The International Chamber of Commerce (ICC) has published a new report setting out proposals to tackle the challenge of defining and setting common standards for sustainable trade and trade finance.

Developed in partnership with Boston Consulting Group (BCG), and with input from over 200 banks and corporates, the report outlines the world’s first standardised framework and assessment methodology to qualify the sustainability profile of trade transactions.

Unlike other asset classes, such as bonds, no standards currently exist to allow financial institutions to grade the sustainability performance of trade finance transactions – a market which is currently worth $5 trillion annually.

In the report, released today, the ICC claims that existing frameworks governing sustainable finance are not well-suited to deal with the hidden complexities of international trade, since they tend to focus only on the intent of financial instruments.

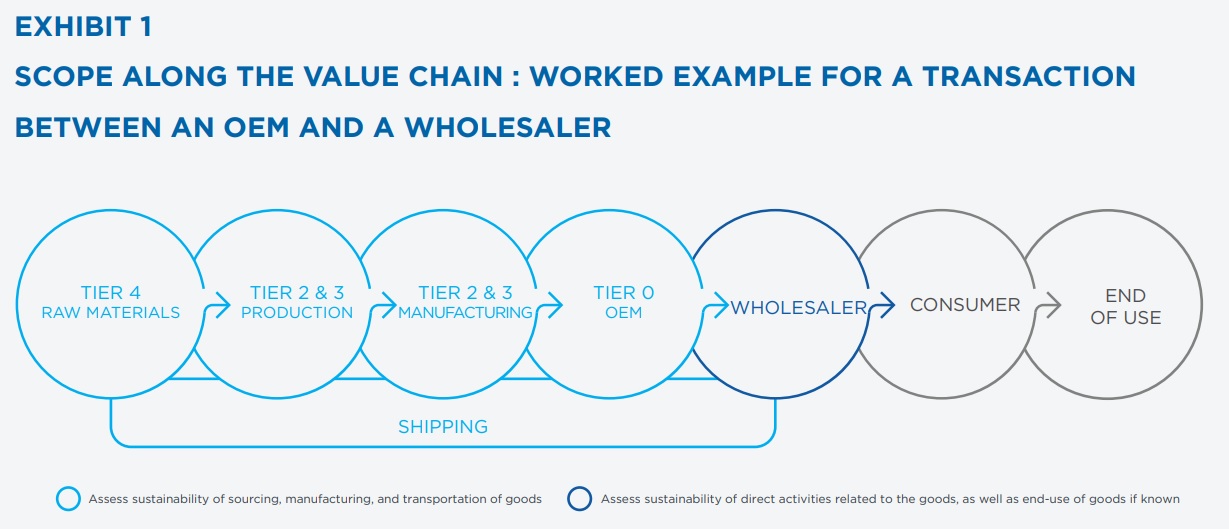

For example, the report notes that a single trade transaction can involve as many as 20 different parties and different types of goods, services, and raw materials crossing multiple jurisdictions, with each using different forms of transport.

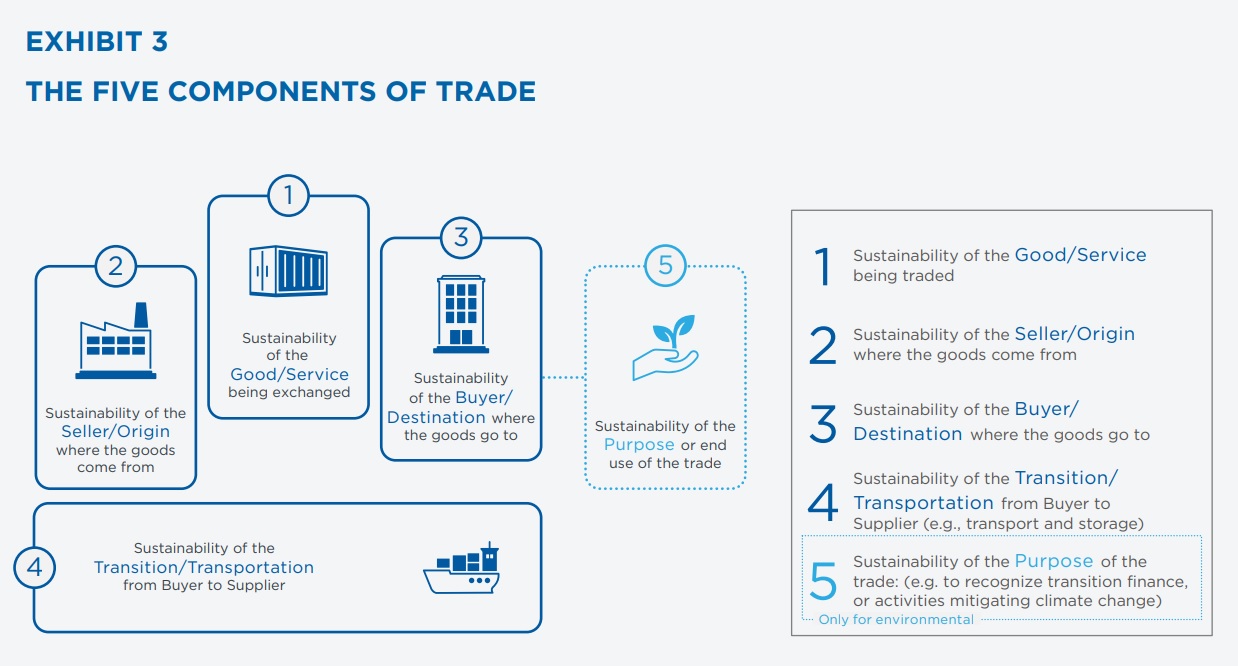

In addition, while specific goods may not in themselves be sustainable, they can often be used for purposes such as sustainable infrastructure.

The same also applies in reverse when it comes to the trade of sustainable goods for non-sustainable purposes.

In response, the ICC’s proposed framework seeks to break through this complexity by recognising not only positive activity, but also guiding banks and corporates towards the use of best-practice standards.

John W.H. Denton AO, secretary-general of the ICC, said: “We recognise the imperative to ensure that international trade is a trusted vector of economic, societal, and environmental progress.

“But the difficulty of defining workable sustainability standards for cross-border commerce should not be underestimated.

“The proposed framework we are setting out today is intended to cut through the inherent complexity of global value chains, establishing a standard methodology for banks and corporates to reliably grade the economic, environmental, and social performance of individual transactions.”

Transparent trade finance

The report also proposes an assessment framework that provides transparency on the sustainability credentials of different components of a trade transaction, including the buyer and seller, the nature of the goods being sold, the intent of a transaction, and the mode of transportation.

This is backed by a standard definition of “sustainable trade” that aims to ensure integrity in the application of the framework.

Rather than defining a new set of standards for financial institutions and businesses to follow, the framework draws on existing standards where possible.

Instead, the ICC wants to avoid adding any further complexity for traders, particularly small businesses, whose activities are often the least measurable in terms of sustainability.

“We see a remarkable opportunity to put the US$5 trillion trade finance market squarely behind global sustainability goals,” Denton added.

“But to achieve this, we need to ensure we land an approach that sets a high bar on sustainability, while still being capable of being implemented in the real world by banks and corporates, regardless of their size, sector, or geography.”

Next steps

Off the back of the draft proposals outlined in the report, the ICC now plans to launch its largest ever consultation process in search of feedback from industry, policymakers, and trade financiers worldwide.

In addition, the ICC wants to hear from civil society, academia, and international organisations, and will be opening a structured review process later this week, which is open to all interested stakeholders.

Then in 2022, the ICC plans to refine its methodology, map existing standards to the framework, and – crucially – determine how to most effectively implement them in practice.