Estimated reading time: 7 minutes

Women’s participation in international trade is substantially lower than their male counterparts.

Only about 15% of exporting firms worldwide are led by women, and these entrepreneurs face higher trade barriers and limited access to finance, which further restricts their business growth and participation in international markets.

To address these disparities, the International Finance Corporation (IFC) has been actively involved in programmes designed to empower women in trade.

One notable initiative is the Banking on Women Global Trade Finance Program (BOW-GTFP), launched in mid-2019, which focuses on providing financial support and resources to women-owned businesses involved in international trade.

Since its launch, the programme has facilitated over $260 million in transactions.

Through these efforts, the IFC aims to enhance women’s participation in global trade, thereby promoting gender equity and economic inclusivity.

In IFC’s whitepaper, “Banking on Women Who Trade Across Borders”, the IFC highlights the need for gender equality in international trade and trade finance while emphasising its importance for sustainable development in emerging markets.

Barriers across borders: major challenges for access to finance

Often when we hear about trade barriers, we think of government-imposed measures like tariffs or quotas that impede the free flow of goods from one nation to another.

For many small and medium entrepreneurs – particularly women – the reality is that the real barriers to international trade have very little to do with intergovernmental posturing and they strike well before goods come anywhere near a border.

All too often the true culprit is a lack of financial support.

Accessing global markets usually requires longer payment terms, and dealing with different parties in different jurisdictions. Therefore trade finance becomes a necessity for firms to stay in business and grow.

Yet, despite the relatively safe nature of trade finance as a whole, due to its short-term tenor, trackable nature and often self-liquidating character, accessing such financing proves difficult for many businesses, especially those helmed by women entrepreneurs.

One reason is the level of collateral required by financiers.

In Africa, 90% of commercial banks cite the absence of collateral as the primary reason why trade finance applications are rejected. Unsurprisingly, this disproportionately impacts newer and smaller businesses such as women-led enterprises, that simply don’t have a large enough asset base to use as collateral against a loan.

The nature of trade financing costs further incentivises financiers to pursue larger ticket traders in lieu of smaller players, since their fixed costs can be spread across a larger commission size, leading to more profit for the financiers.

On aggregate, the average size of a letter of credit in Africa is around $2 million, a figure that is heavily impacted by larger traders, since smaller firms simply don’t need this much money. The average size of a general-purpose loan is $1,250, $21,500, and $133,000, respectively for micro, small, and medium-sized enterprises (MSME).

These financial figures still don’t touch on the complexity of applying for trade finance, which can require up to 100 documents and specific knowledge.

Take the example of a micro-enterprise that needs a mere $1,250 in financing to grow. The time and costs of gathering any required documents and employing staff with the requisite skills to submit an application for funding can eat away at nearly all of the financing that the firm hopes to receive.

Why bother?

And this isn’t just a theoretical problem. The IFC’s research shows that these issues stand in the way of real businesses every day.

Case studies: Brazil, Kenya, and Nigeria

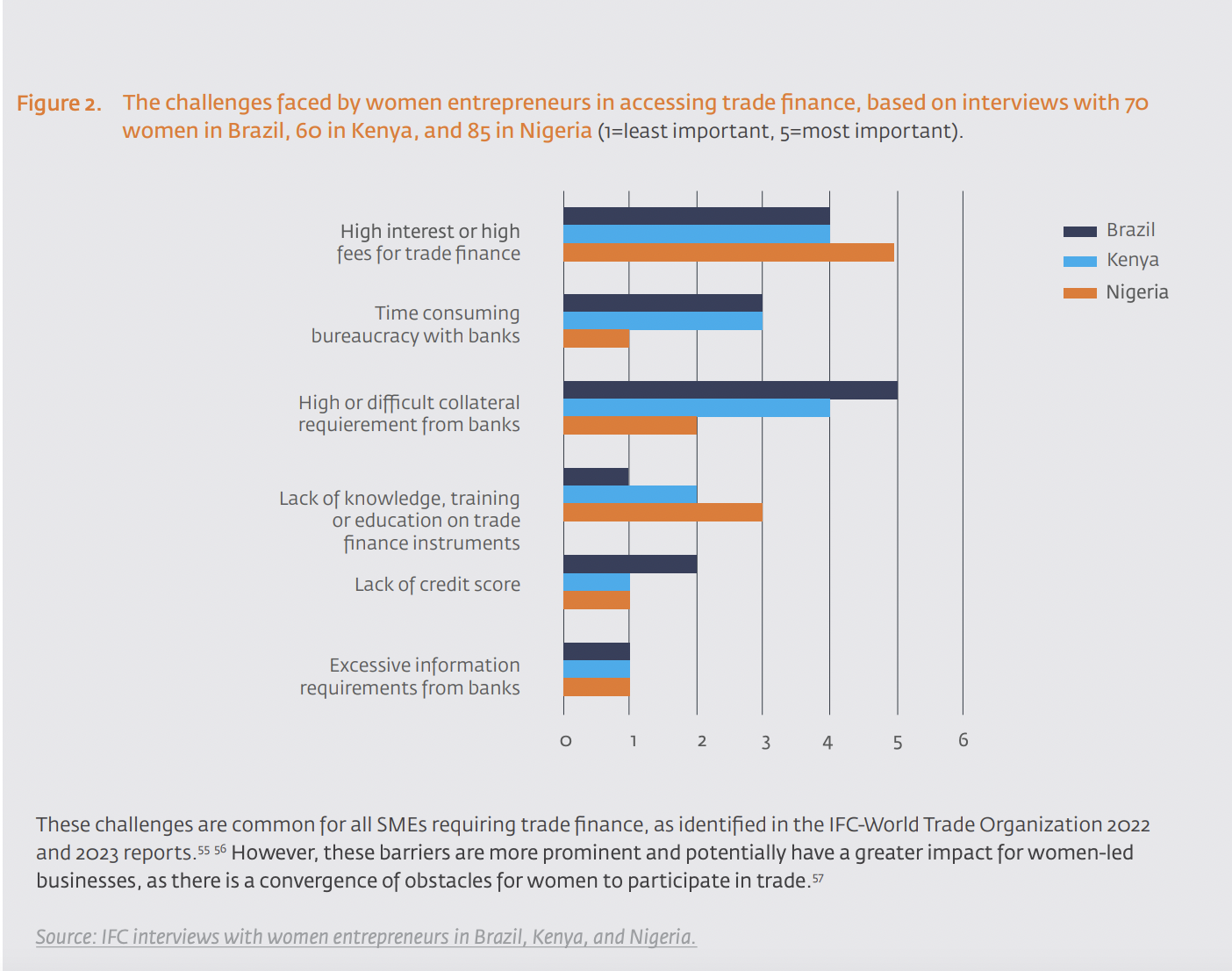

The IFC interviewed female entrepreneurs and financial institutions in Brazil, Kenya, and Nigeria to try and better understand the actual challenges women-owned firms face in accessing trade finance.

The results reveal a series of shared difficulties, underscoring gender-specific barriers in global trade financing.

In Brazil, the main barrier is the stringent requirement for collateral that banks impose on women-led businesses. This challenge is not unique to Brazil but is also prevalent in Kenya and Nigeria, where it is similarly cited as a major impediment.

Women entrepreneurs in these countries struggle to meet these demands, which often exceed their available resources, effectively locking them out of necessary financial services to expand their trade activities.

One Brazilian businesswoman said, “Some of us found our way in digital banks as they are less bureaucratic than the traditional ones.”

Additionally, the cost of accessing trade finance – manifested through high interest rates or fees – is another significant barrier, particularly highlighted as the top challenge in Kenya.

These financial constraints reflect broader, non-gender-based disparities that pervade the economic landscapes of these countries.

An entrepreneur from Kenya said, “I was told you need to bring collateral – a title. However, this piece of land was not very valuable, but I brought it. Then, I need to bring an [appraiser] which is a big cost…. Then was told I need to bring in documentation for my car. The amount of money for the car valuation was also high. The sad thing is, I still won’t be given the money! I have spent so much of my own money, and they still won’t [lend] it to me.”

Adding to these structural and financial challenges is a knowledge gap among women entrepreneurs regarding trade finance instruments.

This lack of understanding, alongside inadequate training or education on how to navigate these financial tools, points to a critical need for tailored capacity-building initiatives.

A Nigerian businesswoman said, “I rely more on friends, family and e-commerce platforms for financing my business, as I have limited understanding on trade finance products offered by banks.”

The collective experiences from Brazil, Kenya, and Nigeria highlight systemic issues in accessing trade finance, critical for integrating women into global markets yet largely unattainable due to these barriers.

However, as these challenges are identified, there is hope that the international trade industry can provide solutions to make it more feasible and accessible for smaller, women-led organisations to get the financing they need to access global markets and grow their businesses.

The challenges are identified, but what next?

Recognising the barriers that many smaller, women-led businesses face when securing trade finance, the IFC has outlined a variety of recommendations.

To help women entrepreneurs in general who lack physical assets for collateral, the IFC will strengthen its Banking on Women program under its Global Trade Finance Program (GTFP) and will continue promoting more access to trade finance for women entrepreneurs in emerging markets.

IFC will also facilitate more training programmes for financial institutions and women SMEs to share knowledge on trade finance as well as warehouse receipts financing and supply chain finance.

Nathalie Louat, Global Director, Trade and Supply Chain Finance, IFC said, “IFC is committed to further strengthening the existing Women in Trade program under its Global Trade Finance Program to support more women-led businesses in trade in emerging markets. To underscore our commitment, we are launching the Women in Trade Network which will serve as a learning platform where our partners share best practices with one another.”

From a financial perspective, the IFC’s report highlights the importance of blended finance, which seeks to combine public, private, and philanthropic funds to reduce the financial risks associated with lending to women-led businesses in trade that any one investor must take on.

By providing concessional funding, lending to these entrepreneurs will be a more attractive prospect for banks and investors, ideally increasing liquidity in the ecosystem.

On the strategic side, the IFC is strengthening its impact through strategic partnerships with other development agencies. These collaborations leverage external expertise in gender-focused programmes and will help to support the specific needs of women in business.

The challenges outlined in IFC’s Banking on Women Who Trade Across Borders whitepaper are very real for women worldwide, but they are not insurmountable.

The IFC has numerous success stories from women across different countries and industries, beating the odds with their respective initiatives. To see more about IFC’s success stories, visit IFC’s Women in Trade website.