Estimated reading time: 5 minutes

For decades, trade document checkers at banks have mastered the crucial, time-consuming, and somewhat niche skill of manually reviewing complex documents to ensure they meet international standards.

These experts sift, scan, and scrutinise to find discrepancies among documents, including letters of credit (LCs) and guarantees, that vary widely in quality and complexity.

With what the International Chamber of Commerce (ICC) estimates to be four billion pages of paper circulating in documentary trade at any given time, bank staff working in document examination are sought-after experts, requiring years of training and significant investment by their employers.

As the ICC noted in a June briefing last year about automating trade document examination, locating and placing staff into such roles, as well as retaining existing staff, has already – and will increasingly – become more difficult and costly.

It adds that the manual review process can also be “detrimental” to the scalability of LC businesses for banks as well as restricting the evolvement of document examination.

Banks are now facing impending and increasing risk with a generation of trained document checkers heading into retirement and, as such, are having to rethink what it means to be a trade finance expert.

It is widely accepted that younger workers are not keen to train in document examination, with the ICC pointing out that talent in this specialist field is “scarce”.

That leaves the burning question of how this unique expertise can be captured and enhanced before it’s too late.

Technology for document checking

Technology is enriching – and disrupting – many areas of our lives, from how we work to how we travel, manage finances, and more.

For trade, it offers a clear path to augment intelligence and improve efficiency in the field of document examination, by removing the highly manual and repetitive task of document review with automation.

Companies that fail to successfully implement digitalisation strategies in trade processing are finding their operations increasingly at risk, as their ability to supplement or replace staff in this field diminishes as time goes on.

Banks have found themselves in the age of “digital Darwinism”, meaning they must adapt to survive.

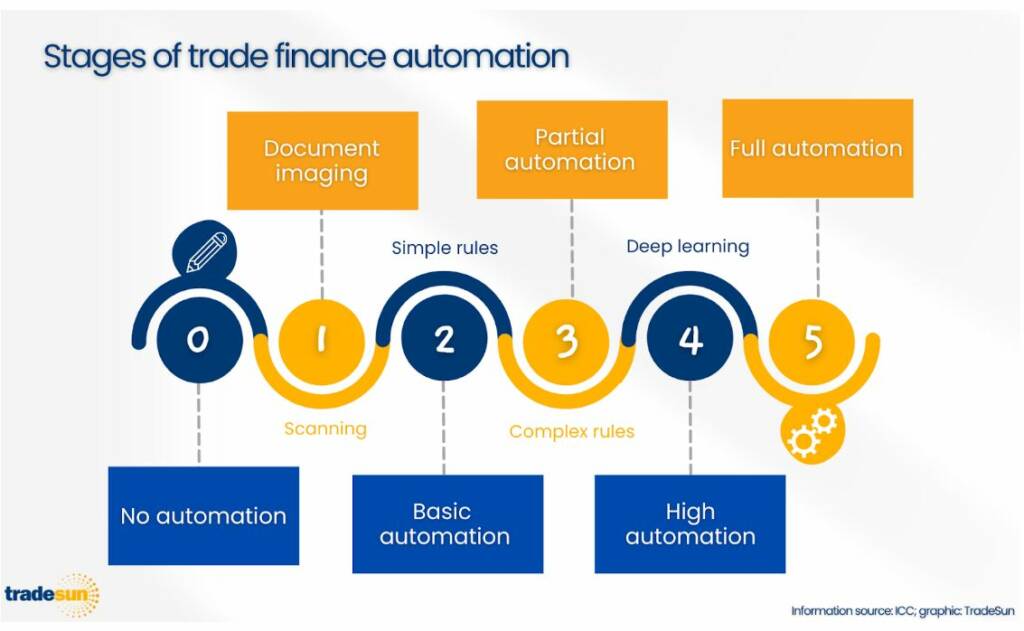

It’s important to remember that automation in trade finance is a journey with organisations at different stages in their progress.

The ICC outlines in its report an automation “matrix” with various levels of automated capabilities.

Level zero has no automation, and the highest level – five – has a completely automated process without any need for human intervention.

Reaching a certain level of automation in document examination depends on the ability to correctly classify and extract key data from documents, and to utilise this extracted data to confirm compliant presentations and complete transactions.

To achieve a high level of automation, cutting-edge technology must be deployed.

Optical character recognition and natural language processing combined with neuro-symbolic artificial intelligence and curated machine-learning are being used to automate transactions.

The knowledge to enable this technology must be trained into the AI and machine learning at the earliest opportunity with the current generation of experts.

Forward-looking banks that are already using this technology are automatically classifying and extracting data from both unstructured and structured documents to the highest level of accuracy.

Once the data is extracted and standardised, a smart rules-based engine should be deployed to compare the data against a host of requirements: from internal bank policies to International Standard Banking Practice (ISBP) rules, as well as the Uniform Customs & Practice for Documentary Credits (UCP 600), the rules agreed by the ICC to govern documentary credits.

Additionally, with all this data extracted and standardised, compliance screening for potential sanctions breaches, dual-use goods, fair price, and trade-based money laundering can be seamlessly undertaken.

These checks, offered by technology companies that already have anonymised and protected data, can help banks and corporates build a holistic view of their financial crime prevention.

Automation is necessary

For the foreseeable future, nothing can – or should – totally replace human knowledge and experience in document examination.

Trade finance experts will remain the ultimate decision-makers, however, their role should now focus on the review of potential discrepancies in documents and transactions that the technology has flagged.

Technology removes the manual and onerous task of document review, enabling bank staff to focus on higher-value tasks, improving operational efficiency and ensuring every presentation is fully compliant with the rules.

Digital tools can also facilitate faster document processing – from hours or days down to mere minutes – and eliminate the risk of human error.

Overall, a more automated process enables banks to better monitor and control their risk, paving the way for increased trade finance activities.

Indeed, the global trade finance gap remained a stubbornly high $1.7 trillion in 2020, up 15% from two years earlier, as reported by the Asian Development Bank.

By expanding their trade business, processing larger document volumes, and ingesting data to feed curated machine learning, banks can be confident in advancing their trade operations and compliance processes to better support clients of all sizes to access trade finance.

As a generation of expert trade document checkers heads into retirement, talent in this field becomes ever scarcer, and global trade volumes increase, banks can no longer rely on the manual processing of documents and must embrace technology for a more efficient and cost-effective way of working.

The time is now for automation in trade finance, and artificial intelligence and machine learning will support the evolution of the trade finance expert.

Read the latest issue of Trade Finance Talks, June 2022