-

- Technological disruption: Countries cannot cooperate; technological disruption races ahead of regulation, creating a borderless world for some, but with greater uncertainty and inefficiencies.

-

- Sovereignty first: Countries cannot cooperate; prohibitive unilateral barriers lead to inefficiencies, high economic risks and a decline in productivity and innovation.

-

- Open International rules: Countries cooperate to address issues through a revitalized WTO and complementary international frameworks.

-

- Competing coalitions: Countries cooperate, but are often drawn into competing spheres (US, Europe and China, for example) with regional blocs outside the WTO.

“The combination of beggar-thy-neighbour tariffs, unilateral barriers against flows of people, goods, services and capital, heightened nationalist rhetoric from many quarters, growing politicization of trade and investment agreements and competing coalitions looks set to put the world on a path of greater risk, uncertainty, economic decline and geopolitical conflict – the impact of which may be felt for several generations to come”

WEF, 2020

In January 2019, the World Economic Forum (WEF) Global Future Council on International Trade and Investment produced a brief – “Four Scenarios for the Future of Trade and Investment”, that assessed the rising geopolitical tensions present globally, and offered four potential avenues that the global economy would take in the coming years.

Speaking exclusively to TFG, Anabel González, Non-Resident Senior Fellow, Peterson Institute for International Economics said: “Trade is a formidable force for good and can support inclusion and sustainability, as well as address challenges associated with technology, investment, taxation and development. But, to leverage the power of trade, we first must make sure that we act to strengthen the architecture of the global trading system so that it can serve the world for many years to come.”

January 2020, and the WEF has released another briefing entitled “The Future of Trade and Investment: A Call to Prevent Economic Fragmentation”, analysing the avenue which was chosen and the threats that come with it.

From trade wars to global-institutional failings, the brief stands as a stern warning that the political-economic decisions of the world’s leaders in the past year will not lead to prosperity in the future.

“To halt this downward spiral, the world’s leaders must take immediate, concerted action to restore global cooperation.”

Predicted Scenario’s

In their 2019 brief, the WEF highlighted four possible scenarios for the future of global trade and investment:

- Technological disruption: Countries cannot cooperate; technological disruption races ahead of regulation, creating a borderless world for some, but with greater uncertainty and inefficiencies.

- Sovereignty first: Countries cannot cooperate; prohibitive unilateral barriers lead to inefficiencies, high economic risks and a decline in productivity and innovation.

- Open International rules: Countries cooperate to address issues through a revitalized WTO and complementary international frameworks.

- Competing coalitions: Countries cooperate, but are often drawn into competing spheres (US, Europe and China, for example) with regional blocs outside the WTO.

The brief correctly highlights that, as a global platform we seem to have shifted more toward the “sovereignty first” scenario than any other. There are many instances to choose from – US-China Trade War; Brexit; Hong Kong-China; Japan-Korea; middle eastern tensions. All of which present movement away from the multilateral approach that has undoubtedly been the underlying principle for much of the global trading successes of the past 70 years.

US – China Implications

With the US imposing a total of $360 bn worth of tariffs on China – who have retaliated with $110 bn worth of tariffs – we are seeing trading tariffs used as a political weapon by some of the world’s largest and most influential nations. Not only does this produce uncertainty that bests that experienced in the 2008 financial crisis (by 683.9 index points according to the Economic Uncertainty Policy Index), it also and more directly impacts firms that are operating within and with the sanctioned Chinese sector.

The position of the consumer, along with trade levels (and patterns) on both sides of the table are damaged. On 6th November, 2019 the United Nations conference on Trade and Development published a paper entitled “Trade and Trade Diversion Effects of United States Tariffs on China”.

The paper found that as a result of this trade war, there has been a sharp decline in bilateral trade, higher prices for consumers and what is called ‘trade diversion effects’, which is the increase in imports from countries not associated with the trade war. Interestingly, US consumers were found to carry more of burden from the trade war than any other in the form of higher prices, and yet the tensions continue.

The UNCTAD’s paper was accompanied by a caution by the Director of International Trade and Commodities, Pamela Coke Hamilton, not too dissimilar to that of the WEF’s 2020 brief – “The results of the study serve as a global warning. A lose-lose trade war is not only harming the main contenders, it also compromises the stability of the global economy and future growth”. (UNCTAD, 2019)

Wider Implications

The WEF pointed toward the use of trade restrictions with the justification of national security – first used by the US and now being replicated in many other international disputes – as a monumental threat to global prosperity, and also to “the multilateral foundations for cooperation built up after WWII”. Trade wars, in all forms seems to have become much more of a norm, and an apparently-viewed engine for political gain.

The brief also emphasized the risk to future innovation – visa restrictions and immigration opposition. Both of which, result in limited sharing of information between nation’s citizens which in turn dampens the rate at which we as a civilisation innovate.

Visa restrictions have been present in many of the geo-political upsets as of late, and have been applied to all walks of people – diplomats included, which then begins to impact the extent to which national governments communicate and innovate politically and cooperatively. This of course impacts short term trade, as well as long term trade possibilities.

Innovation, is seen alongside a multilateral approach in terms of its significance in global prosperity. Nathan Rosenberg, Professor of Economics at Stanford said in his paper ’Innovation and Economic Growth’ published by the OECD, “It is taken as axiomatic that innovative activity has been the single, most important component of long-term economic growth”.

Furthermore, Eric Neymayer, Professor of Environment and Development at the London School of Economics wrote a paper investigating the effect of visa restrictions on bilateral trade flows and foreign direct investment. It was found that restrictions bring about a significant reduction in international contact, which is a prominent aspect of FDI.

The WEF brief outlined the successes of China’s Belt and Road Initiative (BRI), or at least the prospect of it, and how this has spread across the globe. Initiatives such as the Indo-Pacific Strategy, or the EU-Japan Investment Cooperation Pack, bare promise for some of safe havens for secured investment channels. Others, however have not taken the same perspective.

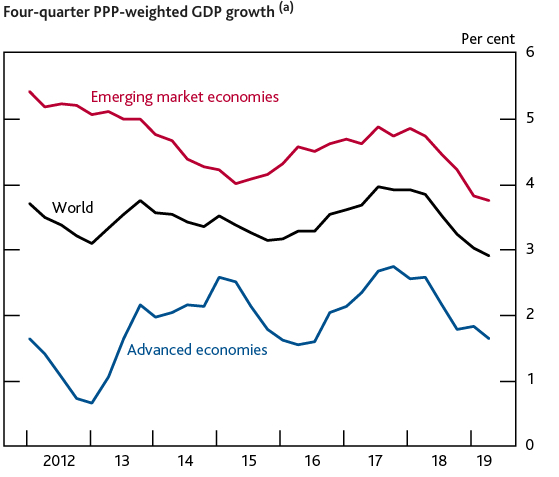

Created using the real GDP growth rates of 189 countries weighted by their individual share of world GDP, the Bank of England’s Monetary Policy Committee presented the below in their November 2019 report:

This slowdown in economic growth is a symptom of higher economic and political uncertainty fuelled by protectionist trade measures. From the above image, we can see that it is the global economy that is suffering. These unilateral shifts cause businesses and economies to turn inward, and a domino effect ensues through the uncertainty.

It is because of the aforementioned significance of bilateralism that so much of the global economy has grown dependent on it, and it is because of that, that a threat to it’s cooperative foundation causes such uncertainty.

Proof of this lies with another key player in the global economy suffering – Europe. With the UK’s impending exit (and whatever that may entail), and also the US’ aggressive stance toward trade, Europe experienced a deepening of economic uncertainty which has contributed to the global state of volatility.

Economic Fragmentation and the WTO

“The consequences of this economic fragmentation should not be underestimated”

The disrupt to political, and more specifically trade relations mentioned above are but one part of the story. The World Trade Organisation (WTO), operating with a goal to “ensure trade flows as smoothly, predictably and freely as possible”, is in the midst of it’s most significant crisis since it’s commencement in 1995.

Labelled an “urgent priority” in the WEF brief, the WTO’s Appellate body is in ruins. The AB was established in 1995 under Article 17 of the Understand on Rules and Procedures Governing the Settlement of Disputes (DSU) with the intention of diluting trade disputes brought forward by WTO members.

Usually consisting of seven members, the body requires a minimum of three members to hear a dispute case. As of December 10th 2019, the body has only one member. Each member serves their term, and upon the end of said term a replacement in chosen. Why? Because the US has been blocking the reappointment of members.

In 2016, under the belief that Seung Wha Chang had been involved in decisions that were seen as unfavourable to the US, and so was blocked by them for reappointment. Members have since proposed to start a new selection process, to which the US declined.

Volume 18 – Issue 3 of the World Trade Review, curated by the WTO and Cambridge University Press explains how Sections 2 and 3 of Article 17 prove all reasons offered by the US are not sufficient justification for the disruptions to the WTO legal and dispute system. It goes on to argue that the US is in breach of it’s “legal duties and democratic mandates given by national parliaments to maintain the AB, as prescribed in Article 17”, and that other nations are also breaching such duties by not acting to rectify.

Referred to as “probably the busiest international dispute settlement system in the world’ by Arie Reich in EUI Working Papers 2017/11: ‘The effectiveness of the WTO dispute settlement system: A statistical analysis’, the Appellate Body may not be perfect (and has indeed faced criticisms from other nations in the past) but it is so busy for a reason. The WTO, as it says on their home page “is the only global international organization dealing with the rules of trade between nations”.

“The WTO is confronting its most fundamental crisis since its creation, in particular in relation to its system for the orderly settlement of trade disputes”.

A Plea to Reassess

Global growth, global investment and global stability have all suffered significantly, all the while political uncertainty, trade tensions and the likelihood of continued disrupt is on the rise.

The WEF release urged action from political leaders to build upon initiatives such as this, with the goal of protecting global trade and innovation – both present and future. Mentioning the potential good that trade can do in the way of overcoming challenges associated with technology, investment, taxation and development.

A more unified, cooperative approach to global relations will help secure a more stable, productive environment for the world’s nations and businesses to trade within. Without this, as the brief correctly illustrates – it is not a positive outcome.

TFG recently spoke with 20 industry experts on their top predictions for 2020, with the aim of helping businesses navigate the global trading platform as we move into a new decade.

Thanks to Ross McKenzie, Journalist, Trade Finance Global for co-editing this piece.