The trade finance asset class

Trade and trade finance have been intertwined for centuries, and have afforded traders the opportunities to grow their businesses whilst providers of trade finance have been able to generate significant returns. The evolution of this form of finance continues to this day, as banks and non-bank alternative financiers develop new ways to provide this critical element of the trade cycle.

The trade finance asset class is one that is relatively new to many investors and continues to garner interest in its ability to return competitive yields that are largely uncorrelated to other asset classes. In as much as interest in investing into trade finance has grown immensely, there is still a disconnect between investors and those that desperately require financing to be able to compete on a global scale.

The issue surrounding the estimated $1.5 trillion trade finance gap is not new, however the role that trade finance funds have to play in alleviating this gap has never been more prevalent.

These funds have both the opportunity and ability to assist in bringing small and medium-sized enterprises (SMEs) in emerging markets to the fore and in turn stimulate economic growth in these regions.

The SME struggle is real

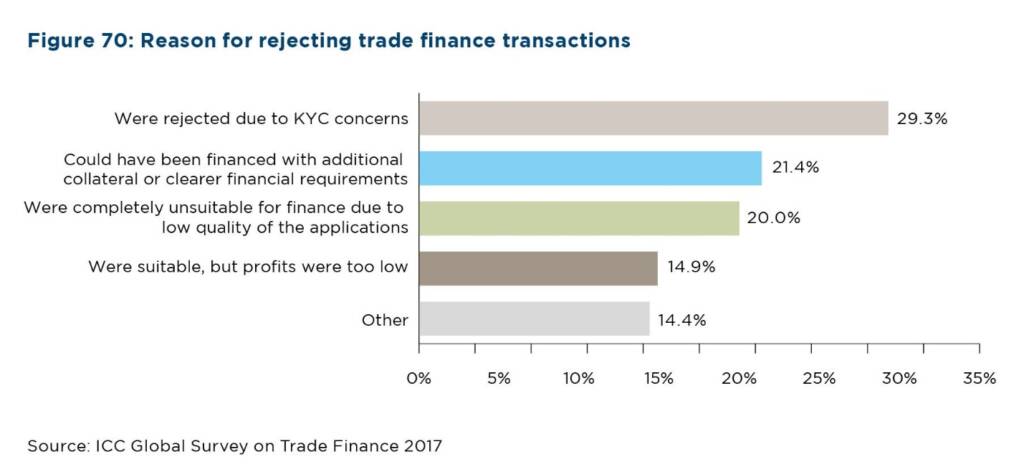

SMEs in developing markets are faced with a seemingly insurmountable challenge to secure trade finance as they are often unable to meet the basic requirements of a financial institution’s pre-screening checklists. These requirements, such as audited financial statements, detailed credit histories and collateral are often too onerous and impracticable, which preclude most SMEs from any further participation in the financing process. In addition to this, regulations such as Basel III have had a significant impact on financial institutions who have had to pull back on financing in several emerging markets, further compounding the plight of the SME. This is an unfortunate by-product of well-intentioned regulations and has had a devastating effect on SMEs reliant on funding to be able to engage in cross-border trade.

Trade finance funds could hold the key

Trade finance funds have a critical role to play in providing finance to SMEs in developing economies. The trade finance fund universe consists of a few large players with funds in excess of $1bn, with the majority being smaller funds ranging from between $5m to $200m. The smaller funds are able to focus on SMEs with financing requirements that range from $500k to $10m, a key segment that has seen financial institutions reduce appetite for, given stringent regulation and the resources required to pursue these smaller transactions.

Whilst there is a need to provide finance to emerging market SMEs, significant risks do remain and it is critical to mitigate these risks wherever possible. Trade finance funds are well-positioned to ensure this mitigation through sufficient security taken over the underlying commodity as well as through tracking and monitoring the commodities as they move through the trade cycle. This can be combined with effective oversight on trade documents and payment terms to significantly reduce the risk of default.

There is immense synergy to be unlocked between SMEs and trade finance funds by working closely together and developing relationships that allow for a level of comfort on both sides of the coin to be developed over time. Whilst there is yield to be generated for the fund, the SME is in turn able to unlock much needed working capital to enter into new trades and to be able to supply to a wider, international market. In addition to financing, the benefits to the SME include monitoring and tracking of deals as part of risk mitigation for the fund, which adds an extra element of oversight for an SME.

Case study: Issues faced by SMEs in Cote d’Ivoire

Cote d’Ivoire is a burgeoning West-African country, and from a trade perspective, one that has developed into the largest exporter of cocoa to the global market. Cote d’Ivoire produces and exports approximately 2m tons of cocoa annually, with exports mainly to Europe and the United States.

A major issue for the various cocoa players in Cote d’Ivoire comes down to a lack of liquidity provided by the local banks. Banks in Cote d’Ivoire were severely impacted by the liquidation of SAF-Cacao in 2018, when the global price of cocoa dropped by more than 40%. SAF-Cacao was one of the largest exporters of cocoa in Cote d’Ivoire and was heavily indebted. At the time, several banks were owed approximately $250m according to an article by Reuters, and this led to a liquidity squeeze in which funding for most Ivorian exporters was pulled.

Olivier Kouadio, a cocoa bean exporter in Cote d’Ivoire outlined the issues faced by Ivorian SMEs as follows:

“We work incredibly hard as cocoa exporters to secure contracts to European buyers, but we lack funding from the banks to support our operations. The bank’s requirements are very difficult for us to fulfill, as they request personal guarantees as well as other security such as our homes which many of us do not even own. We are very good at sourcing quality cocoa beans and exporting them, but we cannot always totally satisfy the bank’s requirements. We lose out on many opportunities as we do not have the financing required to purchase the beans needed to fulfill our contracts.”

Cocoa beans are not the only type of cocoa exported, and the region has seen a move towards cocoa liquor processing. Cocoa liquor is the product of processed cocoa beans and is far more lucrative than simply exporting raw cocoa beans. Exporters are able to earn a higher margin by exporting cocoa liquor that otherwise would have been earned by a European processor. The same funding issue applies to these SMEs and as a result, Ivorians are often unable to fulfill their contracts, losing out on this valuable margin.

Herein lies the opportunity for trade finance to assist as exporters are desperate for financing to enable them to purchase raw cocoa beans. Financing once the goods are held under collateral management frees up significant working capital for the exporter to purchase more beans, all whilst the financier has significantly mitigated their risk as the beans are both legally and practically controlled. The collateral management system in Cote d’Ivoire is operated mainly by Katoen Natie, who hold the goods on behalf of a financier and are involved in the entire process from receiving the beans to ensuring they are shipped according to the deal plan. In addition to this, the cocoa market is highly structured and regulated by the Conseil du Cafe-Cacao, an Ivorian governmental institution responsible for the local cocoa industry.

An opportunity arises

There is a dire need to encapsulate as many quality SMEs in emerging markets as possible, whilst ensuring investors capital is both preserved and being put to good use. It is important for the various players in the trade finance industry to engage in robust discussions about potential solutions to make financing more easily accessible to SMEs.

One such solution could lie in the digitization of the trade finance process with the creation of platforms through which SMEs and investors are seamlessly matched together. The trade finance fund would be responsible for onboarding SMEs by going through their Know Your Client (KYC) and due-diligence processes. This would be in addition to the evaluation of the business owner/operator and the proposed transaction cycle. The onboarding process would involve interaction with the SME on a deeper level than a simple tick-box exercise, to evaluate whether the risks could be mitigated through alternative means such as tracking and monitoring of the collateral throughout the deal and control of the underlying through collateral management and documentary ownership.

The benefit of such a platform is that a single fund could onboard hundreds of SMEs with deals that follow the same process and can be managed appropriately. Once onboarded, an SME can load their deals and be able to complete the trade should either the fund or an investor be willing to buy into the deal.

An example of the platform process

- The SME is onboarded once the fund has completed the requisite due-diligence

- The SME loads supporting documentation on a trade-by-trade basis such as supplier contract, off-taker contract and insurance documents as required by the fund

- 3rd-party service providers such as collateral managers and/or freight forwarders documents would be verified by the trade finance fund and loaded alongside those provided by the SME

- The deal is presented on the platform and available for investors to evaluate and potentially invest in. Deals can be separated by commodity, stage of the transaction, yield on offer, loan-to-value and size of the deal

- As each transaction moves through the trade cycle, the platform would reflect the change in risk profile of the transaction that would allow for investors to enter at a stage their own mandate is comfortable with

- The fund would be able to finance deals as per their mandate, with overflow fulfilled by investors buying into the individual transactions. This could be facilitated through Master Risk Participation Agreements

- The individual deal basis would allow for investors with excess cash being able to earn a return by investing in highly-liquid, short-tenor transactions rather than remain in cash.

The above-mentioned example is a simplified one, but important to consider as funds evaluate new methods of bridging the trade finance gap and leveraging the due-diligence performed on SMEs to increase the liquidity on offer.

Banking the unbanked – Conclusion

As the evolution of trade finance continues to gather momentum, it is imperative that trade finance funds continue to look at new ways to broaden the discussions around financing SMEs. Opportunities abound for trade finance funds to generate yield and to make a lasting difference in stimulating economic growth in emerging economies.

This article was written by a member of TFG’s 2020 International Trade Professionals Programme. Find out more here.

Disclaimer: The views that have been expressed on this page are that of the author, which may or may not be in line with their company, Trade Finance Global or London Institute of Banking and Finance’s view.