Within the course of just over half a year, cocoa prices have experienced the extremities at both ends of the scale. July 2016 saw the price of the commodity soar to a 40 year high, chiefly attributed to the vote in favour of Brexit, whilst in stark comparison prices dropped considerably during February 2017, falling to a 4 year low. Complexities within the market hedge predictions on whether prices are likely to rebound.

What’s happening to cocoa prices?

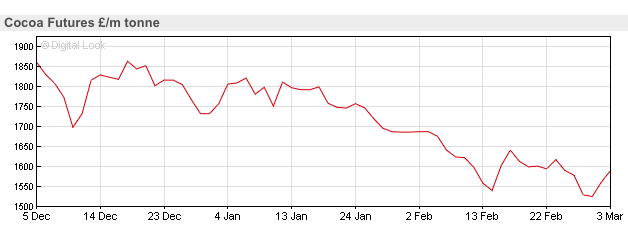

Looking at the market data, just 3 months detail many fluctuations in £/m tonnes for the rates on cocoa. The most substantial falls being the sharp declines during December last year, and the extensive downward slope from the mid January through to mid February as of this year. Naturally, cocoa has experienced various peaks during this time, but the overall outlook for the year so far has been looking rather bleak.

Demand vs Supply

Having fallen a dramatic 40% since July, cocoa is among one of the worst performing commodities of the year, perhaps a surprise with consideration to chocolate being one of the most popular and widely consumed products internationally.

SOURCE: News Market Data: Cocoa Futures £/m Tonnes – BBC News, Business.

But not even recent events such as Valentine’s Day, a presumed boost in demand for chocolate, could persuade cocoa’s prices to rise significantly. According to The Financial Times, the London benchmark was down 11% with prices at £1,562 a tonne, whilst the New York contract had dropped to $1,918 a tonne, an 8 year low, as of February.

On the supply side, cocoa has seen a surge in harvests thanks to benign weather in West Africa. However, this may not bode well due to the scepticism over contracts with the Ivory Coast. The negative forecasts for future prices have led some exporters of the cocoa to withdraw from purchases, leaving a surplus of cocoa beans deposited in warehouses.

The rise of ‘shrinkflation’

The situation has been further aggravated by the increasingly popular strategy of ‘shrinkflation’, whereby manufacturers decrease the size of products or use substitutes in order to lower costs. A good example being the latest scandal surrounding the ‘cost-saving measure’ of Mondelez International in shrinking the size of Toblerone. To see examples of other products that have been subject to shrinklafton, see the following link: https://www.telegraph.co.uk/news/2016/11/21/9-chocolates-have-become-smaller-expensive-due-shrinkflation/.

Is cocoa to see a rebound?

Having peaked to a momentous high only to reach a subsequent multi-year low, we have witnessed a volatile journey for the cocoa trade. Supply has been seen to outweigh demand, or if not demand, perhaps the confused predictions within the market being a disincentive to trade.

Despite this however, it is possible for cocoa to make a rebound by the end of 2017. Lower prices are expected to cause an increase in demand. We can already see evidence of this through the modest increase in cocoa futures, up by 2% this beginning of March. Furthermore, with Easter approaching and the probable increase in the demand for shrinkflated creme eggs, a rallying in cocoa prices could be plausible.

The prospective cocoa prices are uncertain. If you want to find out about food and perishable food finance at TFG, talk to our experts here.