In June 2017, the ICC Banking Commission announced the launch of the “Digitalisation of Trade Finance Working Group” which included, among other aims, an evaluation of existing ICC rules in order to assess compatibility with digital data.

As a result of the evaluation, authorisation was provided to proceed with an update of the existing version 1.1 of eUCP in order to ensure continued digital compliance and to draft the eURC in order to cater for digital compatibility in the presentation of electronic records under Collections.

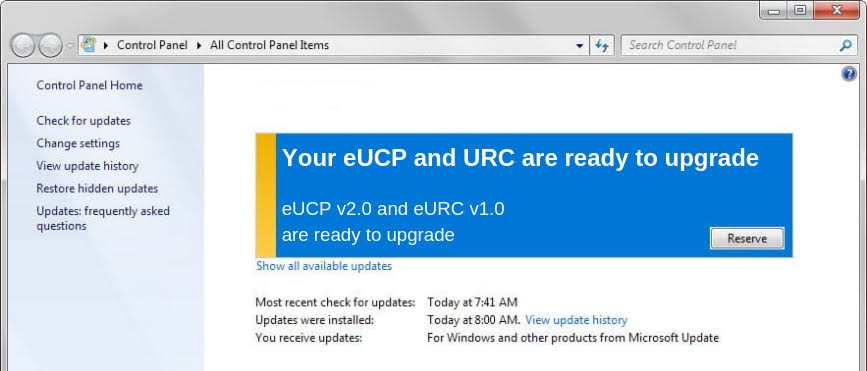

The drafting process came to an end in January 2019, and ICC National Committees voted for approval of both sets of rules in March 2019, with the result that eUCP Version 2.0 and eURC Version 1.0 came into force on 1st July 2019.

Owing to the pandemic, these rules have received increased interest over the past few months. There is a growing realisation by practitioners that paper documents are causing delays and disruption.

The focus of the eRules is concentrated upon the presentation of electronic records under the eUCP and the eURC, alone or in combination with paper documents, and not on to issuance of an eUCP credit or an eURC collection instruction. The principles on which the eRules have been based are the underlying principles in UCP 600 and URC 522, and the standard practice currently existing for eCommerce transactions.

Benefits of these new rules

Existing ICC rules, such as UCP 600 and URC 522, whilst being invaluable in a paper world, provide limited protection when applied to electronic transactions. As such, it is inevitable that traditional trade instruments will, over time, inexorably move towards a mixed ecosystem of paper and digital, and, ultimately, to electronic documents alone. In this respect, the eRules provide numerous benefits, some of which are listed below:

- Ensuring relevance in an evolving digital trade world

- Explicitly and unambiguously supporting the usage of electronic documents

- Extending risk mitigation to a digital environment

- Providing conformity when faced with divergent local or regional practices

- A shared understanding of terminologies

- Uniformity and consistency in customs and practice

What to keep in mind

Whilst the rules are fairly straightforward and should not cause any problems for users, it makes sense to put in place certain arrangements in order to ensure that no issues will arise:

- Operational – the format of an electronic record is key to the entire process. As stated in the rules, each transaction must indicate the format of any required electronic document as, if the format is not indicated, it may be presented in any format.

- Technology – essential that internal data processing systems can handle the relevant formats for electronic records, authenticate messages, and execute electronic signatures. In view of the fact that data processing systems are unlikely to be able to access all formats, it is essential that any data received is readable by the relevant data processing system(s).

- Legal – as far as is known, no conflict exists between the eRules and eCommerce laws. It should be noted that when there is a mandatory requirement under local electronic commerce law for a higher degree of authenticity than would be required under the eRules, local electronic commerce law may impose additional requirements on an electronic presentation. UNCITRAL Model Laws, including the Model Law on Electronic Transferable Records (MLETR), create no problems with respect to the eRules. The definitions within the eRules are modelled on those in the MLETR.

- Customer Agreements – it is important that a review of customer agreements be undertaken in order to ensure that issues such as formats for electronic documents, authentication, and electronic signature requirements are covered.

- Risk Management – review handling guidelines in order to account for changes in processing practices for eUCP credits and eURC collection instructions, as well as any additional risks deemed relevant to transaction processing. Banks need to undertake a thorough analysis of the impact on operational risk related to the presentation of electronic records and create new procedures and risk guidelines for these practices.

- Customer Relationship – consider a specific strategy for approaching customers as to their interest and preparedness for the eRules. Moving towards a digital environment will result in cost and efficiency savings on all sides, whilst also introducing a competitive advantage

Guidance on eUCP and eURC

The ICC has made the full text of both the eUCP and the eURC available online, together with an article-by-article analysis of both sets of rules. This guidance provides an in-depth explanation for each rule, as well as the preparation and drafting process. Learn more here.

Pursuant to feedback received at the October 2019 Banking Commission meeting in Paris, the ICC published further handling guidance in respect of the utilisation of the eRules. Learn more here.

An additional guidance paper was released on 7 April 2020 which provided technical guidance to the market on issues of force majeure, elements to consider in modifying ICC rules for specific trade finance instruments, and common scenarios experiences in the delivery of documents during the public health measures undertaken in response to COVID-19. Within the above paper, it was confirmed that the ICC would continue to promote the broader use of the eUCP Version 2.0. It further clarified that for existing credits subject to UCP 600, if all parties intend to change from paper documents to electronic records, they may do so by agreeing an amendment of the credit from UCP 600 to eUCP Version 2.0. Scanned documents will fall within the definition of an ‘electronic record’ in eUCP Version 2.0 but would need to meet the requirements for authentication as mentioned in eUCP sub-article e6.

On 23 April 2020, ICC issued a collection of rapid response measures by trade finance banks to keep trade finance and trade flowing in the face of COVID-19. This paper highlighted that, among other common adjustments to workflows during the pandemic, the adoption of eUCP Version 2.0 and eURC Version 1.0 as operating models had been growing. Organisations have been configuring internal processes for greater use of these rules. The fact that both sets of rules covered digital formats was seen to be of great advantage.

And, most recently, an in-depth Users Guide was made available for download free of charge, which you can download here.