- In a Sibos exclusive, Trade Finance Global (TFG) spoke to Xiong Yuanmeng, director of Cross-border RMB & Foreign Exchange team, Global Transaction Banking Department of Bank of China HQ (BOCHQ).

- China’s centrality in trade, along with favourable interest rate policies, has made their currency more attractive.

- China’s currency is exhibiting the enthusiasm typically associated with the Year of the Dragon.

China’s currency – the renminbi (RMB) – is finding new appeal among emerging market traders and global investors seeking alternative settlement options.

In July 2024, China’s use of the renminbi in cross-border transactions reached a record high of 53%. In light of this milestone, TFG spoke to BOC’s Xiong Yuanmeng to learn more about the renminbi’s burgeoning internationalisation.

The new centre of gravity for trade

According to BOC’s historical documents, China began to implement renminbi pricing and settlement in Hong Kong and Macao in 1968, creating a precedent for the use of renminbi in international trade. In September 2008, China made a series of strategic arrangements to promote cross-border trade renminbi settlement. In July 2009, China officially kicked off the pilot program in renminbi. “In the very beginning”, Xiong summarised, “we didn’t even call it renminbi internationalisation. We called it ‘pilot use of renminbi in cross-border trade’.”

The picture now is unrecognisable from a decade ago. China is now the main trading partner of over 150 countries. The dominance in trade volumes, cementing China’s position as a globalised powerhouse, has naturally given the activation energy to renminbi internationalisation. With these international tendrils, Xiong observed, “In some scenarios, and for some countries and regions, the renminbi may be an alternative choice.”

This alternative is becoming increasingly attractive to emerging markets, particularly in the current monetary environment. For decades, the dollar has dominated as the global currency in trade finance: as of August 2024, 49.07% of global payments were made in the dollar, far ahead of 21.58% in the euro in second.

However, US interest rates have been a topic of contention over the past year. The Federal Reserve’s decision last month to cut interest rates by half a percentage point, rather than a typical quarter, has generally paid off – but with the election looming, no moves in the US market are without uncertainty.

The extended period of high US interest rates has created funding challenges for developing economies. As a result, China’s lower interest rate policy, aimed at stimulating economic growth, has made renminbi funding more appealing.

Xiong emphasised that interest rate differentials are just one factor in the currency’s growing adoption. “In the short term, the gap between dollar funding cost and renminbi funding cost will impact the demand for renminbi funding,” he said. “But in the long term, it still depends on the natural progress for a currency to be recognised and more accepted in the international trade or investment market.”

The shift is reflected in corporate treasury operations. Multinational companies, both Chinese firms expanding globally and foreign enterprises operating in China, are increasingly incorporating renminbi into their cash management strategies. Using the renminbi rather than the dollar, considering the divergence in Chinese and US rates is up to 150 to 250 basis points, according to traders and corporate advisers.

As such, foreign companies with operations in China are far more willing now to accept renminbi revenue at their local headquarters, leading to the establishment of RMB cash management pools.

Hong Kong, with its sobriquet as the Gateway to China, is crucial in the renminbi’s flow. Not only does it have the deepest renminbi liquidity pool outside of mainland China, of over RMB 1 trillion, according to SWIFT, more than 70 percent of global offshore renminbi payments are processed in Hong Kong.

Yet Xiong notes that this reflects the territory’s role as an intermediary rather than the final destination. By way of explanation, “Hong Kong serves as a hub or pool for offshore renminbi funding,” he said. “International investors usually swap US dollars or euros into renminbi and put them in Hong Kong.”

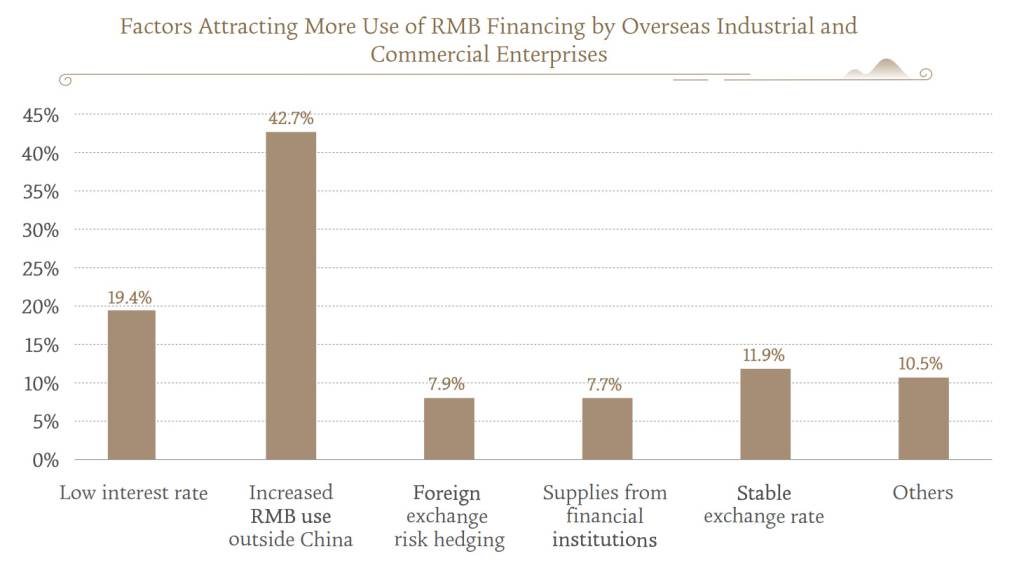

Source: Bank of China

Notches on the Belt

Since China introduced the ‘Belt and Road Initiative’ (BRI) in 2013, the economic and trade ties have increasingly strengthened between China and the countries that “jointly build the Belt and Road”, known as JBBR countries. In 2023, China’s trade with JBBR countries totalled RMB19.5 trillion, representing a year-on-year increase of 2.8%, accounting for 46.6% of China’s total imports and exports. Both the size and the share reached a record high since the initiative was introduced. Based on the solid economic and trade ties, the cross-border use of RMB has become an important link that boosts deeper and solid progress in the BRI.

This is supported by a 2023 survey from the Bank of China, which reveals that for institutions related to countries participating in the BRI, the value of cross-border transactions in the renminbi increased by 90% year-on-year. Additionally, 47% of international enterprises responded with intent to raise the proportion of renminbi settlement – up from 11% in 2022.

A large part of this is to facilitate trade with China, making renminbi trade financing an increasingly popular offshore renminbi product, and optimising international balance management for developing economies. Besides trade financing, which was the primary purpose for nearly 40% of industrial and commercial enterprises surveyed, the following sources of renminbi demand were:

- Replacing high cost debts (9.6%)

- Incremental financing needs (17.6%)

- Diversifying the currency mix of debts (7.5%)

25.5% of respondents stated ‘Other’. The strength of the renminbi as a primarily trade financing currency is made evident.

The appetite is there, but implementation is not without challenges. “One of the biggest challenges we are facing is the insufficient support from the financial infrastructure in those emerging markets,” Xiong said, mainly with regard to basic financial services, such as RMB account opening and clearing services, in those local markets. Meanwhile, as all international currencies may be involved, this infrastructure gap is compounded by tight foreign exchange controls in many developing countries and growing compliance burdens.

“The increasing burden comes from anti-money laundering and sanction compliance screening,” continued Xiong. “Commercial banks who provide cross-border trade finance services need to put more resources and efforts into building up their AML/sanction compliance capabilities, and it’s not an easy task.”

—

In the past, the renminbi was primarily used for payment and settlement. But as overseas enterprises increasingly focus on investment and reserve functions with the currency, it can no longer be ignored that the renminbi stands as a vital financing channel, for a large part as a spillover of China’s monetary policy, extending their influence through development financing.

Xiong believes the positive momentum in renminbi internationalisation will continue, though he acknowledges that China’s current low interest rate environment plays a role in the currency’s appeal. “In the near future, I feel that China will maintain a relatively low interest rate to help economic growth,” he said. “But in the long run, the gap between different currencies’ interest rates is just a small portion of that momentum.”

China’s position, as central in orbits of global trade networks, is predicted only to rise. It fares well to keep a watchful eye on the renminbi, which looks ready to make up for the dollar’s oft-cited shortcomings.