The two-day BCR Publishing Supply Chain Finance Summit got underway this morning, boasting important names from the supply chain finance sector and banks including HSBC, Lloyds and ABN AMRO. What happened? TFG’s Fin Kavanagh reports.

“Exceptionally Uncertain”

The remote conference was opened by Chairman Betrand de Comminges, Global Head of Trade Finance Investments & Global Investment at Santander Asset Management.

In his keynote address Dr Robert Koopman, Chief Economist at the World Trade Organization, opened up the summit labelling the economic outlook for 2021 “exceptionally uncertain”, with performance over the next few months critical in the global recovery from the COVID-19 pandemic.

Koopman offered two scenarios where world GDP could return to pre-pandemic level as soon as this year, based on OECD predictions from late 2020; however, low consumer and business confidence could also majorly hinder any momentum and contribute to a weaker recovery.

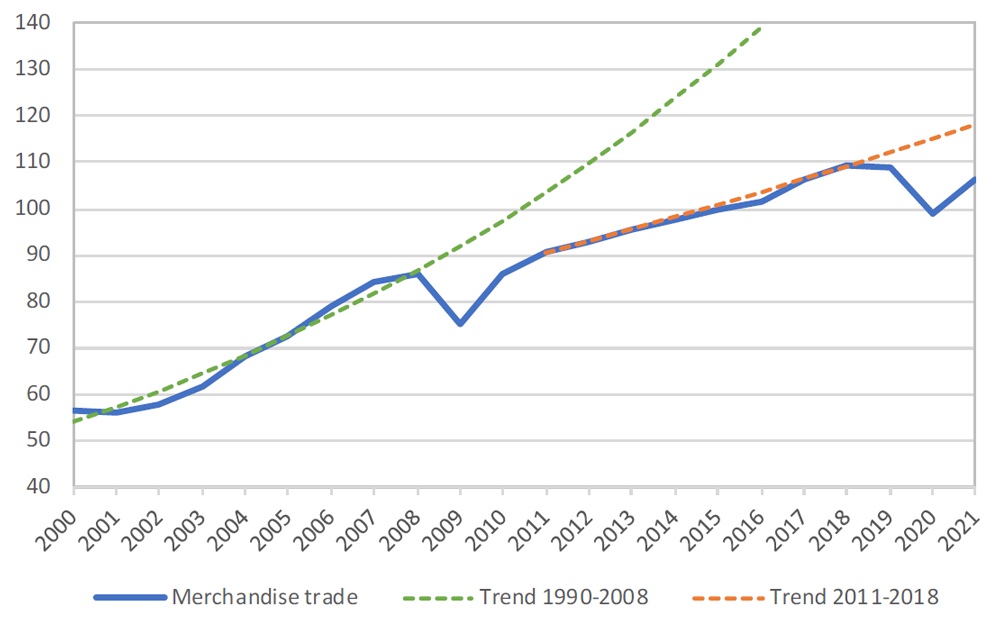

World Trade merchandise volume, 2000-2021 (Source: WTO)

Koopman described the global economy entering “not a recovery, but a reset”, with a rapid return to previous growth trends. He added that while goods trade had suffered deeply following lockdowns in spring of last year, the impact was “quite different” compared with the 2008 Global Economic Crisis, as this time, the economy had benefited from aggressive fiscal and monetary policies at a national level.

Koopman also acknowledged that recovery in Asia and China specifically had been strong on the supply side, though demand would be as critical for global recovery from the COVID-19 pandemic.

Estimates from the WTO indicated a heavy decline in year-on-year growth in manufactured goods. The industries most severely impacted included automotive products, with growth down 70% compared with April 2019, travel goods (-51%) and footwear (-42%); however, computers, integrated circuits and pharmaceuticals are all estimated to have grown with the rise of remote working and medical advancements relating to the pandemic.

Services trade dropped 30% in Q2 of 2020 with global travel restrictions ravaging the tourism and travel sector. However, analysis from the World Bank also suggests that global value chain recovery has been strong in intermediate goods and passenger vehicles.

The day also saw Bryan Walker, Head of Bank Relationships at Previse deliver a rallying call for digital adoption in supply chain finance, alongside a panel discussion moderated by our own Deepesh Patel on refining the customer journey.

Tomorrow BCR are set to welcome chairman John Bugeja, Managing Director of the Trade Advisory Network. Speakers will include Eugenio Cavenaghi discussing sustainable development and the role of ESG in supply chain finance; alongside panels on SCF in Asia Pacific and corporate journeys when it comes to implementing global programmes.