Although the clocks went forward, they did not shed any fresh light on Brexit. The stalemate continued and the EU granted an extension to Article 50 until Halloween, by which time the clocks will have changed again and we’ll probably still be in the dark.

Theresa May clings to her post for the time being, while stories about the Tories and in-fighting within the party continue. The 1922 Committee even met to discuss changing its own rules so that a possible second no-confidence vote could be brought against the Prime Minister, although they ultimately decided against it. Theresa May invited Jeremy Corbyn for talks to try and find an agreement that both the leaders and their parties could support in Parliament. As the House broke for Easter recess, any hopes of finding common ground looked rather forlorn.

Bleak economic data for the Eurozone

European data continued to show the largest economies struggling with manufacturing, as the global slowdown in growth impacted production. There were some positives however, as growth in the Eurozone jumped by +0.4% in the first quarter of this year.

The real worry is the German economy, which was the engine of growth the last time Europe experienced a dip in productivity. With the manufacturing sector in the continents largest economy looking weak for a few months now, there will soon be questions about whether the zone can avoid recession. The German government downgraded growth for a second time in three months to just 0.5% expected for this year, down from forecasts of 2.1% only a year ago.

The ECB met and kept rates where they were, which was hardly surprising given growth and inflation numbers. They are unlikely to even think about raising rates this year now, and the focus of the meeting was on how much support should be given to the regions banks. Their statement said ‘We are ready to adjust all of our instruments’, an echo of President Mario Draghis’ ‘we will do whatever it takes’. This is all fine in principal, but it’s worth pointing out they haven’t paid off any of the debt from the last round of support yet.

Populism surges ahead of European Elections

A surge of populism was seen again, this time in Europe. With an overwhelming majority of 72%, Ukraine voted to elect Vlodomyr Zelensky as their new president – a comedian and actor with no real political experience or manifesto. The landslide will have sent a shiver through Brussels as they also hold European Parliament Elections in May. This comes at a time when establishment politics is under a greater threat than ever.

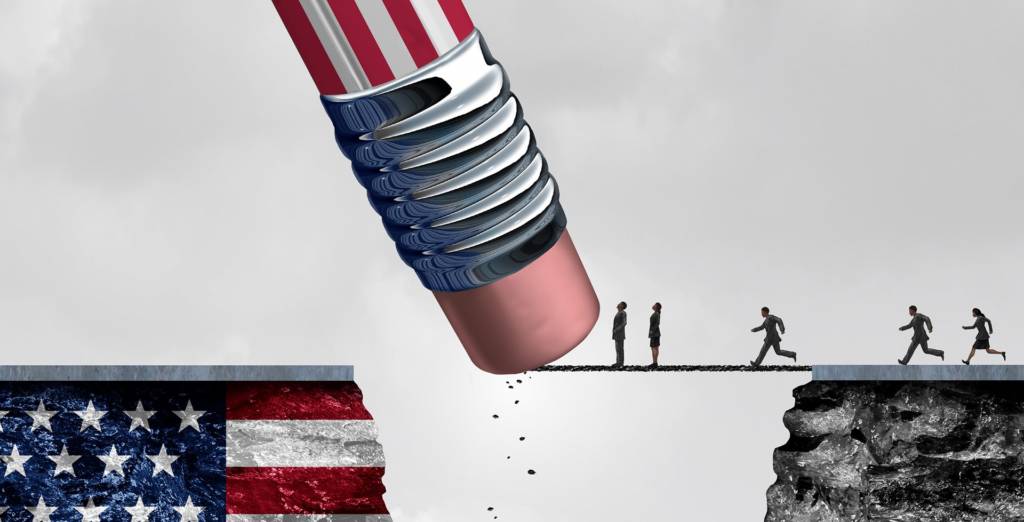

Most countries have seen a rise in populism to some extent since the last elections, and a decentralization of power could make policymaking in Brussels very difficult going forward. In the UK, we were left still waiting to see whether we participate in those elections. Terms from the EU stated that if we do not, however, we would be leaving the EU without a deal by the 1st of June.

US-China trade talks continue

The trade talks continued between the US and China. Despite both sides continuing their rhetoric that progress was being made, little has been seen. It increasingly looks like a compromise will have to be found if a deal is to be agreed, and it will be interesting to see whether that is seen as a fudge by the American people and the markets. All of this comes as Boeing enter another month with their 737 planes grounded globally, a situation which is likely to have knock on effects for the US economy more broadly. Both sides have an interest to finalise terms and get a deal in place as quickly as possible, yet it looks as though some of the differences might be too hard to resolve.

Donald Trump proposed two potential candidates for the Federal Reserve Board of Governors. Both Stephen Moore and Herbert Cain have obvious political bias towards Republicans and specifically Mr Trump himself. This made the nominations look like more politicization of central bank policy, especially following the Presidents’ critical tweets of the FOMC and Fed Chair ‘Jay’ Powell. The choice of both men came in for significant criticism from economists and politicians alike.