Africa is home to 1.3 billion people spread across 54 countries, 20 of which have economies set to expand by an average of 5% or higher over the next five years. We spoke to BACB’s CEO about export opportunities in Africa.

Africa presents unparalleled opportunities. The continent is home to 1.3 billion people spread across 54 countries, 20 of which have economies set to expand by an average of 5% or higher over the next five years. There’s also a burgeoning middle class, and a growing trend towards African integration.

Of course, many exporters are aware of the continent’s rise and are eager to explore the opportunities presented by its stellar growth. Yet many also struggle to obtain the trade finance required to mitigate the risks – hindering their expansion into those potentially-lucrative African markets.

Entry into any new market brings with it both opportunities and risks. Yet the risks can be dealt with through developing an understanding of local business customs, which requires a banking partner that brings such intimate knowledge while also understanding the exporters’ needs. Local knowledge and understanding is most certainly important with respect to any new market. When it comes to Africa, however, it is nothing short of critical.

A hands-on and personal approach can only come from having people on the ground and a decades-long track-record. That said, more than a simple presence is required: African markets are highly diverse – so much so that cookie-cutter solutions won’t work. Transactions must be structured to fit individual circumstances – and can often involve sums too small to meet the lending thresholds of the larger lenders.

Lending smaller amounts against bespoke structures in challenging markets: in recent years this has not been a recipe likely to attract the global lending banks. But it’s one well suited to smaller, specialist banks with local knowledge and strong, niche structuring skills. In this respect, banks such as the London-based but African (and Middle East) focused BACB plc – a UK regulated specialist bank – can offer trading companies the comfort of a fully-compliant and well-regulated banking partner.

Bridging the trade finance gap

BACB’s local presence is not only critical, it’s timely – thanks to the growing “trade finance gap”. This concept was first publicised by the Asian Development Bank when measuring the growing gap between demand and supply for trade finance in the wake of tougher post-Crisis regulatory treatment for emerging market trade instruments (as well as perceived heightened risks). As the key region for documentary trade finance, Asia was the hardest hit by what was estimated to be a US$1.5 trillion global deficit. Yet, as Africa grows and trade to the region expands, the continent is in danger of becoming “the new Asia” in this respect – with global banks shying away from offering trade finance for African deals because of the regulatory costs imposed by Basel III and other regulations.

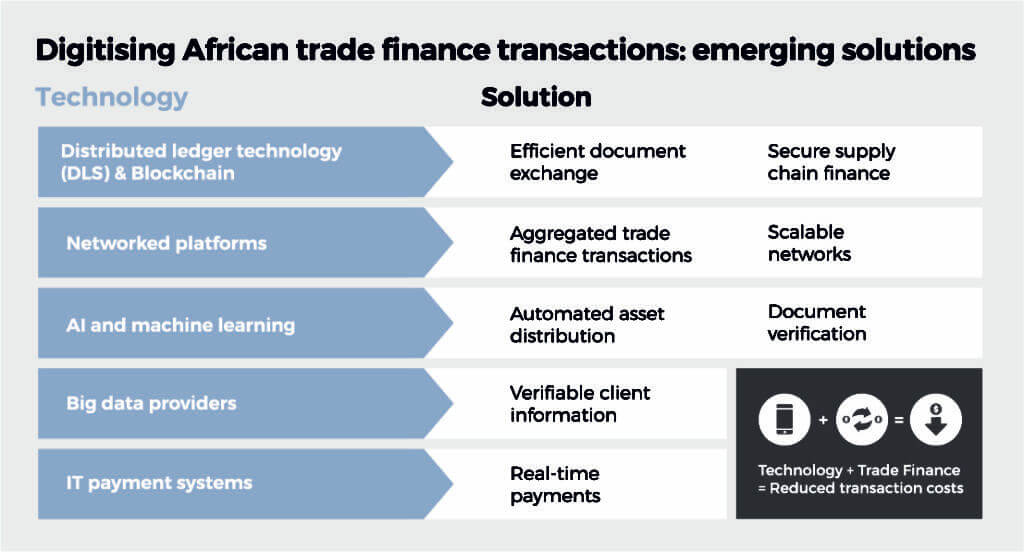

Technological advancements can, of course, go some way in tackling this. Using automation and artificial intelligence – with deals presented on digital platforms – risk appetite can be provided from a wider group of investors. However, the trend in Africa is unfortunately mostly in the other direction – with major banks stepping back from African trade thanks to increased regulatory costs and a perception of increasing risk. The continent is losing not gaining liquidity.

At BACB, we think this is short-sighted. Africa is currently the world’s second-fastest growing region, with GDP growth forecast to reach 4.1% this year. And, indeed, the most significant threat to trade in Africa is one of perceived rather than actual risks. The approach to trade should, therefore, be one of managing risks, which requires expertise and understanding – as well as the conviction that comes from being constituted as a specialist trade bank focused on bridging the knowledge gap between understandably-wary exporters and potentially-fruitful African markets.

Africa performs well

Despite perceptions, and taken as a whole, financing African trade is a relatively safe bet. Analysis from the ICC’s 10th Annual Trade Register reveals a significant decrease in African default rates between 2016 and 2017 for letters of credit (LCs) and loans for cross-border trade. Weighted by obligor, Africa witnessed an absolute decline in default rates from 1.47% to 0.13% for loans for import/export, 0.59% to 0.05% for export LCs, and 0.48% to 0.14% for import LCs. Yet the risk appetite of international banks has deteriorated dramatically in recent years – partly because banks have to satisfy not only their own regulators (as mentioned above), but – under “know your clients’ clients” stipulations – the regulators governing each of their correspondent banks.

Given this – as well as the potentially punitive fines imposed on banks for non-compliance – it’s unsurprising that overall market capacity for African trade finance has been in decline. Indeed, the ICC Banking Commission’s 10th Global Survey on Trade Finance found that 50% of respondents from African banks expect the trade finance gap to widen over the next three years.

Add to this the fact the region has one of the highest trade finance rejection rates, at 17% of all African trade finance requests, and it is easy to paint a pessimistic picture. But it would also be a false one, perhaps based on the negative outlook of the global lenders that have, in all but name, pulled out of the region. For those with deep roots, on-the-ground capacity and in-country knowledge, the opportunities represented by African trade far outstrip the challenges. But it’s that local knowledge that’s the key differentiator with respect to this more optimistic view. Without such expertise, compliance with the due diligence protocols required for African trade becomes almost insurmountable.

And while there are promising initiatives to help tackle the problem, from centralised registries to fintech applications and mobile-phone-based client on-boarding – indeed the trade space in Africa is a hotbed of innovation – it’s the very old-fashioned value of relationship banking that remains critical for Africa. So while African trade is becoming increasingly sophisticated, and although transaction-based lending techniques can enable banks to serve the needs of large corporates in well-known markets, it is the relationship approach that still succeeds in Africa, based on local knowledge and boots on the ground: something BACB is rather good at.

Now launched! Spring Edition 2020

Trade Finance Global’s latest edition of Trade Finance Talks is now out, taking a deep dive into trade finance in emerging and developing markets.