this regard were “more digital” (53% for banks, 52% for corporates), “more time-efficient” (53% for banks, 52% for corporates), and “more streamlined and simple” (41% for banks, 45% for corporates).

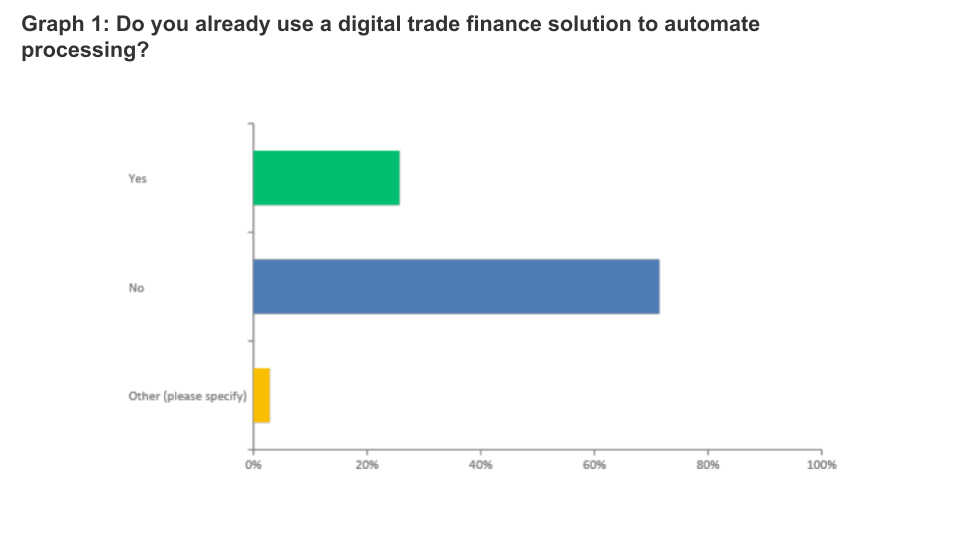

Interestingly, despite this strong desire for improvement, the survey results revealed a noticeable gap when it comes to adoption.

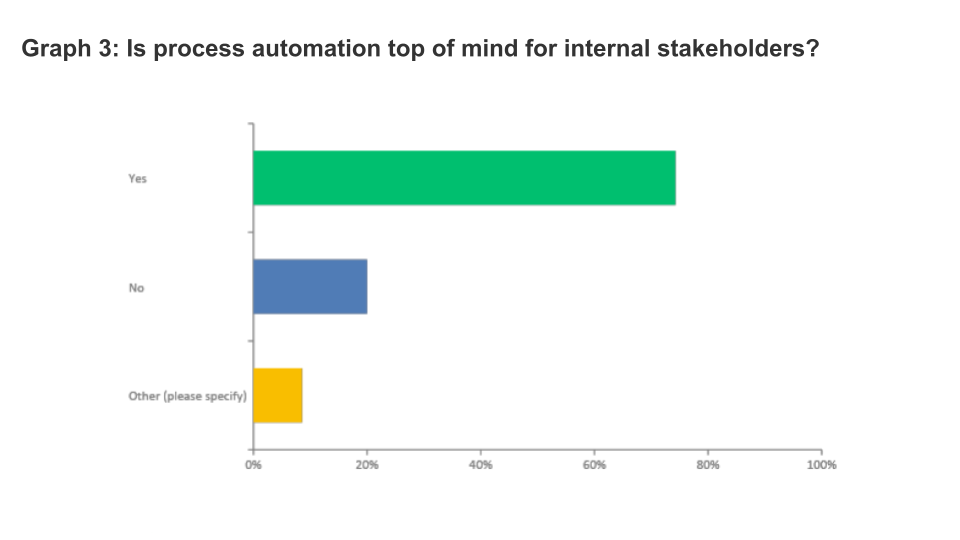

While 71% of banks and 73% of corporates acknowledged that process automation is a top priority for internal stakeholders, a significant proportion have yet to implement digital trade finance solutions to automate their processes.

A striking 59% of banks and 70% of corporates reported not using a digital trade finance solution for process automation.

Furthermore, 93% of banks continue to rely on email as the primary mode of communication with their trade finance customers, highlighting the ongoing use of time-consuming and error-prone manual processes.

“This gap presents a substantial opportunity for growth and transformation, and by overcoming it, banks and corporates can unlock the full potential of digitalisation, streamline their processes, and achieve enhanced efficiency,” said Weitzel. “The challenge, however, lies in determining the most suitable means of doing so.”

To buy or to build, that is the question

The trade finance industry has experienced a surge in technological innovation in recent years, with a plethora of solutions emerging to address various pain points and inefficiencies in the sector.

However, the landscape is characterised by fragmentation, with numerous fintech solutions and blockchain platforms in various stages of development.

Many solutions have yet to move beyond the proof-of-concept stage to live production, and the events of recent months, where several large-scale initiatives have closed down after failing to reach commercial viability, have yet to inspire confidence.

Weitzel said, “Banks have invested enormous sums of money into digital transformation, but they’re making slow progress.”

“Whether it be building API connectivity for corporate clients into the backend, or spending money on integrations into platforms that don’t achieve scale, things aren’t moving as fast as they may have expected.”

Meanwhile, the proliferation of new technologies creates new challenges.

Not only do stakeholders face the risk of investing in technologies that may eventually fail, but the need for standardisation across various solutions creates significant integration hurdles, with banks and corporates finding themselves having to invest in multiple platforms to cater to different aspects of their operations.

Given this backdrop, building a custom, in-house solution may appear attractive in terms of flexibility and control.

By building their own services, banks can create unique features and capabilities that distinguish them from their competitors, creating a tailored offering that caters to the specific needs of their clients.

This competitive differentiation can be a valuable asset in an increasingly crowded and competitive trade finance landscape, enabling institutions to stand out and capture a larger share of the market.

However, only some financial institutions are able to roll out their own digital services: while larger banks may have access to specialised teams capable of designing and implementing digital trade finance systems, smaller institutions might need more resources and knowledge.

What’s more, the risks and limitations inherent in this approach often outweigh the potential benefits.

“Building a custom trade finance solution demands significant time and human resources,” said Weitzel. “By opting to buy, banks can allocate their resources more strategically, focusing on activities that drive competitive advantage and differentiation. We’ve seen this in the way that the relationship between banks and fintechs has transformed from one of competition to one of strategic collaboration, where banks can leverage fintechs’ specialised knowledge and technological experience.”

Responses received by Surecomp from the market revealed a mixed picture as to which side of the buy or build debate the industry is settling on.

Of the banks and corporates that said they were already using a digital trade finance solution, roughly half said this was a third-party platform, while the remainder said they either used host-to-host integration between their enterprise resource planning (ERP) software and their banks’ servers, or a proprietary solution developed by the bank.

Given the trade-offs associated with building a custom solution versus procuring an existing platform, it may be tempting for industry players to hold off on making the leap for now, until the landscape matures somewhat. However, doing nothing is not an option.

Patel said, “Despite the hurdles the industry is facing on the path towards trade digitalisation, the direction of travel is clear.”

“Changes underway in the regulatory, legislative and policy environment are set to catalyse the utilisation of digital processes, and huge progress is being made around the adoption of value-creating use cases. The potential benefits of making trade faster and easier for everyone are real, especially given the current tough macroeconomic situation.”

Bridging the gap between buying and building

To unlock significant economic and operational benefits, corporates and banks alike should start adopting digital trade strategies now – and this will mean bridging the gap between buying and building to leverage the advantages of both options while reducing the risks.

“As stakeholders within the trade finance ecosystem look to navigate the complexities of the buy or build dilemma, finding a hybrid approach that can enable them to make tangible progress now and expand their capabilities over time is a compelling alternative,” said Patel.

This alternative to the strict binary choice between buying and building combines the control and customisation capabilities of in-house solutions with the specialised expertise and scalability of external platforms, enabling banks and corporates to create a more adaptable and resilient digital trade finance infrastructure.

Surecomp’s RIVO platform, a digital hub that provides open API access to importers, exporters, banks, insurers, shipping companies and solution providers, is one example of this concept in action.

By integrating with RIVO, organisations can easily connect their existing in-house trade finance solutions with external platforms and services, enabling them to customise their offerings and adapt to evolving market needs without the need for significant in-house development or procurement efforts.

Embracing the future of trade

The world of trade is at a crossroads, with the relentless march of digitalisation forcing banks and corporates to re-evaluate their traditional processes and systems.

The benefits of embracing digital transformation are clear, yet the challenges and decisions that institutions must navigate along this journey are complex and multifaceted.

Ultimately, this will not be a one-size-fits-all endeavour.

Each organisation must carefully assess its unique needs, resources, and objectives to determine the most suitable path forward.

However, what is clear is that those who proactively embrace digital transformation, whether through buying, building or adopting a hybrid approach, will be best positioned to thrive in this rapidly evolving landscape and be instrumental in bringing forth a more efficient, transparent, and inclusive global trade ecosystem.