Estimated reading time: 3 minutes

British International Investment (BII), the UK’s development finance institution and impact investor, has partnered with Citi to launch a $100 million risk-sharing facility.

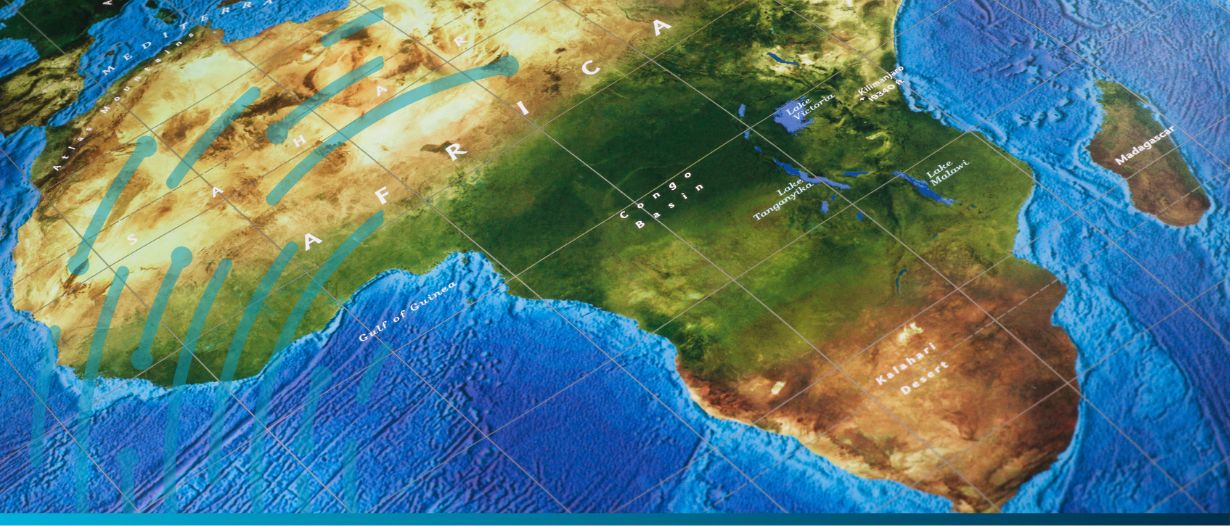

This initiative aims to bolster the trade finance availability for SMEs and corporates in frontier and emerging African markets. The agreement was signed during the World Bank’s Spring Meetings in Washington and seeks to enhance the business prospects of enterprises that are currently constrained by financial limitations.

The programme will mitigate the acute foreign currency shortage in these regions by augmenting the trade finance liquidity through Citi’s widespread network of commercial banks. This arrangement enables financial institutions to extend more substantial support to African companies importing essential commodities like wheat, fertiliser, rice, and sugar.

The BII and Citi collaboration will assist local businesses in accessing finance to import economically valuable goods, including transportation, critical equipment, and machinery. This support is crucial for fostering the growth of manufacturing sectors in various African nations such as Benin, Cameroon, Côte d’Ivoire, Rwanda, Tanzania, Uganda, and Zambia.

The need for this funding has become more pressing as local enterprises face difficulties in securing necessary imports. These challenges are the result of high inflation, escalating interest rates, and rising commodity prices following the COVID-19 pandemic and the Russia-Ukraine conflict.

Consequently, the trade finance gap in Africa has widened significantly, increasing by about a third since the pandemic began, from $81 billion in 2019 to $120 billion in 2023.

The newly introduced facility capitalises on BII’s expertise in the African continent and is set to enhance Citi’s engagement with over 200 local banks, enabling them to support ambitious companies in accessing the finance needed in less accessible markets.

The UK’s Minister for Development and Africa Andrew Mitchell said, “This investment underlines BII’s commitment to supporting fragile economies across Africa in accessing vital goods to support food production, including fertiliser and agricultural machinery. By investing in countries where support is most needed, BII continues to take a lead in the fight against food insecurity.”

Nick O’Donohoe, CEO, BII said, “Our investment with Citi deepens BII’s footprint across the continent and supports local businesses struggling to maintain and expand operations due to a lack of capital. The facility is testament to our commitment to tackle complex issues such as food security in Africa by extending liquidity solutions to strategic sectors. This empowers local businesses to strengthen supply chains and accelerate the flow of essential trade.”

Stephanie Von Friedeburg, Head of DFI Strategic Partnerships, Citi said, “Citi is proud to work with BII in seeking to strengthen trade, and food security in frontier and emerging African economies. Today’s announcement brings together BII’s long history of support in the region, with Citi’s unique cross-border vantage point. At Citi, we understand the transformative potential of global trade and are committed to bringing solutions that facilitate critical investments to enable economic growth.”

This investment contributes to the United Nations’ Sustainable Development Goals 1, 2 and 8, No Poverty, Zero Hunger, and Decent Work & Economic Growth.